2025 Outlook for

Oil, Refining and the Petrochemical Market

in Asia

2025 Outlook for

Oil, Refining and the Petrochemical Market

in Asia

Read the eight Asia Outlook stories below.

Regulatory Changes to Drive Asian Carbon Markets Development

Regulatory Changes to Drive Asian Carbon Markets DevelopmentCarbon markets in the Asia Pacific are poised for significant shifts in 2025 as regional policies tighten and market mechanisms evolve. Key themes across countries include the broader impact of carbon costs, structural realignments in inefficient sectors, reduced free allowances to address EU Carbon Border Adjustment Mechanism (CBAM) pressures, growing support for voluntary decarbonization projects, and the increasing relevance of Article 6 credits in connecting compliance and voluntary markets.

New Chinese Policies, Geopolitics to Shape Asia’s Fuel Oil Market

New Chinese Policies, Geopolitics to Shape Asia’s Fuel Oil MarketIn recent years, Asia’s fuel oil and bunker markets have been significantly impacted by major geopolitical events – in particular, the Russia-Ukraine war in early 2022 and the intensifying Middle East conflict since October 2023.

Such events continue to influence Asia’s fuel oil market. When Brent prices hit $81.84/bbl on Jan. 13, 2024, the highest in four and a half months due to new U.S. sanctions on Russia, both high sulfur fuel oil (HSFO) and very low sulfur fuel oil (VLSFO) prices hit similar multi-month highs of $486.71/metric tons and $580.70/mt on the same day.

Energy Transition to Shape Asia’s Gasoline Market

Energy Transition to Shape Asia’s Gasoline MarketAsia’s gasoline market in 2025 will be shaped by a swift transition to green energy, particularly driven by the growing adoption of electric vehicles (EVs) in major markets like China, while demand in South and Southeast Asia remains stable and new trade flows emerge in the Middle East.

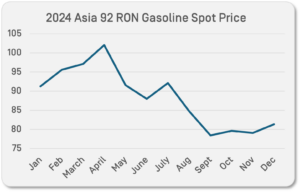

The Asia 92 RON gasoline spot price averaged $88.360/bbl in 2024, rising to a six-month high of $102.022/bbl in April before declining to a three-year low of $78.427/bbl in September, according to OPIS data.

Asia’s LPG Supply to Remain Long

Asia’s LPG Supply to Remain LongAsia’s LPG supply is expected to remain long in 2025 with demand largely dependent on the downstream petrochemicals sector, where poor downstream margins have plagued the Chinese market, industry players said.

The prices of CFR Japan propane and butane, the reference prices for Asia LPG, eased by around 0.9% and 3.2% in 2024 from a January average of $619.65 per mt and $630.64/mt to an average of $614.25/mt and $610.25/mt as of Dec. 13, OPIS data shows.

Firm aviation demand looks set to drive Asia jet fuel demand in the first-half of 2025 although the clean energy transition is expected to dampen gasoil demand in key markets such as China and South Korea, according to market sources.

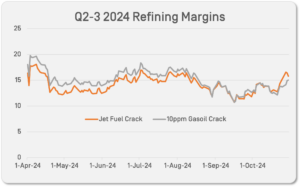

In the last quarter of 2024, the jet fuel crack, or jet’s refining margin against Dubai crude, rose to an average of $15.16/bbl compared to an average of $14.25/bbl in the previous quarter, according to OPIS data.

Naphtha crackers across Asia are bracing for further margin pain in the year ahead, as increasing input cost, oversupply driven by China’s capacity expansion, and looming trade barriers weigh on the market.

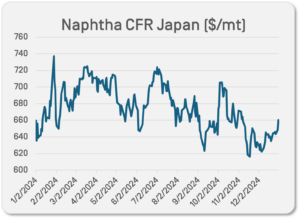

The benchmark CFR Japan naphtha price averaged $674.17 per metric ton (mt) in 2024, a 4.2% increase from the average of $648.59/mt one year prior, OPIS data shows. This, combined with the downstream ethylene expansion, has posed a stress test for the entire petrochemical industry and, in turn, could negatively affect the upstream naphtha market over the long term.

Asia’s paraxylene market is expected to remain volatile in 2025, with China cost and freight PX prices likely driven by U.S. gasoline blending demand as well as supply fundamentals.

CFR China PX prices averaged around $956.68 per metric ton in 2024, hitting a year-low of $795/mt on Nov. 15, according to OPIS data. But margins are expected to remain positive with the PX-to-naphtha spread returning to above $300/mt during the peak U.S. summer gasoline blending season, according to Chemical Market Analytics by OPIS.

Asian phenol prices are projected to remain weak relative to feedstock benzene in 2025 as supply growth continues to surpass demand growth amid ongoing capacity expansion driven by China.

In 2024, spot FOB Northeast Asia phenol prices averaged $982.50 per metric ton basis selling to China, according to Chemical Market Analytics (CMA) by OPIS data, $2.20/mt below that of spot benzene, which OPIS assessed at $984.70/mt FOB Korea. This is $200-$250/mt below the spread needed by phenol makers to stay viable. As supply outstrips demand, Asian phenol makers’ margins are projected to remain negative for the third year running, according to a forecast by CMA.

Carbon markets in the Asia Pacific are poised for significant shifts in 2025 as regional policies tighten and market mechanisms evolve. Key themes across countries include the broader impact of carbon costs, structural realignments in inefficient sectors, reduced free allowances to address EU Carbon Border Adjustment Mechanism (CBAM) pressures, growing support for voluntary decarbonization projects, and the increasing relevance of Article 6 credits in connecting compliance and voluntary markets.

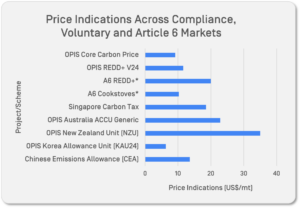

In 2024, carbon prices in Australia and South Korea saw moderate gains in their local currencies, ending the year at A$36.65 per metric ton ($22.87/mt) for Generic Australian Carbon Credit Units (ACCUs) and KRW 9,295/mt ($6.32/mt), respectively, according to OPIS assessments, up 3% and 2% since the launch of OPIS APAC pricing on March 5. New Zealand’s market experienced policy driven volatility but stabilized in the fourth quarter as regulatory clarity improved, closing the year at NZ$62/mt ($34.97), down 7% over the same period.

The upward price trends reflect increasing cost pressures on emitters, a pattern expected to intensify as governments in the region impose stricter climate policies.

The reach of carbon costs is set to widen across APAC as more countries expand the scope of their emissions coverage under trading schemes. Governments are tightening caps and introducing carbon pricing to cover additional sectors.

The reach of carbon costs is set to widen across APAC as more countries expand the scope of their emissions coverage under trading schemes. Governments are tightening caps and introducing carbon pricing to cover additional sectors.

