2025 Outlook for

Oil, Refining and the Petrochemical Market

in Europe

2025 Outlook for

Oil, Refining and the Petrochemical Market

in Europe

View the Europe Outlook stories below.

Europe LPG Market Eyes Trump Tariffs, Russia Sanctions

Europe LPG Market Eyes Trump Tariffs, Russia SanctionsAs the northwest European liquefied petroleum gas (LPG) market moves into 2025, further rationalization in the petrochemical sector is expected. Moving beyond the petrochemical landscape, retail LPG use may see existing supply from Russia into Eastern Europe and Poland supplanted by supply from the U.S. as the ban on Russian-origin LPG takes effect after December 2024.

The EU estimates the ban will impact LPG imports worth over €1 billion ($1.09 billion)/year. Russian supply made up around 6% of total LPG imports in the EU in 2023, according to EU Commission data.

Voluntary SAF Demand Turns Mandatory

Voluntary SAF Demand Turns MandatoryThe nascent sustainable aviation fuel (SAF) market will enter a new phase in its development in 2025, when government mandates kick in across Europe.

SAF is seen as the easiest way to decarbonize the aviation industry because it is a drop-in fuel that results in a significant reduction in lifecycle emissions compared to petroleum-based jet fuel. While the U.S. is incentivizing SAF growth via fiscal incentives, European governments have opted for the stick rather than the carrot approach.

Slower Jet Fuel Demand Ahead

Slower Jet Fuel Demand AheadDemand for jet fuel will continue to increase in 2025 both in Europe and globally, but growth is likely to be slower than in 2024 due to a post-Covid 19 normalization in passenger volumes and ongoing improvements in aircraft fuel efficiency.

The International Energy Agency (IEA) expects global jet fuel and kerosene demand to grow by just 2.2% in 2025 to 7.67 million barrels/day. This compares with a growth rate of 5.3% in 2024, when air traffic expanded at a faster pace.

The 2025 aromatics markets, defined as benzene, toluene and styrene and their derivatives, is expected to be much the same as that of 2024, according to feedback received by OPIS from multiple sources.

Especially in terms of demand from the gasoline blending pool, the aromatics markets failed to meet expectations in 2024, and was softer than predicted, while supply remained healthy across the chain.

Prices drifted lower but there were also occasional spikes, mainly driven by a squeeze in supply that prompted a surge in demand. Issues with feedstock availability for benzene and unexpected lower supply of toluene over the last four months of the 2024 did provide a floor for both aromatics and helped their prices remain firm. This pattern is expected to continue in 2025.

Decarbonization of EU Power Sector, CBAM Loom

Decarbonization of EU Power Sector, CBAM LoomThe influence of European carbon markets and the tentacles of the incoming carbon border adjustment mechanism (CBAM) continued to be felt around the world in 2024, even as British carbon allowances (UKAs) traded near record lows and European Union carbon allowances (EUAs) traded below €80 ($84.08)/metric ton for most of 2024 after reaching triple digits in early 2023.

Emissions from the power sector in Europe continued to fall, lowering demand for EUAs and UKAs. As a result, leading carbon analyst Mark Lewis, head of climate change research at Andurand Capital, suggested in the spring that the market was in a “no man’s land”, with few big potential price drivers.

Diesel and gasoil markets in Europe are poised to become more balanced in 2025 after a period of flux amid supply shifts, demand dynamics and refinery rationalizations. However, the push towards energy transition and electrification continues to temper long-term demand, particularly in road transport.

Navigating the Hydrogen Headlines in Europe

Navigating the Hydrogen Headlines in EuropeThe renewable hydrogen sector is undergoing a transformation, characterized by rapid technological advancements, expanding manufacturing capabilities, and complex geopolitical dynamics. As the world seeks sustainable energy solutions, hydrogen emerges as a critical component in the global decarbonization strategy.

Electrolyzer manufacturing capacity doubled in 2023 to 25 gigawatts/year, with China accounting for 60% of this figure. However, utilization remains low, with only 2.5 GW of output used in 2023. Those projects with a final investment decision (FID) outstanding, or currently under construction, suggest that manufacturing capacity could exceed 40 GW/year by the end of 2024.

European Shipping Navigates Unchartered Waters of Going Green

European Shipping Navigates Unchartered Waters of Going GreenThe shipping industry in Europe is under pressure to reduce the use of traditional, petroleum-based marine fuels in favour of frequently more expensive, zero-carbon alternatives to adhere to stringent environmental regulations. The industry is also battling with increased operating costs from purchasing European Carbon Allowances, upgrading or retrofitting older less efficient vessels as well as trying to compete with the aviation and road transport sectors for biofuels.

Several refineries in Amsterdam, Rotterdam and Antwerp (ARA) scheduled maintenance work during the fourth quarter of 2024 reducing output.

As the northwest European liquefied petroleum gas (LPG) market moves into 2025, further rationalization in the petrochemical sector is expected. Moving beyond the petrochemical landscape, retail LPG use may see existing supply from Russia into Eastern Europe and Poland supplanted by supply from the U.S. as the ban on Russian-origin LPG takes effect after December 2024.

The EU estimates the ban will impact LPG imports worth over €1 billion ($1.09 billion)/year. Russian supply made up around 6% of total LPG imports in the EU in 2023, according to EU Commission data.

Increases in LPG supply from the North Sea are highly unlikely given the maturity of existing fields. Instead, any new supply in 2025 is likely to depend on expansion of U.S. export terminals. However, this may not come to pass given that U.S. export terminals had maxed out their capacity by the middle of 2024, sending spot fees soaring.

Enterprise Products Partners expects its 195,000 b/d Fractionator 14 at Mont Belvieu to be operational in 2025, while to alleviate constraints at terminals, other projects are on track to expand capacity.

Enterprise Products Partners is expecting the first phase of its Neches River NGL Export terminal to be operational in 2025 as well as the final phase of its Morgan’s Point Terminal Flex expansion. Targa Resources is planning a debottlenecking of its existing terminaling facilities during 2025.

Meanwhile, seasonally dryer weather along the Panama Canal is expected to begin again in January, bringing the risk of transit restrictions implemented in the early part of 2025 and impacting supply. From a shipping point of view, terminal constraints in the U.S. Gulf Coast are likely to be the largest concern for the market in 2025.

Energy Transfer says the expansion of its natural gas liquids (NGLs) and LPG export terminal in Nederland, Texas, is on track to start limited service in mid-2025 and will likely reach full capacity of 250,000 b/d in Q3 2025. The expansion in capacity available in the latter part of 2025 could inflate VLGC freight rates in the period as ton-mileage builds and vessel inefficiencies surge.

Additional export projects in the U.S. Gulf and west coast of Canada could increase capacity 40% through to 2028, according to data from shipowner Dorian LPG. In the U.S. Gulf, there are four projects in the pipeline, all based in Texas, that could add a potential 2.27 million mt/month of capacity.

Nevertheless, pressure on U.S. exports is set to increase further in 2025 with terminal capacities continuing to run at full-capacity and Asian consumption capacity growing.

U.S. NGL production is expected to increase 5% on the year in 2025, consultancy NGL Strategy noted. And with exports capped and production grown, the inventories are expected to climb above the five-year average. However, geopolitics are likely to play their part on global trade again in 2025.