For example, China’s national emission trading scheme (ETS) is expected to include more industries in 2025, including steel, cement and aluminum smelting, while South Korea is refining its allocation process to reflect tighter baselines. This trend places an increasing burden on emitters, particularly those in energy-intensive sectors. The acceleration of these measures reflects a shared urgency among APAC nations to align with global climate commitments.

CBAM has heightened the urgency for APAC exporters to manage embedded carbon costs. CBAM requires importers to cover the price difference between the EU’s carbon costs and those of the producing country, impacting carbon-intensive goods.

Key strategies include reducing free allowances and raising carbon prices to promote decarbonization. India, reliant on high-emission sectors like steel, cement and aluminum, is among the most affected and is working toward a carbon trading mechanism by 2026. Similarly, Malaysia is planning a carbon tax on iron and steel the same year, while South Korea aims to reduce free allowances to offset CBAM costs.

Stricter emissions baselines also drive a structural overhaul across industries with chronic overcapacity or inefficiency, such as in China and South Korea.

The steelmaking sector in China, responsible for over 15% of global CO₂ emissions, faces significant overcapacity. The expanded inclusion of steelmaking under emissions coverage is expected to address these inefficiencies and reduce emissions, according to sources.

South Korea’s industrial sectors have been hindered by excessive emission free allowances (see chart 2), reducing the urgency for emissions cuts and suppressing carbon price growth.

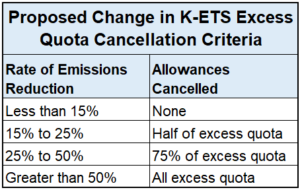

Regulators are proposing to tighten rules from 2025 to cancel unused allowances issued to emitters, preventing windfall profits from emissions cuts not linked to real decarbonization efforts, using a tiered rate system (see Chart 3). For those whose emissions decline by more than 50%, for instance, all excess allowances are proposed to be canceled.

With plans to tighten allocations, industries will face growing pressure to improve efficiency or incur higher carbon costs. While precise quantitative data on baseline tightening varies, the broader implication is clear: inefficient producers will face increased pressure to adapt or exit.

With plans to tighten allocations, industries will face growing pressure to improve efficiency or incur higher carbon costs. While precise quantitative data on baseline tightening varies, the broader implication is clear: inefficient producers will face increased pressure to adapt or exit.

Carbon markets with tighter compliance requirements are creating opportunities for voluntary carbon projects, with rising APAC compliance prices making premium credits, like blue carbon projects, more economically viable.

The growing alignment between voluntary and compliance markets highlights the potential for credits like New Zealand Units to benchmark premium offset projects. Forestry credits already comprise 60% of privately held NZUs, alongside free and paid allocations. Though offshore voluntary credits are currently ineligible for compliance, this trend highlights how carbon pricing

drives decarbonization and fosters carbon removal projects, emphasizing the role of market-driven solutions in sustainable carbon management across APAC.

Article 6 Credits: Bridging Voluntary and Compliance Markets

Article 6 Credits: Bridging Voluntary and Compliance MarketsThe landscape for Article 6 credits under the Paris Agreement is also becoming clearer, fostering convergence between compliance and voluntary markets. This alignment is expected to provide a much-needed framework for the APAC region, where the role of Internationally Transferred Mitigation Outcomes (ITMOs) begins to take shape.

Emerging price indications from Article 6 discussions suggest a pathway for voluntary carbon markets (VCMs) to support compliance objectives. Chart 4, tracking price indications across APAC, could illustrate the growing interplay between VCM pricing and compliance benchmarks, with VCMs providing price signals for ITMO transactions.

Singapore’s carbon tax is another critical price indicator, providing guidance for voluntary offset markets. Set at $18.30/mt in 2025, the tax establishes a baseline for pricing eligible voluntary offsets. The first eligible offsets, potentially tied to a Papua New Guinea cookstoves project, are expected to align closely with the carbon tax rate, meeting the demand for taxable obligations.

In 2025, the APAC carbon market is expected to undergo significant changes with policy tightening, market reforms and greater integration of voluntary and compliance frameworks. While challenges like CBAM costs and decarbonization persist, trends in pricing and market coordination suggest opportunities for voluntary projects and Article 6 credits.

— Reporting by Lujia Wang, lwang@opisnet.com, Melissa Goh, mgoh@opisnet.com; Editing by Mei-Hwen Wong, mwong@opisnet.com

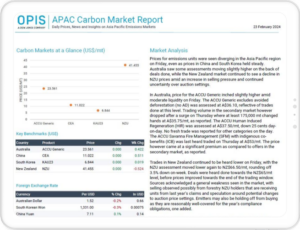

Sample the APAC Carbon Market Report for FREE

Sample the APAC Carbon Market Report for FREE

Carbon Credit Price Assessments for Asia-Pacific Markets

Countries in the Asia Pacific are increasingly implementing carbon markets as a proven mechanism for achieving decarbonization objectives and reaching climate policy goals. These markets are diverse in their scope and ambition – presenting opportunities and risks for market participants across the region.

OPIS APAC Carbon Market Report provides daily price transparency for carbon markets in Australia, New Zealand, South Korea and China, plus news and market commentary to support your trading strategies across the region.

In recent years, Asia’s fuel oil and bunker markets have been significantly impacted by major geopolitical events – in particular, the Russia-Ukraine war in early 2022 and the intensifying Middle East conflict since October 2023.

Such events continue to influence Asia’s fuel oil market. When Brent prices hit $81.84/bbl on Jan. 13, 2024, the highest in four and a half months due to new U.S. sanctions on Russia, both high sulfur fuel oil (HSFO) and very low sulfur fuel oil (VLSFO) prices hit similar multi-month highs of $486.71/metric tons and $580.70/mt on the same day.

Earlier, the Red Sea Crisis that erupted on Oct. 19, 2023 resulted in bullishness in the bunker markets as vessels had to avoid the Suez Canal and take the longer route around the Cape of Good Hope. This caused bunker prices in Singapore to surge ahead of bulk fuel oil prices, with the price spreads between VLSFO bunker and bulk VLSFO jumping to $63.13/mt on Nov. 29, 2023 from $18.23/mt on Oct. 2, 2023, OPIS data shows.

While the price spread was quickly corrected downwards soon after, it generally remained above the $20/mt level till late February 2024 as the Asian bunker market adjusted to the new normal.

With a new U.S. President in the White House in 2025, all eyes will be on how his administration and policies will affect these events and the resulting fallout on Asia.

While decarbonization remains at the top of mind for most market players, in reality, the use of renewable fuels has been limited and largely restricted to trials and demonstrations. This is unlikely to change in 2025, with the exception of China.

Asia’s demand for renewable energy should increase incrementally in 2025, but this is unlikely to make a significant dent on fossil fuel consumption in the marine and power generation sectors.

Importantly, Asia’s largest consumer, China, announced new policies in 2024 that will shape its fuel oil market in 2025 onwards.

China introduced three policy changes in the second half of 2024 that will affect the import appetite for fuel oil, particularly among the teapot refineries.

A consumption tax rebate on fuel oil imports taking effect January 2025 will affect teapot refiners that import fuel oil for refining into higher-value products such as gasoline and gasoil, market sources said.

Previously, the Chinese government gave full rebates to refiners once imported fuel oil was further processed. With the change, refiners will only receive rebates based on the amount produced.

As yields are typically in the range of 60-70%, refiners would receive over 400 yuan ($54.55)/mt less in rebates, according to market sources.

Starting in December 2024, China also reduced the export tax rebates to 9% from 13% for refined oil products such as gasoline for automotive and aviation use, jet fuel and diesel, a move that would reduce margins for exporters.

The third change was the imposition of a flat provisional import tariff of 3% on all its fuel oil imports since Jan. 1, 2025 to replace the current two-tiered system of 0% and 1%.

All three changes eat into refiners’ already thin margins.

Recently, some Chinese buyers have expressed concerns over Chinese ports potentially rejecting sanctioned vessels carrying Iranian crude and other products. These concerns are preventing some buyers from purchasing Iranian fuel oil imports for the time being, and have stopped some Chinese importers from purchasing higher-sulfur fuel oil at the start of 2024. The HSFO crack value to Dubai crude fell to a discount of $7.97/bbl on Jan. 7, the lowest in two months, OPIS data shows.

The Chinese government is expected to reduce the export quotas for VLSFO, and instead introduce new export quotas for biofuels blended with marine bunkers (biobunkers) starting 2025, according to market sources.

The export quotas for biobunkers should total around 500,000 mt, while export quotas for VLSFO, which stood at 13 million mt for 2024, will likely be reduced by the same amount.

To complement this measure, the Chinese government also eliminated the export tax rebate for waste-based biofuel feedstock, such as used cooking oil (UCO) and brown grease, starting Dec. 1.

This move has made it more expensive for sellers to export, and should improve the availability of feedstock for domestic biofuel production.

Russia’s invasion of Ukraine in February 2022 has resulted in a change in trade flows for crude and oil products as players worked around sanctions placed on Russia.

Russian fuel oil exports to Asia rose from 337,000 mt in January 2022 to a high of 2.8 million mt in December 2022, according to Vortexa. The lowest export volume to Asia in 2024 was 1.4 million mt in April.

Over 90% of exports were delivered to China, India and Singapore, and over 90% were HSFO.

Any change in the conflict will impact Asian fuel oil trade flows, and all eyes are on how the new Trump administration plans to resolve the conflict.

Presently, the general consensus is that a full resolution will neither be easy nor straightforward.

Bunker sales rose in Asia after most vessels avoided passing through the Suez Canal due to tensions in the Middle East, specifically the Red Sea.

Total bunker sales in Singapore rose by 6.0% year on year to 54.9 million mt in 2024, according to the Maritime and Port Authority of Singapore. Every month in 2024 recorded higher on-year bunker sales, except April and December.

It is uncertain if the crisis can be resolved in 2025. Shortly after Israel and Lebanon agreed to a ceasefire, Abdulmalik Al-Houthi, leader of the Houthi group, announced on Nov. 28 that it would continue its attacks in the Red Sea in support of the Palestinian people.

While heavy attention was paid to renewable alternatives to fossil-based bunkers in 2024, renewable fuels are unlikely to replace a significant portion of fossil bunkers in 2025.

This is largely due to a lack of mandates and regulations that promote the use of and increase the price competitiveness of renewable options, so Asian players are using renewable bunkers voluntarily.

This is unlike the European Union, where the EU Emissions Trading System and FuelEU Maritime Regulation directly and indirectly promote the use of renewable, low-carbon fuels.

To give an idea of the limited inroads made by renewable fuels in Asia, the Singapore Port sold 882,800 mt of biobunkers and 463,900 mt of LNG in 2024, representing a mere 2.5% of the 54.9 million mt of all bunkers sold.

Although China is pushing for more renewable fuel sales, its target of 500,000 mt of biobunker sales in 2025 is less than 4% against an estimated 13-14 million mt of total bunker sales in 2023-24.

Biobunker blends were more attractive in 2024 due to softer biodiesel prices after the EU imposed anti-dumping duties on Chinese biodiesel in July, resulting in ample supply in Asia.

The biodiesel market may pick up in 2025 as China will require large volumes of biodiesel for blending into biobunkers, though details such as blend levels are still unavailable.

–Reporting by Kite Chong, kchong@opisnet.com; Editing by Mei-Hwen Wong, mwong@opisnet.com

Asia’s gasoline market in 2025 will be shaped by a swift transition to green energy, particularly driven by the growing adoption of electric vehicles (EVs) in major markets like China, while demand in South and Southeast Asia remains stable and new trade flows emerge in the Middle East.

Asia’s gasoline market in 2025 will be shaped by a swift transition to green energy, particularly driven by the growing adoption of electric vehicles (EVs) in major markets like China, while demand in South and Southeast Asia remains stable and new trade flows emerge in the Middle East.

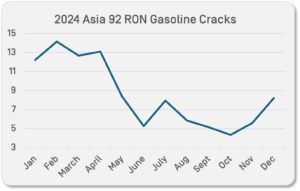

The Asia 92 RON gasoline spot price averaged $88.360/bbl in 2024, rising to a six-month high of $102.022/bbl in April before declining to a three-year low of $78.427/bbl in September, according to OPIS data.

The Asia 92 RON gasoline cracks meanwhile averaged $8.557/bbl in 2024, starting the year at $13.018/bbl in the first quarter before dropping to a one-year low of $2.972/bbl in October, and recovering to $8.226/bbl in December.

Trade sources said that weaker demand across Asia in 2024 contributed to the lower prices and refining margins compared to previous years. They also expect gasoline prices in 2025 to remain low amid oversupply risks.

Trade sources said that weaker demand across Asia in 2024 contributed to the lower prices and refining margins compared to previous years. They also expect gasoline prices in 2025 to remain low amid oversupply risks.

A further decline in demand across Asia, mostly driven by China’s shift away from traditional fuels, coupled with steady production from key exporters like the Middle East and South Korea, is likely to create a supply glut, keeping gasoline prices low throughout the year, sources added.

Outlook dim for exports and production in China

China’s gasoline exports and production declined in 2024. Data from the General Administration of Customs (GAC) showed that exports totaled nearly 9 million metric tons in the first 11 months, a 21% decrease year on year.

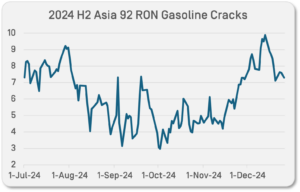

According to trade sources, poor refining margins prompted refiners to cut back on exports. The Asia 92 RON gasoline cracks plummeted from $11.086/bbl in the first half of 2023 to $6.150/bbl in H2 2024, OPIS data shows.