President-elect Donald Trump’s promised trade policies of hikes in tariffs on goods coming from Mexico, Canada and China could disrupt the global trading pattern, offering the possibility of a two-tiered market for exports into Asia.

While comparisons will obviously be made to the tariffs implemented by Donald Trump in 2019, the market has changed significantly since then amid surging Chinese LPG demand. In 2018, the U.S. exported 1.17 million mt of propane and butane to China, data from shipping analytics firm Vortexa showed, dropping to 88,500 mt in 2019. But in 2024, the U.S. exported a whopping 16.1 million mt of propane and butane to China.

In a 2025 trade scenario that assumes no U.S. product is exported to China, then even if all Middle East, West Africa, Canadian flows were re-directed to China, the amount required would still be short, according to NGL Strategy, as the U.S.-China flow remains essential.

The tariffs bring about the possibility of U.S. flows travelling to another country, just for China to then purchase the same volumes from a third party. This offers the possibility of increased ton-mileage for the VLGC fleet, bringing extra costs to shipping and putting more pressure on Chinese buyers who are already operating with fine margins at some of their PDH and steam cracking units.

And as mentioned, in Europe, as the ban on Russian propane and propane-mix products comes into force, how prepared are some of the countries that were previously more reliant on Russian LPG flows?

Poland has been a major recipient of Russian LPG over the years, not just via sea but also rail. Ukrainian consultancy A-95 said Russia exports around 1 million mt/year of propane and butane via rail links to Poland.

On the import side, infrastructure and logistics remain key. There are four main seaborne LPG terminals in the north – Police, Szczecin, Gdansk and Gdynia. However, their combined capacity is not enough to cover the total seaborne flow needed to make up for the ending of Russian LPG trade.

There is a great expectation that more LPG will be sourced from fellow European countries like Sweden, Finland and Norway, as well from the U.S., which is expected to ramp up exports to Europe in 2025.

As a result, the European coaster market could become more active, particularly on trades from Karlshamn and Stenungsund in Sweden. These are typical re-export hubs in northern Europe, importing large volumes from the U.S., a pattern likely to increase to offset Russian shortfalls.

Additional volumes could be sourced via railways from the Amsterdam-Rotterdam-Antwerp (ARA) region, although this could be a costly method from a logistical perspective.

Turning more to shipping, the Very Large Gas Carrier orderbook is expected to slow in 2025, according to BW LPG, who expects 13 new carriers to be delivered in 2025, compared to 22 in 2024. Of the 13 due for delivery in 2025, only one will not be capable of burning ammonia as an alternative fuel, BW LPG data showed. VLGC shipowner Dorian LPG notes an additional 41 VLGCs – equivalent to roughly 3.6 million cubic meters of carrying capacity – are expected to be added to the global fleet by 2027.

However, what concerns the market from an orderbook perspective isn’t likely to come to fruition in 2025 but more likely in 2026 and beyond when the fleet of Very Large Ammonia (VLAC) and Very Large Ethane Carriers (VLEC) flood the market.

According to OPIS shipping data, there are approximately 122 VLACs and VLECs on order to be delivered from 2025 onwards, although the majority of these are due for delivery in 2027.

It’s a similar scenario in the Midsize Gas Carrier (MGC) orderbook, with nine MGCs scheduled for delivery in 2025, according to StealthGas data. But it feels like the sector is just getting warmed up for what is to come from 2026 onwards.

StealthGas notes there are 53 MGCs due for delivery from 2026. With a full orderbook, there is a risk of softer freight rates because the market is currently awash with available carriers.

But it is different again for the 3,000-7,500 cubic meter pressurized carrier segment, where the age of the fleet and greater scrapping potential may have bigger impact. A total of 16 carriers are expected to hit the market in 2025 before dropping to six for 2026 and beyond, StealthGas data showed.

To sum up, while there are a few key geopolitical sensitivities for 2025, with the U.S and China at the center, there are also potential pressure points from a production, export and demand side. Gas carrier fuel-and-voyage inefficiencies, rising ton-mileage, the critical role of the Panama Canal, increasing environmental regulations, alternative fuel and emission costs, are all going to be prevalent in 2025.

–Reporting by Jamie Aldridge, Dermot McGowan; Editing by Rob Sheridan

Try the OPIS Global LPG Ticker FREE for 10 days

Try the OPIS Global LPG Ticker FREE for 10 days

Real-time LPG pricing helps you see how global markets fit together.

Now you can track live the arbitrage relationships between key European and Asian spot LPG markets and the Mont Belvieu, TX, hub where OPIS holds the official industry pricing benchmark. Mont Belvieu, a very liquid market with massive capacity for exporting propane, butane and ethane, has become the world’s compass for LPG price direction.

The nascent sustainable aviation fuel (SAF) market will enter a new phase in its development in 2025, when government mandates kick in across Europe.

SAF is seen as the easiest way to decarbonize the aviation industry because it is a drop-in fuel that results in a significant reduction in lifecycle emissions compared to petroleum-based jet fuel. While the U.S. is incentivizing SAF growth via fiscal incentives, European governments have opted for the stick rather than the carrot approach.

SAF is seen as the easiest way to decarbonize the aviation industry because it is a drop-in fuel that results in a significant reduction in lifecycle emissions compared to petroleum-based jet fuel. While the U.S. is incentivizing SAF growth via fiscal incentives, European governments have opted for the stick rather than the carrot approach.

This means that, from January 2025, EU and U.K. government mandates will oblige airlines to use SAF blends of at least 2% on their flights departing from domestic airports.

“Last year, a lot of the demand was driven by corporate and airline targets. [In 2025] it will be driven by the EU and U.K. mandates,” said Alastair Blanshard, aviation sustainability director at the ICF consulting firm. “We think that the voluntary market in Europe will be small [in 2025].”

Assuming that jet fuel consumption in the EU and the U.K. reaches a combined 60 million metric tons in 2025, the mandates would require SAF supplies of 1.2 million mt in the region.

Many European airlines have already started using SAF in recent years, either on a voluntary basis or because they operate in countries where mandates were approved earlier such as France, Norway and Sweden. For instance, Air France-KLM consumed 80,000 mt of SAF in 2023, making it the world’s largest user.

But, in part driven by these mandates, consumption volumes are set to grow fast. IAG—the group that owns British Airways and Iberia—expects its SAF volumes to triple to more than 150,000 mt in 2024, or around 2% of its total jet fuel needs.

Finnish producer Neste—arguably the leader in the industry—estimates that global demand for SAF will double to 4 million mt in 2025 from 2 million mt in 2024, as European blending mandates are complemented by tax incentives in the U.S.

Still, fuel producers look well equipped to meet this sharp increase in demand, at least for now. Forecasts for global SAF production capacity in 2025 range from 4.6 million mt (Barclays) to 9.5 million mt (SkyNRG). Capacity is hard to assess because many production plants can easily switch between maximizing SAF and renewable diesel (HVO) yields.

Much of this capacity will depend on a single player, Neste, which is in the process of ramping up output at two of the world’s largest plants in Singapore and Rotterdam. However, efforts to increase production have met with delays and technical issues at both facilities.