According to trade sources, poor refining margins prompted refiners to cut back on exports. The Asia 92 RON gasoline cracks plummeted from $11.086/bbl in the first half of 2023 to $6.150/bbl in H2 2024, OPIS data shows.

China’s rapid EV adoption has also led to decreased domestic gasoline demand, reducing refiners’ output, sources said. The latest data from China’s Association of Automobile Manufacturers shows that EV production and sales reached 8.316 million and 8.32 million in the first three quarters of 2024, reflecting year-on-year increases of 32% and 33%, respectively.

Looking ahead to 2025, market sources anticipate flat growth or even a decline in gasoline demand, as EV penetration rates are expected to continue rising.

With the ongoing shift towards EVs, sources foresee that China’s refining landscape will change significantly, driven by a move away from traditional fuel production and a growing priority placed on integrated petrochemical complexes.

“As China’s refining sector undergoes consolidation, capacity for gasoline production will be reduced, and output and supply will drop in 2025,” a source said.

Other sources noted that the reduction in Chinese export rebates for refined oil products, introduced in the fourth quarter of 2024, is expected to raise export costs and suppress gasoline exports in 2025.

A Singapore-based analyst said that this policy change could put independent refineries at risk of bankruptcy or closing, as many are already struggling amid poor export margins.

Another analyst added that the policy change could reduce China’s role as a major gasoline exporter in the region, with other key exporter nations likely stepping in to fill the gap to meet Asia’s gasoline demand.

Meanwhile, Japan’s refinery run rates declined to 73% in H2 2024, down from 77% in H2 2023, according to the data from the Petroleum Association of Japan (PAJ).

In Q3, major Japanese refiners experienced numerous unplanned outages and maintenance, which affected runs and increased gasoline imports to meet domestic demand, sources said.

Sources anticipate that Japan’s refining sector will likely experience continued weakness in 2025. Demographic headwinds, such as an aging population and low birth rates, are projected to reduce gasoline consumption. With weak demand, industry sources anticipate that Japanese refiners are expected to maintain low production runs in 2025.

In South Korea, refineries struggled amid weak refining margins in Q3 as the Asia 92 RON gasoline crack fell to $6.366/bbl. This led to a decline in exports from 3.64 million mt in Q2 to 3.49 million mt in Q3, Vortexa data shows.

However, margins recovered slightly in Q4, rising to $8.372/bbl by December, prompting refiners to increase runs again, according to sources.

However, margins recovered slightly in Q4, rising to $8.372/bbl by December, prompting refiners to increase runs again, according to sources.

Sources expect stable export volumes and production in 2025, as reduced Chinese exports from the new rebate policies could potentially create opportunities for South Korea to fill the gap. A trader predicted that the country will export around 10 to 12 MR-sized cargoes of gasoline per month in 2025.

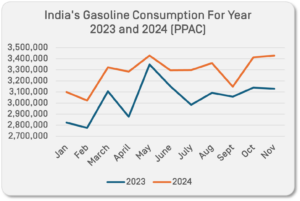

India, in contrast, continues to see robust gasoline demand in 2024, with consumption surpassing last year’s levels in every month. Data from the Petroleum Planning and Analysis Cell shows that consumption reached nearly 36 million mt in the first 11 months, up from 33 million mt the previous year.

Analysts predict that gasoline demand will grow by approximately 50,000 b/d in 2025, driven by India’s growing economy. Rising vehicle sales and ongoing infrastructure developments are expected to boost gasoline consumption as the country continues its economic growth, sources said.

Analysts predict that gasoline demand will grow by approximately 50,000 b/d in 2025, driven by India’s growing economy. Rising vehicle sales and ongoing infrastructure developments are expected to boost gasoline consumption as the country continues its economic growth, sources said.

Indonesia also maintained steady gasoline demand in 2024. Vortexa data revealed that imports rose to 14million mt in the first 11months, compared to 13.34 million mt during the same period in 2023. Strong economic growth is also expected to support continued demand and import levels through 2025, according to sources.

In Thailand, data from the Ministry of Energy showed that gasoline production reached 2 million b/d in the first 10 months, slightly higher than in 2023. However, sources expect flat gasoline demand growth in 2025, as the increasing adoption of EVs, supported by policies like the EV3.5 initiative and various government subsidies, will dampen consumption.

Australia’s gasoline production this year was reduced due to extended maintenance at Ampol’s Lytton refinery, which lasted from Q3 to November. According to analysts, this maintenance reduced output from 290,000 b/d in Q2 to 270,000 b/d in Q3, with a further drop of 10,000 b/d month on month in November.

However, sources expect Australia’s gasoline production and supply to remain stable next year, largely driven by the government’s push for a green transition towards low-sulfur gasoline. According to company sources, both the 109,000 b/d Lytton refinery and Viva Energy’s 120,000 b/d Geelong refinery will focus on upgrades next year to start producing and supplying low-sulfur gasoline.

In the Middle East, refinery capacity expansions and the construction of new refineries in 2025 are expected to increase gasoline supply and exports. However, ongoing geopolitical tensions have altered shipping routes, with vessels rerouting around the Cape of Good Hope due to Suez Canal disruptions.

“This routing change could reshape export patterns next year, potentially reducing exports to Europe and creating opportunities for increased exports to Asian markets like China and India,” a ship broker commented.

— Reporting by Cheryl Lee, clee@opisnet.com; Editing by Mei-Hwen Wong, mwong@opisnet.com

Asia’s LPG supply is expected to remain long in 2025 with demand largely dependent on the downstream petrochemicals sector, where poor downstream margins have plagued the Chinese market, industry players said.

Asia’s LPG supply is expected to remain long in 2025 with demand largely dependent on the downstream petrochemicals sector, where poor downstream margins have plagued the Chinese market, industry players said.

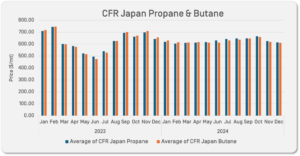

The prices of CFR Japan propane and butane, the reference prices for Asia LPG, eased by around 0.9% and 3.2% in 2024 from a January average of $619.65 per mt and $630.64/mt to an average of $614.25/mt and $610.25/mt as of Dec. 13, OPIS data shows.

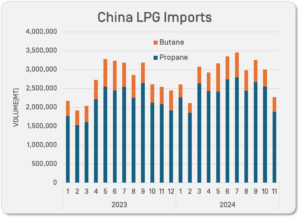

According to data from China Customs, China imported 32.21 million mt of LPG over January to November 2024, retaining its position as Asia’s largest LPG importer. The import figure exceeded the total import volume of 32.20 million mt over 2023.

According to data from China Customs, China imported 32.21 million mt of LPG over January to November 2024, retaining its position as Asia’s largest LPG importer. The import figure exceeded the total import volume of 32.20 million mt over 2023.