The Finnish company’s pioneering impetus is part of the reason why the SAF market is so well supplied at the moment. “We have seen good opportunities in the marketplace, with supply becoming relatively affordable,” IAG’s SAF director Aaron Robinson told OPIS.

With capacity rising ahead of demand, the profitability of making advanced biofuels such as SAF and HVO plummeted in 2024. Neste’s biofuel sales margin narrowed to $422/mt in the first nine months of the year from $889 in the same period of 2023, and the company’s shares are down 63% over the past 12 months.

In 2025, biofuel markets have also taken a hit from their fossil fuel counterparts. Global jet fuel and diesel prices have declined significantly in 2024, forcing biofuel suppliers to trim their own margins in order to compete for demand.

In addition, prices for U.S. tax credit incentives have faltered due to strong growth in biofuel production, while the cost of feedstocks such as used cooking oil (UCO) and animal fats remained broadly flat.

This market downturn has forced producers to review some of their projects. Shell halted the construction of a 800,000 mt/year SAF and HVO production plant in Rotterdam over the summer of 2024. Around the same time, BP also suspended plans for similar projects in Germany and the U.S.

However, Blanshard believes that the market will be more balanced in 2025 as regulatory demand increases.

“In the last months of 2024 there has been an oversupply of SAF to some extent, because a lot of facilities have come online in anticipation of the mandates. But as soon as we go into 2025, the mandates kick in and demand will close the gap to the increased supply.”

Repsol CEO Josu Jon Imaz holds a similar opinion. In a recent earnings call with analysts, Imaz said that he expects biofuel markets to strengthen in 2025 due to the SAF mandates and the new EU anti-dumping tariffs on Chinese HVO and biodiesel.

The impact of tariffs and other protectionist policies on biofuel and feedstock trade flows will be an important factor to monitor 2025. China in December removed export tax rebates for certain biofuel feedstocks, and Donald Trump will take office as U.S. president in January with promises of raising import tariffs.

Moreover, the U.S. Production Tax Credit (PTC) that subsidizes domestic SAF sales is set to expire at the end of 2024. It was expected to be replaced by the Clean Fuel Production Tax Credit (CFPC), which rewards production rather than consumption. As a result, the CFPC could discourage U.S. SAF imports and incentivize exports instead, placing further pressure on European biofuel producers.

–Reporting by Jaime Llinares Taboada; Editing by Rob Sheridan

Try the OPIS Biofuels Daily Report for FREE

Try the OPIS Biofuels Daily Report for FREE

Stay ahead in the dynamic biofuels sector with our comprehensive coverage of biofuels prices, market trends, and breaking news.

Easily keep up with the complex and evolving biofuels market, navigating through shifts in the political landscape, regulatory uncertainties, and transportation challenges with the OPIS Biofuels Daily Report. Seamlessly access up-to-date biofuels prices, breaking news, and insightful analysis via OPIS Context, an interactive and customizable web platform. Stay informed with the latest developments in biofuels through our comprehensive reporting, ensuring you stay ahead in the ever-changing landscape of biofuels news.

Easily keep up with the complex and evolving biofuels market, navigating through shifts in the political landscape, regulatory uncertainties, and transportation challenges with the OPIS Biofuels Daily Report. Seamlessly access up-to-date biofuels prices, breaking news, and insightful analysis via OPIS Context, an interactive and customizable web platform. Stay informed with the latest developments in biofuels through our comprehensive reporting, ensuring you stay ahead in the ever-changing landscape of biofuels news.

Demand for jet fuel will continue to increase in 2025 both in Europe and globally, but growth is likely to be slower than in 2024 due to a post-Covid 19 normalization in passenger volumes and ongoing improvements in aircraft fuel efficiency.

The International Energy Agency (IEA) expects global jet fuel and kerosene demand to grow by just 2.2% in 2025 to 7.67 million barrels/day. This compares with a growth rate of 5.3% in 2024, when air traffic expanded at a faster pace.

According to Eurocontrol, the number of passenger flights in Europe rose by 5.1% in 2024, but growth will slow to 3.7% in 2025 and 2.0% in 2026 and beyond. Similarly, the International Air Transport Association (IATA) sees growth in global passenger volumes slowing in the coming years as all regions surpass pre-pandemic levels.

“It’s very clear that demand has softened, and some expected market recoveries have not occurred,” aviation industry analyst John Grant told OPIS. “2024 is not going to be as good a year as 2023; and, unsurprisingly, 2025 is not going to be as good as 2024.”

Grant said that issues with aircraft production and supplies of spare parts are grounding planes and constraining global capacity. Ryanair, the largest airline in Europe, recently trimmed its outlook for the April 2025-March 2026 period due to the risk of further delays in Boeing aircraft deliveries.

According to IATA, aircraft deliveries in 2024 fell 30% short of forecasts, while the current order backlog stands at an all-time high of 17,000 planes. Still, the share of aircraft in storage remains above 2019 levels due to engine inspections.

Meanwhile, analysts also highlight the substantial impact on fuel use from engine efficiency gains in recent years. Boeing, for instance, claims that its latest 737 MAX family of airplanes reduces fuel consumption and emissions by 20% compared to the models they replace.

Meanwhile, analysts also highlight the substantial impact on fuel use from engine efficiency gains in recent years. Boeing, for instance, claims that its latest 737 MAX family of airplanes reduces fuel consumption and emissions by 20% compared to the models they replace.

Finally, airlines are increasingly using sustainable aviation fuel (SAF) in order to reduce their carbon emissions, which directly cuts into demand for traditional petroleum-based jet fuel. In January, the EU and U.K. mandates will kick in, forcing fuel suppliers to ensure SAF blends of at least 2%.

Despite the extraordinarily high margins seen after the Russian invasion of Ukraine, Europe is expected to continue reducing its oil refining capacity in 2025 as countries aim to transition towards greener sources of energy.

In 2025, the Grangemouth refinery in Scotland and the Wesseling refinery in Germany will cease processing crude oil, and BP will shut one-third of capacity at the Gelsenkirchen plant in Germany.

Moreover, the remaining refineries are likely already maximizing jet fuel yields, which leaves little potential for upside. “Jet/kero production cannot be increased arbitrarily, and years of strongly diverging demand growth paths between jet fuel and diesel have left especially mature markets maxed out in terms of jet supplies,” Vortexa’s chief economist David Wech said.

As a result, Europe is increasingly reliant on imports in order to meet structural—albeit slowing—increases in jet fuel demand from the aviation sector.

EU and U.K. jet fuel imports have been on the rise since the pandemic. Purchases from the rest of the world surged from 21.2 million mt in 2022 to 24.1 million mt in 2023, and were up 12% at 19.6 million mt in the first nine months of 2024, according to GlobalTradeTracker.

However, Europe’s short jet fuel position doesn’t mean that it will lack supplies. While some domestic refineries are being closed or repurposed for biofuel production, global crude oil processing capacity is expanding with new facilities in Asia, Africa and the Americas.

According to Bank of America, global refining capacity is expected to increase by 1.13 million b/d in 2025 and by 730,000 b/d in 2025. The investment bank said that this will more than offset increases in oil product demand in the short term, particularly when accounting for the impact of biofuels.