Some market participants attributed the overall import increase to the startup of new propane dehydrogenation (PDH) plants and crackers in China.

“Prices of LPG stayed relatively high through 2024, but new cracker and PDH plants starting up might have prompted a slight improvement in LPG appetite. However, most of these units are eventually subjected to poor margins,” a Singapore-based analyst said.

Six new PDH plants started up in 2024, bringing 4.1 million mt/year of propylene capacity online. This included Formosa Industries in Ningbo (600,000 mt/year, started up in January), Ningbo Kingfa Advanced Material (600,000 mt/year, March), Fujian Meide Petrochemical (900,000 mt/year, April), Shandong Zhonghai Petrochemical (300,000 mt/year, May), Jinneng Science and Technology (900,000 mt/year, July), and Dongying Zhenhua Petrochemical (750,000 mt/year, August), according to data from OPIS Chemical Market Analytics (CMA).

As for crackers, Sinopec Tianjin’s new cracker came online in November with an ethylene (C2) capacity and 1.2 million mt/year and a propylene (C3) capacity of 500,000 mt/year, the same data showed.

There are plans for at least two more PDH plants and three crackers to begin operations in 2025. These include Quanzhou Grand Pacific Chemical (660,000 mt/year), Sinopec Zhenhai Refining and Chemical (ZRCC) (600,000 mt/year), ExxonMobil (Huizhou) Chemical (C2: 1.6 million mt/year, C3: 900,000 mt/year), Wanhua Chemical (C2: 1.2 million mt/year, C3: 340,000 mt/year), and Shandong Yulong Petrochemical (C2: 1.5 million mt/year, C3: 645,000 mt/year), according to CMA data.

Market analysts believe that while there is upside to LPG demand from the petrochemical segment with these new projects, most PDH and cracker operators are still more focused on keeping costs low than ramping up operating rates and propane purchases with margins still in the red, another Singapore-based analyst said.

Operating rates of Chinese PDH plants, key consumers of LPG as feedstock, were at around 73.8% in October 2024 before falling to 68.2% in November, CMA data shows. PDH operating rates, however, were anticipated to be at 70.3% for December 2024 before increasing slightly to around 72% in January 2025 and to 74.3% in February 2025, still a far cry from optimal capacity.

Operating rates of Chinese crackers, with the option of using LPG as feedstock, were at 83.8% in October 2024 before falling to 81.7% in November, OPIS CMA data showed. Cracker operating rates, however, were anticipated to be at 82.7% for December 2024 before easing slightly to 82.1% in January 2025 and to 81.2% in February 2025, far below maximum capacity.

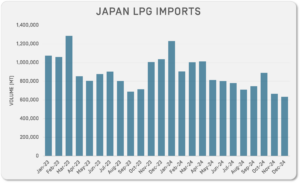

A similar slowdown is taking place in Japan, Asia’s second-largest LPG importer. Based on Vortexa’s data for 2024 so far, the country imported 10.2 million mt of LPG for the year, down 8.2% year to year.

A similar slowdown is taking place in Japan, Asia’s second-largest LPG importer. Based on Vortexa’s data for 2024 so far, the country imported 10.2 million mt of LPG for the year, down 8.2% year to year.

Japan’s slowing LPG cracking demand was attributed as one of the main factors for the fall in its imports, according to industry sources. Investments into Japan’s LPG cracking flexibility projects have been limited, unlike in South Korea where the country has a proximity advantage in supplying petrochemicals to China, said a Singapore-based analyst.

South Korea was observed to have imported a total of around 10.2 million mt of LPG from January to December 2024, up 5% year-to-year from 9.7 million mt, according to Vortexa’s data.

Overall, LPG demand for the cracking pool improved in 2024 from 2023, with the annual average for 2024 at around 440,300 mt, up 27.3% from last year’s 349,150 mt, according to OPIS data. Market participants attributed the increase to slightly improved petrochemical margins compared with 2023.

Most market participants however remain concerned that a full recovery in demand from the petrochemical segment is still not in sight for 2025.

Monthly contract prices (CPs) for Middle Eastern LPG heading to Asia have averaged $610.40/mt for propane and $607.50/mt for butane in 2024, up from the average of $575/mt and $577.10/mt, respectively, in 2023, according to OPIS data.

Demand from Asia is the driving factor for the lift on Saudi Aramco’s monthly CPs. Still, some market analysts believe that the monthly CPs might ease heading into the first quarter of 2025 with limited demand from Asian buyers.

Some market analysts believe that the monthly LPG export volume from Saudi Arabia to be around 600,000-700,000 mt/month over Q1 2025. It might hold at the same level from Q2 2025, depending on whether OPEC+ announces any further cuts on crude.

Without waiting time issues or low water level issues at the Panama Canal, cargoes flowing into Asia from the West will most likely compete with Middle Eastern cargoes, which might add some downward pressure on the Aramco CPs, market sources said.

Outside of Asia, LPG exports from the U.S. continue to rise. The U.S. exported an estimated 36.8 million mt of LPG into Asia from January to December 2024, 15.7% higher compared with the same period in 2023 at around 31.8 million mt, according to Vortexa as of Jan. 2.

Japan remains the main outlet for U.S.-origin LPG cargoes, unchanged from 2023 with China and South Korea the next largest.

–Reporting by Alex Theo, atheo@opisnet.com; Editing by Mei-Hwen Wong, mwong@opisnet.com

Take a FREE trial to the Global LPG Outlook

Take a FREE trial to the Global LPG Outlook

Empower your LPG Market Decisions with Expert Analysis and Forecasts from OPIS

The OPIS Global LPG Outlook offers a unique blend of weekly market updates and monthly deep-dive analysis, specifically tailored for LPG (propane and butane) market participants. This new report, backed by Chemical Market Analytics’ expertise and reflecting the OPIS Mont Belvieu benchmark, provides the comprehensive insights needed to navigate the fast-paced global LPG market.

Firm aviation demand looks set to drive Asia jet fuel demand in the first-half of 2025 although the clean energy transition is expected to dampen gasoil demand in key markets such as China and South Korea, according to market sources.

In the last quarter of 2024, the jet fuel crack, or jet’s refining margin against Dubai crude, rose to an average of $15.16/bbl compared to an average of $14.25/bbl in the previous quarter, according to OPIS data.

In the last quarter of 2024, the jet fuel crack, or jet’s refining margin against Dubai crude, rose to an average of $15.16/bbl compared to an average of $14.25/bbl in the previous quarter, according to OPIS data.

Market participants remain bullish towards jet fuel demand heading into 2025 as airlines add and resume flight routes from pre-Covid periods. Global airline seating capacity is projected to reach 5.91 billion for 2024, surpassing 2019 capacity by 2.4% and increasing 6.4% compared to 2023, according to a report published by OAG.