Notable refinery start-ups include Nigeria’s 615,000 b/d Dangote, China’s 400,000 b/d Yulong and Mexico’s 340,000 b/d Dos Bocas. These will be on top of a notable expansion in capacity across the Middle East and India which has already weighed significantly on middle distillate margins in 2024.

Highlighting this availability of Asian barrels, the jet fuel crack spread versus Brent crude in Northwest Europe (NWE) has averaged $20.8/bbl in 2024, narrowing from $29.7/bbl in 2023 and $41.2/bbl in 2022, according to OPIS data.

Vortexa’s David Wech has a more bullish opinion, however, arguing that supply potential from the main jet fuel exporting countries may soon hit a ceiling, which could result in prices strengthening, at least relative to diesel.

It’s also worth noting that European jet buyers currently pay higher freight costs due to 2024’s rerouting of Asian-origin cargoes around Southern Africa, as shippers steer clear of Houthi attacks in the Red Sea. Nearly all of Europe’s jet fuel imports come from the Middle East, India and other countries in Asia.

As a result, should voyages resume via the Suez Canal, this could put further pressure on jet fuel prices in NWE.

Freight rates for clean product tankers have already been quite low recently, reflecting higher vessel availability. The cost of shipping 90,000 mt of jet fuel from Jubail to Rotterdam was just $2.85 million on Nov. 15, 2024, down from highs of almost $9 million at the beginning of 2024, according to Baltic Exchange data.

All in all, the outlook for European jet fuel margins in 2025 looks relatively neutral. Domestic refinery closures leave the continent more reliant on imports, but the bigger picture is that global demand growth is slowing and refining capacity is expanding in emerging countries.

–Reporting by Jaime Llinares Taboada; Editing by Rob Sheridan

Try the OPIS Worldwide Jet Fuels Report FREE for 5 days

Try the OPIS Worldwide Jet Fuels Report FREE for 5 days

Track jet fuel costs with transparent global jet fuel spot prices and commercial airline prices.

OPIS Worldwide Jet Fuel Report delivers daily insight into market trends that enables airlines to purchase fuel at a competitive price. The report provides transparent spot and contract jet fuel pricing and news and analysis of the factors moving the jet fuel market, including regulatory updates.

The 2025 aromatics markets, defined as benzene, toluene and styrene and their derivatives, is expected to be much the same as that of 2024, according to feedback received by OPIS from multiple sources.

Especially in terms of demand from the gasoline blending pool, the aromatics markets failed to meet expectations in 2024, and was softer than predicted, while supply remained healthy across the chain.

Prices drifted lower but there were also occasional spikes, mainly driven by a squeeze in supply that prompted a surge in demand. Issues with feedstock availability for benzene and unexpected lower supply of toluene over the last four months of 2024 did provide a floor for both aromatics and helped their prices remain firm. This pattern is expected to continue in 2025.

Aromatics are consumed in most sectors of the economy, but especially in the construction, automobiles, electronics, clothing, sectors and so demand for the product is closely connected to economic growth. Unsurprisingly then, the other key driver for aromatics is energy prices, especially crude oil and naphtha.

In their most recent economic outlook for 2025, Oxford Economics noted that “the prospect of more fiscal stimulus in the U.S. alongside earlier news that China will step up fiscal support imply slightly better global growth over the next year or two.” The consultancy subsequently revised its 2025 forecast for world GDP upwards to 2.8% from 2.7% in 2024. However, Oxford Economics predicts that emerging market GDP growth will slow to 4% from 4.1% in 2025 but the G7 economies will see GDP expand to 1.9% compared to 1.7% for 2024. These figures indicate that demand for aromatics in 2025 could bounce back from their depressed levels of 2024.

The one dark cloud on the economic horizon is the impact the incoming Trump Administration’s economic policies may have on global economic growth, particularly its proposed emphasis on tariffs on goods entering the United States.

An analysis of the likely impact of tariffs on the energy and chemical markets by Chemical Market Analytics (CMA) by OPIS, a Dow Jones company, paints a largely negative picture of the impact for the chemical sector.

CMA observes that the U.S. exports more base chemicals, including ethylene, propylene, benzene and toluene, together with butadiene and butylene, than it imports – 65 million metric tons/year of exports and 21 million mt/year of imports. So, as in 2018, any tariffs would hurt U.S. exports as countries retaliate against them and so could endanger export volumes.

Tariffs are also expected to push inflation up and so precipitate higher interest rates which could dent consumer spending. This may be offset by promises by the Trump administration to lower interest rates, but this is not guaranteed. Over the longer term they could also lower productivity, especially if the tariffs lead to barriers in investing in impacted markets.

The energy price outlook, however, is mixed. Rystad Energy analysts believe that crude markets will be in a surplus during 2025 because of higher non-OPEC output that will grow by 2 million b/d in 2025. OPEC production is expected to remain unchanged at 2 million b/d. Demand is expected to grow by just 1.1 million b/d. Should OPEC raise its production, then a situation similar to 2016 when oil prices collapsed will occur in 2025.

Analysts at Goldman Sachs, however, are more upbeat on oil prices in 2025, and forecast Brent crude futures prices rise to $76/bbl by March 2025 – a $2-3/bbl climb from levels at the time of publish. The Goldman analysts also note that the 1-month/36-month time spread is priced below its “fair value,” indicating potential for a move to the upside.

The analysts also observed that there could be a “substantial” negative impact on U.S. crude and gasoline prices thanks to lower aggregate demand, should the Trump administration impose a universal 10% tariff that exempts oil.

In their World Analysis – Benzene report, CMA forecasts the 2025 average benzene contract price will be about $56/mt below that of 2024 at $1,011/mt.

CMA projects that European benzene production will fall in 2025 because of lower regional refinery runs. During 2025, European refining capacity will be slashed by 400,000 b/d, as Shell’s 325,000 b/d Wessling refinery will be shuttered and converted into a bio-refinery, while Gunvor will permanently shut its 75,000 b/d Antwerp refinery. In addition, a further 422,000 b/d of capacity will be down for planned turnarounds in the first half 2025.

This lowering of refinery runs could support higher benzene prices as the market’s anticipated surplus in 2025 could be tightened because of less feedstock for benzene production. A similar situation occurred in the second half of 2024 when a series of planned and unplanned refinery outages cut benzene feedstock supply, bringing the market into balance, propping up prices.

The prospect of lower benzene availability in 2025 has led some buyers to commit to contract tons to secure supply despite the bearish market outlook for the aromatic in 2025. Underlining this, one benzene supplier confirmed to OPIS that it has settled its 2025 term contracts, placing the same volume under contract as it did in 2024, which was fixed at a time when the market outlook was bright, especially for gasoline blending, key for benzene derivatives.

Even if supply is constrained because of lower refinery runs, CMA’s World Analysis Benzene report notes that demand will be restricted by sluggish growth in the benzene derivatives sector in 2025. Benzene demand is dominated by the ethyl benzene/styrene monomer, cumene/phenol and nitrobenzene/methylene diphenyl diisocyanate sectors and all of these are sensitive to the state of the economy. The weak 2025 economic outlook is likely to depress benzene demand from these sectors.

Despite the gloomy prospects for growth, CMA projects demand will be around the same level as 2024 at about 5 million mt/year. This exceeds projected 2025 production of 4.5 million mt/year and will result in Europe needing to import around 525,000 mt/year which is in line with 2024 import volumes.