On the heating fuel front, seasonal winter demand is expected to draw on Japan’s kerosene inventories. Kerosene inventories were at 16.67 million bbl for the week to Nov. 30, a decrease of 6% from the same period in 2023, data from the Petroleum Association of Japan (PAJ) shows.

In the first quarter of 2025, Asian jet fuel/kerosene demand will be further supported by the Lunar New Year holiday travels, according to an analyst.

Meanwhile, the sustainable aviation fuel (SAF) market remains in its infancy, market watchers said.

Only 10 out of 77 airlines in a ranking put together by Transport & Environment (T&E) “have serious plans to transition to green fuels,” according to the European advocate for clean transport and energy.

The International Air Transport Association (IATA) had noted in early December 2023 that at least 43 airlines have already committed to use some 16.25 billion liters (13 million metric tons) of SAF in 2030.

However, SAF supply has been limited by the available production facilities globally. IATA projected that global SAF production reached over 1.9 billion liters (1.5 million mt), triple the 600 million liters (500,000 mt) produced in 2023.

As for the gasoil market, diesel demand is expected to fall by 160,000 b/d in the whole of 2024, led by China and South Korea, according to an industry source.

In the last quarter of 2024, the gasoil crack spread rose to an average of $15.00/bbl compared to an average of $14.92/bbl in the previous quarter amid market uncertainty and crude oil price fluctuations, according to OPIS data and market sources.

China’s lackluster gasoil demand in 2024 can be partly attributed to a growing shift towards LNG-fueled trucks, said Mia Geng, Head of China Oil Service at FGE.

Sales of LNG trucks in China are on track to rise by 12% y-o-y in 2024, bringing its share in China’s total heavy duty truck fleet to 10%, according to the energy consultancy firm.

Over in South Korea, diesel demand for road transport also looked to be on a downward trajectory amid the transition to cleaner fuels. Its capital of Seoul has ceased sales of new diesel cars for public use since mid-2020 and the city government is targeting to remove all diesel vehicles from public transportation by 2025, according to local reports.

Over in India, gasoil consumption in the first 10 months of 2024 totaled 74.89 million mt, up from 73.61 million mt in the same period of 2023, according to data from the Petroleum Planning and Analysis Cell (PPAC) at the country’s Ministry of Petroleum & Natural Gas.

The South Asian nation is expected to lead the growth in gasoil demand as infrastructure development continues to grow, industry players noted.

Meanwhile, Australia’s demand for gasoil is expected to remain strong with the lack of refining capacity to meet domestic demand.

Australia imported an average of 15.72 million bbls per month of diesel in the first six months of 2024, up 0.3% from an average of 15.68 million bbls per month in the same period last year, the latest data from global oil association, the Joint Organisations Data Initiative (JODI) shows.

In the first quarter of 2025, demand is expected to be capped, especially in China as industrial activities slow down over the Lunar New Year holidays.

On the sustainability front, gasoil demand may see some losses in Southeast Asia as authorities push for increased biodiesel blending.

Indonesia started to blend 35% of biodiesel into its diesel pool (B35) in February 2023 and planned to increase this further to B40 by 2025, said Energy Minister Arifin Tasrif.

Malaysia is looking towards implementing a B30 mandate in 2025 after it failed to pass a mandate to raise the domestic biodiesel blend to B20 in 2022.

Besides Indonesia and Malaysia, South Korea also aims to increase its biofuel blending mandate to 5% by 2030, up from the current 4%.

–Reporting by John Koh, jkoh@opisnet.com; Editing by Mei-Hwen Wong, mwong@opisnet.com

Naphtha crackers across Asia are bracing for further margin pain in the year ahead, as increasing input cost, oversupply driven by China’s capacity expansion, and looming trade barriers weigh on the market.

The benchmark CFR Japan naphtha price averaged $674.17 per metric ton (mt) in 2024, a 4.2% increase from the average of $648.59/mt one year prior, OPIS data shows. This, combined with the downstream ethylene expansion, has posed a stress test for the entire petrochemical industry and, in turn, could negatively affect the upstream naphtha market over the long term.

The benchmark CFR Japan naphtha price averaged $674.17 per metric ton (mt) in 2024, a 4.2% increase from the average of $648.59/mt one year prior, OPIS data shows. This, combined with the downstream ethylene expansion, has posed a stress test for the entire petrochemical industry and, in turn, could negatively affect the upstream naphtha market over the long term.

“Stakes facing naphtha crackers are high amid shrinking margins, and more rationalization is on the horizon,” an industry source said, citing the increased feedstock cost and lackluster downstream demand.

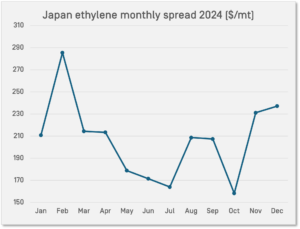

The ethylene spread, a profitability indicator, averaged just $206.76/mt in 2024, well below the breakeven point of $300/mt observed in 2022, according to OPIS’ calculations.

The ethylene spread, a profitability indicator, averaged just $206.76/mt in 2024, well below the breakeven point of $300/mt observed in 2022, according to OPIS’ calculations.

Pressure is building across naphtha crackers, particularly non-integrated plants. Recently, Philippine petrochemical producer JG Summit reportedly decided to shut its naphtha cracker and downstream production in Batangas from mid-December to late March 2025.

Vietnam’s Long Son Petrochemical, which had started commercial operations only on Sept. 30, shut its naphtha cracker indefinitely in mid-October. Sources expect more crackers in Asia to pause production in the new year ahead due to sluggish downstream margins.

A large part of the oversupply is driven by China, a key player in global naphtha demand due to its significant share in downstream consumption. For years, the country was the mainstay in securing ethylene tonnages in the seaborne market.

But this trend reversed in 2021 when China began exporting ethylene to Southeast Asia to address its domestic oversupply issues. This shift has cast a shadow over the petrochemical industry, eroding profit margins for ethylene plants, with most producers now operating in the red.

Between 2018 and 2024, a wave of ethylene capacity expansions — up to 28 million mt — took place across China. Additionally, 21 steam crackers were slated for construction as part of the second wave of investments.

If all these projects are completed on schedule, the second wave of expansion is expected to add another 26 million mt of ethylene capacity by 2026, according to Chemical Market Analytics.

All eyes are now on China, raising hopes that any potential demand recovery from the nation could help absorb the supply glut.

“We are hoping that China will resume ethylene imports, but any potential demand recovery will have to depend on the overall economic climate,” said a Japanese source.

Despite languishing downstream, the price of feedstock naphtha remains supported, thanks to additional demand from the capacity expansion. The resilient feedstock, however, further adds to the market woes facing ethylene plants.

In contrast to ethylene production losses, naphtha crack spread, a gauge of profitability to refine naphtha, saw a notable increase in 2024. OPIS assessed the naphtha crack spread at an average of $74.84/mt as of Dec. 10, more than double the average of $36.28/mt in the preceding year.

“I don’t think the naphtha market is as bearish as what the downstream margin suggests,” a trader said, holding an optimistic view over the short term.

OPIS assessed the naphtha CFR Japan cash differential at an average of $8.65/mt premium to Japan naphtha quotes over the past year, nearly doubling from $4.93/mt the previous year.

“The naphtha market is faring better [than downstream ethylene plants], partly on the back of demand from new capacities,” a second trader said.

In 2025 alone, six naphtha-fed steam crackers are expected to come online from China, adding to one from Indonesia.

That said, concerns are growing about the long-term pressure from downstream, with fears that this could eventually drag down upstream prices as well. Most participants see the inflection point around 2026, at a time when all the new supplies will be hitting the market.

“Over the longer term, demand remains the key concern for the naphtha market, and no one is optimistic about it,” the first naphtha trader said, lamenting downstream pressure.

The new Trump presidency, which vows to impose tariffs on Chinese products, is also expected to exacerbate petrochemical market woes, with the headwinds likely to filter into the upstream sector over time, market sources said.

“The U.S. is more likely to impose import taxes on China’s finished goods rather than on feedstocks, but the impact will also depend on how the market reacts and whether China responds in kind,” a naphtha trader said, adding that any tax on finished products could further dampen petrochemical consumption in China.

Although no concrete policy has been established yet, downstream demand for polyethylene in China has reportedly seen some preemptive benefits from front-loading trades, shrugging off the seasonal lull seen elsewhere, as exporters rush to stockpile materials ahead of potential tariffs.

Still, market sources generally believe the front-loading effect will be temporary and minimal. In the long run, the incoming tariffs will likely harm downstream consumption demand in China and further strain the margins of ethylene producers across Asia.

–Reporting by Yiwen Ju, yju@opisnet.com; Editing by Mei-Hwen Wong, mwong@opisnet.com

Asia’s paraxylene market is expected to remain volatile in 2025, with China cost and freight PX prices likely driven by U.S. gasoline blending demand as well as supply fundamentals.

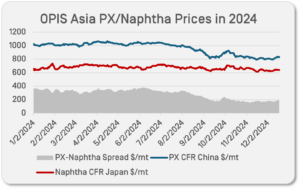

CFR China PX prices averaged around $956.68 per metric ton in 2024, hitting a year-low of $795/mt on Nov. 15, according to OPIS data. But margins are expected to remain positive with the PX-to-naphtha spread returning to above $300/mt during the peak U.S. summer gasoline blending season, according to Chemical Market Analytics by OPIS.

The PX-naphtha spread in 2024 averaged $285.78/mt to date on Dec. 18 after falling to its lowest in the year at $153.38/mt on Nov. 6, squeezing Asian PX producers’ margins as PX supply lengthened amid weak gasoline blending demand. A key challenge for producers in 2025 will be sustaining production at a healthy margin of $350/mt, a level not seen since the first half of 2024, a market source said.

Chinese gasoline exports also have a major impact on Asian PX markets and, in turn, on PX-naphtha spreads. In 2025, CMA expects a lower Chinese gasoline export quota, but with growing electric vehicle penetration expected to slow down gasoline demand in China by 2026 or 2027, CMA expects China to export more gasoline again during these two years.

Chinese gasoline exports also have a major impact on Asian PX markets and, in turn, on PX-naphtha spreads. In 2025, CMA expects a lower Chinese gasoline export quota, but with growing electric vehicle penetration expected to slow down gasoline demand in China by 2026 or 2027, CMA expects China to export more gasoline again during these two years.

U.S. gasoline blending demand in 2024 was mostly sluggish, with gasoline consumption reaching 8.94 million b/d in 2024, flat year on year, according to the Energy Information Administration’s short-term energy outlook forecasts. The agency’s estimate for 2025 gasoline consumption is slightly higher at 8.95 million b/d, with some market participants optimistic that the increase in gasoline consumption will support PX demand in 2025.

However, crude oil supply is expected to increase after OPEC+ withdraws from production cuts in 2025. This means that crude oil and derivative prices are expected to remain under pressure, with a likely trickle-down effect on Asian PX prices, according to a market source.

TDP margins, which were mostly healthy in 2024-with the benzene-to-tuoluene price spread averaging $153.70/mt to date on Dec. 18, according to data from OPIS, have boosted benzene production, with an indirect impact on an increase in PX supply.

Paraxylene-to-tuoluene price spreads, however, averaged lower at $126.59/mt to date over the same period. Meanwhile, the paraxylene-to-isomer mixed xylene price spread averaged the lowest to date on Dec. 18 at $102.03/mt. The still-positive TDP economics are expected to continue to support aromatics production in 2025.

PX demand growth in China has been exceptional in the past couple of years with polyester growth of 17% in 2023 and 12% in 2024, although 2025 growth is expected to be low at around 5-6%, according to Ashish Pujari, Vice President – Aromatics & Fibers, CMA.

China’s supply of PX stagnated in 2024 amid a dearth of new plant startups, with the country’s PX production expected to reach about 44 million mt in 2024, similar to the production volume of 43.8 million mt in 2023, an industry source said.

The uncertain startup date of Shandong Yulong Petrochemicals’ 3 million mt PX plant in 2025 is expected to contribute to tighten Chinese PX supply. This is especially since China has seen no new PX capacities after about 9.5 million mt/year entered the market in 2023.

About 8.3 million mt/year of new PX capacities expected to come online earliest in 2026. But with possible delays in startup for some of these facilities, including Huajin Petrochemicals’ 2 million mt/year plant in Liaoning, ZhongjinNo. 2 unit 1.6 million mt/year plant in Zhejiang, Sinopec Jiujiang No. 2 unit 1.5 million mt/year plant in Jiangxi, and Gulei Petrochemicals 3.2 million mt/year plant in Fujian, China’s PX market is expected to continue to turn to imports to meet demand in 2025.

China’s PX imports stood at about 9 million mt in 2023 and 8.4 million mt in the January-November 2024 period, an industry source said. Imports are expected to play a crucial role in filling the supply void in the Chinese market amid increased downstream terephthalic acid (PTA) demand, the source added.

Looking ahead, downstream PTA supply is expected to increase in 2025 with the startup of Dushan Energy’s 3 million mt/year plant in Zhejiang, Honggang Petrochemical’s 2.5 million mt/year plant in Jiangsu, and Helen (SFX) 3.2 million mt/year plant in Jiangsu, adding about 8.7 million mt/year of PTA supply to the market.

The mismatch in China’s PX supply and PTA demand will lend some support to Asia’s PX demand, though the overall performance of PX market fundamentals in 2025 is unlikely to boost prices drastically, an industry participant said.