Exports, however, are predicted to fall from 2024 levels to around 100,000 mt/year. The majority of exports, some 200,000 mt/year, target the U.S. market. Saudi Arabia and Turkey are forecast to supply the bulk of imports into Europe in 2025 with a combined total of 212,000 mt/year, according to CMA.

The main outlets for the product, construction and automobiles, are heavily dependent on consumer spending which in turn is linked to interest rates and the economy. Subsequently, styrene’s outlook for 2025 will be even more influenced by the state of the global and European economies during 2025 than that for benzene.

Given that most economic forecasters see 2025 economic prospects as differing little from those in 2024, most styrene participants subsequently see the 2025 styrene market as little changed from the one prevailing in 2024.

This is reflected in CMA’s average 2025 contract price projection of $1,711/mt, compared to $1,750/mt in 2024, given in their World Analysis—Styrene report.

Styrene production in 2025 is estimated to be marginally higher than 2024 at 3.04 million mt versus 3.03 million mt for 2024. Plant operating rates for both years are forecast to be 69%, reflecting the weak demand for styrene derivatives in both years.

Any discussion of 2025 styrene supply will need to consider Europe’s largest styrene unit—LyondellBasell-Covestro’s 680,000 mt/year of styrene and 313,000 mt/year of propylene oxide/styrene monomer (POSM) plant at Maasvlakte, Netherland. The plant has fluctuated in its operational status during most of the past two years, usually for economic rather than technical issues, and at the time of publishing it is currently offline with no indication how long it will remain so. Lyondell-Basell can cover any contract sales from the plant from its U.S. POSM unit and so its closure is more impactful on spot supply. Given the depressed nature of these in 2024 and forecast for at least the first three quarters of 2025, its closure will most likely support higher 2025 spot prices in the European market.

Meanwhile, 2025 demand is predicted to be just 53,000 mt above 2024 demand at 3.54 million mt/year. The biggest outlet for styrene is polystyrene and this along with other styrene derivatives all show marginal gains in 2025.

Europe is structurally short styrene and 2025 is not expected to be any different. To cover the shortfall, Europe needs to import styrene and in 2025, around 770,000 mt is expected to be imported. Around 60% of European styrene imports, 461,000 mt, are expected from the Middle East, with a further 249,000 mt landing in the continent from the U.S. The balance would come from North and Southeast Asia.

Toluene is used primarily as an octane component in gasoline as well as in the manufacture of solvents and paints. Out of these three aromatics, the toluene price is the most directly impacted by energy prices, especially crude oil and gasoline.

Both crude oil and gasoline prices are forecast to be slightly weaker in 2025 compared to 2024. Nevertheless, the average toluene spot price in 2025 is predicted to rise by $20/mt from its 2024 average to $1,046/mt.

Over the second half of 2024, European toluene production has been affected by supply issues at one of Europe’s largest suppliers that has led to the halt of most spot sales during Q4 2024.

Market sources tell OPIS that they do not expect this situation to improve in 2025 and the supplier has indicated to OPIS it may reduce, if not halt, toluene spot sales in 2025. Additionally, it will shut its toluene diisocyanate unit in 2025 at one of its refineries that will undergo a major turnaround during the second half of 2025.

These uncertainties have led several European toluene buyers to commit to contracted supply for 2025 to secure volume. One toluene distributor told OPIS it has increased its 2025 sales volumes because of these uncertainties, as buyers seek to realign their supply sources to guarantee supply. This is in stark contrast to initial 2025 term negotiations that began in mid-2024 when buyers were reluctant to commit to contractual volumes and were hinting at reducing them.

As 2024 began with most participants across the aromatics chain expecting a good year similar to 2023 from the gasoline blending sector, so 2025 begins with the expectation of a year like 2024, as many view gasoline blending demand staying depressed.

The trajectory of 2025 aromatics prices, supply and demand will be driven by economic factors as well as energy prices. As 2025 begins, the prospects look weak and this is reflected in the mindset of aromatics participants, who have told OPIS they are not expecting much upturn in demand in the first half of 2025. They hope demand will strengthen over the second half of 2025, but this may well be more a pleasant surprise than a given.

–Reporting by Yazdi Merchant; Editing by Rob Sheridan

The influence of European carbon markets and the tentacles of the incoming carbon border adjustment mechanism (CBAM) continued to be felt around the world in 2024, even as British carbon allowances (UKAs) traded near record lows and European Union carbon allowances (EUAs) traded below €80 ($84.08)/metric ton for most of 2024 after reaching triple digits in early 2023.

Emissions from the power sector in Europe continued to fall, lowering demand for EUAs and UKAs. As a result, leading carbon analyst Mark Lewis, head of climate change research at Andurand Capital, suggested in the spring that the market was in a “no man’s land”, with few big potential price drivers.

Policymaking remains one of the more influential aspects of Europe’s carbon markets, as a number of countries begin to establish their own carbon markets in regions like Latin America and Asia. Perhaps the most significant trade policy mechanism in recent years is the EU CBAM, which will incentivize any business wanting access to the EU market to decarbonize and reduce the embedded emissions within their exports.

ETSs are cap-and-trade systems which reduce the number of allowances, or pollution permits, available to carbon emitters every year, with the declining supply typically boosting prices and encouraging decarbonization.

But carbon prices in the EU and U.K. emissions trading systems (ETSs) have fallen after both saw record high prices in February and August 2023, respectively.

But carbon prices in the EU and U.K. emissions trading systems (ETSs) have fallen after both saw record high prices in February and August 2023, respectively.

In March of 2024, Lewis told OPIS that a “perfect storm” had materialized for EUAs after prohibitively high European energy prices in the summer of 2022 filtered through into reduced industrial demand in early 2024. The ICE benchmark December 2024 futures allowances contract for EUAs started 2024 trading at around €75/mt but fell to just over €50/mt in late February.

Surveying the year’s price movements, John Doncy, a research analyst with Munich Re Investment Partners, the ESG-driven investment arm of the German multinational insurance company, told OPIS that the fall in EUA prices in the second half of 2024 was mainly driven by a weak European economy and greater energy production from renewable sources. As a result, demand for EUAs from industrial installations and coal-fired plant operators fell.

Emissions from all entities subject to the EU carbon scheme fell by 16% from 2022 to 2023, according to the EU Commission. Power sector emissions fell by 24% from 2022 to 2023 “due to a substantial increase in renewable electricity production (primarily wind and solar), at the expense of both coal and gas”, the EU Commission reported in April.

Additional supply of EUAs into the market also contributed to lower carbon prices, Doncy said. REPowerEU, a policy designed to wean the EU off cheap natural gas from Russia and ease the high energy costs for industry in 2022 and 2023, frontloaded auctions of EUAs meant to take place in 2027-2030, bringing the supply forward to 2024-2026.

The EU included the maritime shipping sector into the EU ETS in 2024, adding allowances for this sector into the market that could have contributed to the oversupply of EUAs, Doncy said.

“With ongoing strong renewables generation and muted economic activity expected to continue into 2025, it may well be that EUAs trade in the €60-70/mt range,” Doncy said. “Maybe a ‘normal’ winter in Europe could lead to excess demand for heating and, if renewables cannot cater to this demand, then fossil fuels may come into play to fill this supply gap and increase emissions.”

EUAs could see some support in 2025 as investment funds have now established net long positions, Doncy pointed out. The ICE Commitment of Traders report for the first week of December showed that investment funds continue to build long positions, with a net long position of 14.58 million EUAs. This net long buildup is a reversal from earlier in 2024 when funds held a nearly 40 million EUAs net short position.

Doncy believes it is likely that sectoral dynamics will shift from the power sector—which has already achieved record emissions reductions over the last two years—to the industrial sector, which could be the new demand driver in the EU carbon market.

The industrial sector may also become more exposed to carbon prices as the CBAM is gradually implemented and as free carbon allowance allocation is phased out over 2026-34, Doncy said.

“As renewables output increases, it may even be that the natural gas to coal fuel-switching rationale also ceases to exist eventually and may not contribute to demand,” Doncy said. “If renewables are relatively cheaper, then less coal may be used when natural gas becomes expensive.”

Similarly, Lewis emphasized that the power sector in the bloc was driving decarbonization due to increasing renewables capacity and diminishing coal-fired electricity production.

“Most of the coal, at least in western Europe, has already come off or will be coming off shortly. Will Germany exit coal by 2030? This looks increasingly unlikely but even then, it’s much lower than it was 10 years ago, so that combination of retiring old coal plants and adding more and more renewable capacity to the grid every year is really driving decarbonization in power and that will continue,” Lewis told OPIS.

High energy costs, especially higher prices in natural gas due to the Russian invasion of Ukraine, continue to affect European industry, the Andurand analyst said. Pre-invasion prices used to hover around €18/megawatt hour and are now currently trading at around €50/MWh on the Intercontinental Exchange (ICE) benchmark Dutch Title Transfer Facility (TTF) front-month futures contract, Lewis said.

Potentially complicating matters for European industry and EUA prices is the incoming administration under president-elect Donald Trump, who takes office on Jan. 20, 2025. The president-elect’s penchant for threatening countries with tariffs could affect European industry, Lewis said.

“There are very recent signs that industrial activity is picking up a little bit [in the EU], but with Trump coming in and tariffs on European goods likely and the world moving away from globalization, I think there is a risk that industry continues to flatline, and I’m certainly not expecting a big increase in European emissions from industry [in 2025]. Maybe slightly higher than [in 2024], but I think even that is optimistic given what Trump is saying about tariffs.”

Lewis told OPIS that the performance of UKAs in 2023 had been “extremely weak and very disappointing” following the July 4 election in the U.K. that saw the Labour Party obtain a majority in government.

“I think there were a lot of people in the market, myself included, who thought the new U.K. government… would get serious about carbon pricing and do what it could to close the very big discount of about €27 to EUAs,” Lewis said.

Lewis believes that the easiest way to close the gap between UKAs and EUAs is through linking the two European carbon markets. Doing so would help the U.K. signal that it’s serious about incentivizing low-carbon investments, and also avoid harmful effects on U.K. industry, as the EU’s carbon border adjustment mechanism (CBAM) is scheduled to go into effect in 2026, while the U.K. version of this tariff goes into effect a year later.

“I think there is a policy imperative for the U.K. to get its act together and signal [its intention to link to the EU ETS],” Lewis said, adding that this would need to happen, at the latest, by the end of the first half of 2025.

The fall in carbon prices in the British market is also attributed to the fact that there are no longer any operational steel plants in the country, with Tata Steel’s Port Talbot plant — previously one of the biggest emitting installations in the country — closing down to include electric arc furnaces over the next couple of years, Lewis said.

“At the moment, you can’t get industry to buy [UKAs] when they don’t know what the policy framework is going to be,” the Andurand analyst said. Although the U.K. announced a more ambitious climate target in Baku at COP29 – reducing emissions by 81% by 2035 based on 1990 levels, compared to the previous 78% goal – there is still no clear roadmap for how this will be achieved, Lewis underscored.

EU importers are expected to purchase CBAM certificates to comply with regulation in little over a year when the CBAM goes live in 2026. The tariff has technically been operational since October 2023 as companies have since been required to file quarterly reports detailing the emissions in their products throughout 2024, a gargantuan task that has led the EU to issue delays and some leniency to reporters.

Since the CBAM was initially floated, a number of countries – and particularly trade partners with the EU – have taken notice, and action.

Turkey is a key trading partner of the EU, especially in the steel and cement sectors, which are among the sectors covered by the CBAM.

Turkey’s EST is expected to come online in 2025 through a pilot phase after a climate law is agreed by the country’s parliament. The Turkish carbon market will require companies that emit half a million metric tons or more of carbon dioxide a year to pay for carbon allowances, a threshold that could see around 130 installations form the bulk of this market.

Similarly, Japan announced at COP29 that it would be instituting a carbon market covering installations that emit more than 100,000 metric tons of carbon dioxide per year. According to the EU, Japan is the bloc’s second largest trading partner in Asia after China and the bloc imports “machinery, motor vehicles, chemicals… and plastics” from Japan, sectors that are currently and are likely to be included under the CBAM in future years.

Other countries like Australia, Canada and potentially the United States are also considering CBAM-like measures. These types of mechanisms have led to challenges from China and India to the World Trade Organization (WTO) and concern from organizations like the International Chamber of Commerce (ICC).

“We could be in a world… where we have a patchwork of border adjustment mechanisms with different calculation requirements, different compliance requirements, and that will significantly accentuate the problem,” Andrew Wilson, deputy secretary general of the ICC, told OPIS in Baku at COP29, warning that these tools could fragment international trade.

–Reporting by Humberto J. Rocha; Editing by Anthony Lane

CAMIRO: Carbon & Clean Fuels Analytics, Market Intelligence & Regulatory Outlooks

CAMIRO: Carbon & Clean Fuels Analytics, Market Intelligence & Regulatory Outlooks

Optimize your company’s compliance carbon market and clean fuels strategy with sophisticated price forecasts, real-time policy assessments, and integrated expert outlooks.

As carbon regulations continue to evolve globally, businesses operating in carbon-intensive industries need access to reliable data and foresight to make informed decisions. Compliance is becoming more complex and staying ahead of regulatory shifts is crucial to minimizing risk and capitalizing on market opportunities.

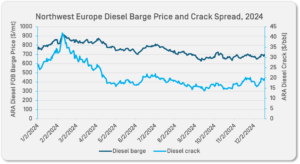

Diesel and gasoil markets in Europe are poised to become more balanced in 2025 after a period of flux amid supply shifts, demand dynamics and refinery rationalizations. However, the push towards energy transition and electrification continues to temper long-term demand, particularly in road transport.

European spot market diesel prices peaked in 2024 during February on geopolitical tensions in the Middle East before softening considerably in May on ample imports. Still, strength was building again towards the end of the year as this influx of product eased.

Spot market prices for diesel are expected to remain elevated early in 2025 due to winter demand. However, Wood Mackenzie has forecast northwest Europe diesel cracks to decrease year on year to average $17.70/barrel as demand for the product in the region contracts, according to senior research analyst Emma Howsham.