–Reporting by Serena Seng, sseng@opisnet.com, Editing by Mei-Hwen Wong, mwong@opisnet.com

Asian phenol prices are projected to remain weak relative to feedstock benzene in 2025 as supply growth continues to surpass demand growth amid ongoing capacity expansion driven by China.

In 2024, spot FOB Northeast Asia phenol prices averaged $982.50 per metric ton basis selling to China, according to Chemical Market Analytics (CMA) by OPIS data, $2.20/mt below that of spot benzene, which OPIS assessed at $984.70/mt FOB Korea. This is $200-$250/mt below the spread needed by phenol makers to stay viable. As supply outstrips demand, Asian phenol makers’ margins are projected to remain negative for the third year running, according to a forecast by CMA.

While margins are expected to remain negative, CMA forecasts a narrowing of losses for phenol producers in 2025, with margins averaging at about minus $110/mt. This represents an improvement from around minus $130/mt in 2024, and minus $170/mt in 2023. In contrast, margins in 2020 were positive at about $140/mt, CMA data shows.

CMA’s analysis shows that phenol supply in 2025 is set to surge by about 14%, while demand is forecast to grow by only 5%.

“The trilemma of the phenol industry today revolves around grappling with an oversupplied market, strong benzene feedstock prices and subdued downstream demand. This is unprecedented in history for phenol producers, who have been operating in losses for more than a year, and is likely to persist in 2025,” said Terence Peh, Singapore-based Associate Director at CMA.

In Northeast Asia, the commissioning of four plants is set to add nearly 1.2 million mt of phenol production capacity in 2025. In China, Sinopec Zhenhai Refining & Chemical, PetroChina Jilin and Shandong Ruilin are set to bring a combined 837,000 mt/year of production capacity online, boosting the country’s total by nearly 13% to 7.3 million mt/year. Ongoing capacity expansion by Wanhua Chemical will further raise China’s total capacity to nearly 7.4 million mt/year by end-2025.

In South Korea, Lotte GS Chemical’s new 350,000 mt/year plant will boost the country’s operational phenol production capacity by 30% to 1.5 million mt/year. The start-up of Lotte GS’ integrated 240,000 mt/year bisphenol-A (BPA) unit is likely to prompt existing South Korean BPA makers to scale back operations, a regional trader said.

“I am not optimistic about the phenol and acetone markets in 2025. Competition among producers will only intensify,” said a China-based phenol trader.

A consequence of rising supply is that Northeast Asian phenol makers will further curtail their capacity utilization, which has already declined from about 76% in 2023 to 70% in 2024. The average operating rate across Northeast Asia could further dip to around 65% in 2025, according to CMA’s forecast.

Imports into China, the world’s largest producer and consumer of phenol, are also expected to extend a decline as the country’s self-sufficiency increases. China imported 237,731 mt of phenol in the first 11 months of 2024, a decline of 25% compared to the same period in 2023, Customs data shows.

“2025 will become even more of a buyers’ market for phenol and acetone,” said a Northeast Asian trader.

The worsening overcapacity has accelerated industry consolidation outside China. In April 2024, Japan’s Mitsui Chemicals announced plans to close its Chiba unit by the end of the Japanese fiscal year 2026, which concludes in March 2027. However, market sources have suggested that operations could cease sooner and within calendar year 2025. Downstream, 2024 also witnessed the shuttering of three BPA plants in Japan.

Regional demand for phenol and acetone will also be curtailed by downstream plant closures as producers shed unprofitable business units.

In September 2024, U.S. producer SI Group announced plans to shutter its alkylphenol manufacturing facility on Singapore’s Jurong Island in 2025.

Separately, Japan’s Asahi Kasei announced in November 2024 the closure of PTT Asahi Chemical in Thailand, its 50:50 joint venture with PTT Global Chemical. The site, including an acetone-based methyl methacrylate (MMA) plant, will be dismantled. This followed the July 2024 closure of Mitsubishi Chemical Group’s acetone-based MMA plant in Hiroshima, Japan.

Also in Japan, Ube Corp. in July 2024 closed one of its two caprolactam production lines in Yamaguchi Prefecture. In line with this, Ube’s production of cyclohexanone and its associated requirement for feedstock phenol have decreased, a market source said.

In their respective announcements, SI Group, Asahi Kasei, Mitsubishi and Ube cited regional supply and demand imbalance as key reasons for ceasing or scaling down operations.

“The market has been tough, and is likely to get tougher,” said another Northeast Asian trader.

Even as the industry grapples with overcapacity throughout the phenolics chain, rising protectionism and trade barriers in the form of tariffs present further headwinds.

In September 2024, China extended its antidumping duties (ADDs) on imports of phenol. In November 2024, the U.S. Department of Commerce announced preliminary ADD rates on imports of epoxy resin from Asia. In early 2025, the European Union is also likely to hand down its own set of ADDs on epoxy resin imports.

Within this region, the implementation of the Bureau of Indian Standards (BIS) certification for acetone since March 2024 has, in effect, barred Chinese suppliers from exporting acetone to India. This was followed by India’s decision in late 2024 to levy ADDs on isopropanol (IPA) originating from or exported by China.

2024 witnessed extended periods when phenol was priced lower than both its feedstock benzene and coproduct acetone. This phenol-to-benzene price spread, or the difference between spot phenol and spot benzene prices in eastern China, flipped from positive to negative, at times widening to minus 1,600 yuan/mt (minus $223/mt), CMA data shows.

According to CMA’s Peh, a phenol-to-benzene price spread of approximately 1,900 yuan/mt, or phenol that is priced about 1,900 yuan/mt higher than benzene, would be considered viable for China-based phenol producers. For Asian producers, a viable spread is at least $200-$250/mt.

In the first half of 2024, as phenol makers responded to margin erosion with production cutbacks, output of coproduct acetone dropped proportionally. At the same time, crimped supply also enabled producers to mitigate their overall losses by raising acetone prices. In China, for example, acetone was priced higher than phenol from April to June 2024, a reversal of the typical price hierarchy between the main product and its coproduct. During this period, spot phenol in eastern China averaged 7,816 yuan/mt ex-tank, 261 yuan/mt lower than spot acetone, CMA data shows. The price hierarchy started to normalize from late June, and in the fourth quarter of 2024, spot phenol averaged 2,042/mt higher than acetone, the data shows.

2024 has been a year of anomalies, demonstrating that it might be more economically viable for producers to procure phenol than manufacturing it from costly benzene and sell it at a loss. The year has also shown that it might be more profitable for phenol makers to sell cumene and capitalize on the spike in benzene prices that had been driven by the seasonal surge in U.S. demand for octane.

Looking ahead, “2025 will be a crucial year for Asian phenol producers,” said a regional producer. “Hopefully, some economic logic will prevail.”

–Reporting by Trisha Huang, thuang@opisnet.com; Editing by Mei-Hwen Wong, mwong@opisnet.com