Spot market prices for diesel are expected to remain elevated early in 2025 due to winter demand. However, Wood Mackenzie has forecast northwest Europe diesel cracks to decrease year on year to average $17.70/barrel as demand for the product in the region contracts, according to senior research analyst Emma Howsham.

Still, Wood Mackenzie expects the second half of 2025 and 2026 to approach a pricing structure more representative of 2019 pre-Covid levels, as global diesel and gasoil demand growth offsets capacity increases in the Middle East and Asia, signaling a rebalancing trend.

The average outright price for diesel loading on barges in northwest Europe in 2024 was roughly $750/metric ton, while the crack – versus Brent crude – averaged around $21/bbl over the same period, according to OPIS pricing data.

Oversaturation of the European market in the third quarter of 2024 was driven by high U.S. refinery utilisation and the trend of switching Very Large Crude Carriers to carry refined products from East of Suez production centers. This capitalized on lower freight and a period of limited crude usage, but this eased off in Q4 as the arbitrage became increasingly uneconomical, Howsham noted.

Significant strength then returned to the European diesel market at the end of 2024, which was mostly driven by big draws in regional stocks as imports to the region subsided, alongside improved seasonal demand.

At the end of October 2024, the prompt Low Sulfur Gasoil futures pricing curve flipped into backwardation, and at the time of writing in the third week of December, the forward curve remains in backwardation through to August 2025, according to data from the Intercontinental Exchange, highlighting tightness in the market.

This increase in strength towards the end of 2024 was also attributed in part to reduced exports from China into Q4 because of lower crude runs in the country, James Noel-Beswick, commodity owner at Sparta Commodities told OPIS.

“However, increased U.S. and Middle Eastern crude runs, and recovering refinery margins in Europe and the Far East suggest that diesel supply should increase from here, potentially capping any large gains in cracks and spreads,” Noel-Beswick said.

Meanwhile, Rystad Energy predicts a European diesel and gasoil demand peak in summer 2025, like that of 2024, but still well below the 2019 peak.

“However, with Chinese demand forecast to rebound in [2025, Asian] margins and cracks could strengthen,” vice-president oil markets at Rystad Energy Janiv Shah told OPIS. “European refinery utilization rates have been fairly strong with limited upside, so additional middle distillate material is likely to be imported as opposed to being supplied within the region.”

Diesel flows to Europe have changed significantly following the European sanctions which prohibited imports of Russian product from February 2023. Since then, most of the gap has been filled by the Middle East, the U.S., and India. On the other hand, Russia has found new markets including Brazil and Turkey.

Diesel flows to Europe have changed significantly following the European sanctions which prohibited imports of Russian product from February 2023. Since then, most of the gap has been filled by the Middle East, the U.S., and India. On the other hand, Russia has found new markets including Brazil and Turkey.

Sparta Commodities has noticed that increasingly, the United States Gulf Coast (USGC) is the swing barrel for Europe in the absence of Russian diesel.

“For example [in November 2024], the Colonial Pipeline’s positive line space values indicated a large pull from PADD 1, and that along with a large pull from Latin America worked to subdue USGC transatlantic diesel loadings, adding to the tightness in Europe at the end of 2024,” said Noel-Beswick.

The balancing of the European market in 2025 in part leverages on the tightening of U.S. exports to Europe via improved U.S. demand growth, but Wood Mackenzie’s Howsham added that indirectly, this is also affected by disruption in Russian diesel exports to Brazil, as Russia remains constrained by disruption, opening the Brazil market for further U.S. diesel barrels.

Europe’s supply outlook is constrained by several factors including refinery rationalization which continues to limit regional capacity, with notable closures like Petroineos’ Scottish refinery, Grangemouth, slated for 2025. Additionally, the energy transition is reshaping production strategies, reducing diesel and gasoil availability within the region.

Wood Mackenzie expects European crude capacity to shrink over 300,000 b/d due to refinery conversions and closures, while total European diesel demand is forecast to contract by 100,000 b/d in 2025.

Still, new refining capacities coming online at Dangote in Nigeria and Dos Bocas in Mexico will add increasingly to the supply landscape. U.S. and Middle Eastern refineries appear determined to run hard until their seasonal turnarounds at the end of Q1 2025, which could result in increased diesel flows to Europe in the coming months.

With these large flows into Europe from the U.S. and Asia, alongside Dangote and Dos Bocas, Sparta expects more refineries in Europe to follow Grangemouth’s lead.

Furthermore, emerging demand in Asia could divert some of these barrels away from Europe, meaning the European diesel/gasoil market is likely to become more balanced towards the second half of 2025.

Also highlighting the pressure on European refineries from new plants in the Middle East and Africa as well as the energy transition, Gunvor announced the temporary closure of its Rotterdam refinery effective Nov. 25. It cited the lack of commercially viable feedstock, but various market analysts speculate it could be due to lower-than-expected diesel cracks during the October 2024 maintenance season.

From May 2025, the introduction of the Sulfur Emission Control Area (SECA) in the Mediterranean will potentially boost demand for compliant gasoil and diesel, but this uptick is expected to be offset by a continued downward trend in road diesel demand.

Consequently, Wood Mackenzie “do [expect] an initial price jump but do not anticipate this to last,” said Howsham.

In 2025, stricter carbon dioxide emissions will be applied to car manufacturers ahead of the sale ban of new diesel cars in 2035, and therefore there will be an increased push towards electric or hydrogen-powered vehicles.

A regulatory incentive mechanism for zero- and low-emission vehicles (ZLEV) will be in place from 2025 through 2029. If a manufacturer meets certain benchmarks for the sales of ZLEVs, it can be rewarded with less strict CO2 targets, according to the EU Council.

Overall, Europe’s diesel and gasoil market in 2025 will face the usual mix of challenges and opportunities. While refinery rationalization constrains regional supply, global trade flows and capacity additions are expected to provide balance. Seasonal dynamics and tightness in the market will keep prices elevated in the short term, but a more balanced pricing environment could emerge later in 2025.

–Reporting by Jen Caddick; Editing by Rob Sheridan

The renewable hydrogen sector is undergoing a transformation, characterized by rapid technological advancements, expanding manufacturing capabilities, and complex geopolitical dynamics. As the world seeks sustainable energy solutions, hydrogen emerges as a critical component in the global decarbonization strategy.

Electrolyzer manufacturing capacity doubled in 2023 to 25 gigawatts/year, with China accounting for 60% of this figure. However, utilization remains low, with only 2.5 GW of output used in 2023. Those projects with a final investment decision (FID) outstanding, or currently under construction, suggest that manufacturing capacity could exceed 40 GW/year by the end of 2024.

Looking further ahead, the pipeline for projects to 2030 could add over 165 GW/year, although only 30% of this has reached the FID stage.

Electrolyzer capacity stood at 1.4 GW by the end of 2023 and is expected to reach 5 GW by the close of 2024. China has committed the most to new hydrogen projects, potentially contributing nearly 70% of all capacity added in 2024.

By 2030, projects announced to date indicate a potential rise to almost 520 GW, though only 4% of these have either reached FID stage or are under construction. Fossil-based hydrogen production with carbon capture, utilization, and storage (CCUS) shows slightly more progress, with 14% of announced projects achieving FID, buoyed by a significant increase in commitments over the past year. Despite these advances, progress remains slower than anticipated in earlier projections.

Over the past 12 months, 6.5 GW of electrolyzer capacity secured FID, nearly a 12% decline compared to the previous year. Of this, more than 40% is in China, and 32% is in Europe, where capacity commitment has quadrupled in 2024 compared to the preceding year. Most committed projects focus on industrial applications or producing hydrogen-based fuels for transportation.

One challenge remains in balancing domestic production with demand. Europe is forecast to have a hydrogen supply gap in the mid-2020s, potentially requiring imports from regions like North Africa and the Middle East, where solar-powered hydrogen can be produced at lower costs due to abundant sunlight. This would create a stable, cost-effective supply chain while supporting European production capacity expansion and aiding the region in meeting clean energy targets more sustainably.

Meanwhile, the EU is unlikely to reach its goal of 20 million metric tons of renewable hydrogen consumption by 2030, an ambitious hydrogen target for most European states. As pointed out by the EU’s Agency for the Cooperation of Energy Regulators (ACER), although 70 GW of installed capacity was announced for 2030, as of 2024, very few of these projects had advanced beyond the study phase.

Not only that, but a significant number of projects also continue to be canceled due to recurring uncertainties surrounding regulatory challenges, financial constraints and permitting hurdles. An example of one of Europe’s most promising projects is the Norway-Germany blue hydrogen pipeline, which has been completely scrapped as a plan overall due to misaligning legislation amongst participating parties.

And even though supply is now forecasted to run short, not all states are reacting in the same manner. Germany’s Federal Government still expects its national demand for hydrogen and derivatives to reach 95 to 130 terawatt-hours (TWh) by 2030.

Many authorities are keen to not abandon their targets and have therefore embraced the import strategy, as announced by Germany in July 2024. Federal Minister Robert Habeck confirmed that “a large proportion of Germany’s hydrogen demand will have to be covered by imports from abroad in the medium to long term”, with imports expected to account for 50 to 70% (approximately 45 to 90 TWh) of this demand. This share of imports is then anticipated to grow further after 2030 through a strengthened partnership with hydrogen producers outside the EMEA region.

Nonetheless, German network operator FNB Gas confirms that the flow of hydrogen through pipelines will start in 2025, even though the approved network will be smaller than was initially planned.

Further estimates suggest that by 2045, demand could rise significantly to 360 to 500 TWh for hydrogen itself and an additional 200 TWh for hydrogen derivatives, consequently paving the way for hydrogen producers to attain the long-awaited market takeoff.

From this perspective, speakers at the 2024 EU Hydrogen Week conference, held in Brussels from Nov. 18-21, reiterated the need for stronger policies and further financing to develop a hydrogen supply chain to enable such market breakouts. Standardization across regions and production hubs is key to bridging the gap between supply and demand across the continent.

The hydrogen market in 2025 will be shaped by geopolitical tensions, particularly between the U.S. and China, and the effects of the 2024 U.S. presidential election.

If the U.S. maintains robust policies to prevent global warming and climate damage under the Inflation Reduction Act (IRA), Europe could benefit from transatlantic collaboration in hydrogen technology and trade. However, a shift toward a less climate-focused leadership in the U.S. could result in fragmented global hydrogen markets, leaving Europe to push forward alone with its ambitious decarbonization goals.

The IRA’s subsidies have already created competitive pressures for the EU, forcing it to accelerate its Green Deal Industrial Plan and Net-Zero Industry Act. Failure to implement comparable support could drive investment away from Europe, jeopardizing its capacity to maintain leadership in the global hydrogen transition.

Simultaneously, Europe’s reliance on importing hydrogen technologies from China faces significant risks. Trade tensions or restrictions and tariffs could increase costs and further delay projects, as China currently dominates electrolyzer manufacturing and is scaling its domestic green hydrogen production rapidly. These dynamics could push Europe to focus more heavily on developing its own supply chains and securing partnerships with alternative suppliers, such as North Africa and the Middle East.

In parallel, Europe must navigate broader trade disruptions from a potential U.S.-China trade war and global economic fragmentation. While Europe could position itself as a neutral broker to foster international hydrogen trade, it risks being caught between its strategic alliances with Western allies and its economic reliance on Chinese technologies.

Internally, Europe faces its own challenges: financial bottlenecks, permitting delays and underutilized electrolyzer manufacturing capacity could hinder progress in the region. As renewable hydrogen remains costly compared to fossil-based alternatives, Europe must also address market acceptance of higher prices in downstream applications.

Despite these hurdles, Europe retains the opportunity to lead in setting global hydrogen standards and certifications, a move that could strengthen its role as a global hub. However, failure to act decisively could leave it vulnerable to external geopolitical shocks and internal inefficiencies, delaying realization of its hydrogen goals and weakening its influence in the clean energy transition.

With the implementation of the Renewable Energy Directive II (RED II) in 2025, industry specialists will appreciate a turning point for the industry, as it establishes stricter criteria for hydrogen to qualify as “renewable.”

Key requirements will include sourcing electricity from new renewable energy installations (additionality), aligning hydrogen production with renewable energy generation on an hourly basis (temporal correlation), and ensuring geographic proximity between production and energy sources.

These rules aim to ensure that renewable hydrogen genuinely contributes to decarbonization rather than relying on existing fossil-fuel-based grids. This framework sets the stage for accelerating clean hydrogen adoption, aligning with the EU’s climate goals and strengthening the hydrogen economy.

From that perspective, green hydrogen costs are expected to decline from today’s average of around €5 ($5.28)/kilogram to a more competitive €2-€3/kilogram. These cost reductions nonetheless hinge on scaling up production, continuing technology improvements, and lower renewable energy prices. Blue hydrogen, created from natural gas with carbon capture, currently has lower costs than green hydrogen, though prices are influenced by fluctuations in natural gas markets.

Consequently, Europe’s hydrogen industry shows signs of being on track for substantial growth by 2025, largely fueled by efforts to decarbonize sectors like steel, transport and energy.

Under the EU’s Green Deal and aligned policy frameworks, hydrogen production is shifting increasingly toward green (renewable) and blue (low-carbon) hydrogen. This includes plans to install 40 GW of electrolyzer capacity by 2030, with early targets already fostering greater electrolysis and carbon capture technology use.

–Reporting by Matias Poirrier; Editing by Rob Sheridan

Try the OPIS Europe Hydrogen Report for FREE

Try the OPIS Europe Hydrogen Report for FREE

Designed to cater to the diverse data needs of the green hydrogen market in Europe.

The green hydrogen market is poised for significant growth, expanding from under 1 million tons per year now to hundreds of millions of tons per year by 2050.

The green hydrogen market is poised for significant growth, expanding from under 1 million tons per year now to hundreds of millions of tons per year by 2050.

To facilitate this expansion and support greenhouse gas reduction efforts, it is crucial to have a reliable hydrogen market price benchmark that aligns with the UK Low Carbon Hydrogen Standard and the EU Delegated Acts on Renewable Hydrogen. The OPIS Europe Hydrogen Report is an information service designed specifically for the green hydrogen industry in Europe.

The shipping industry in Europe is under pressure to reduce the use of traditional, petroleum-based marine fuels in favour of frequently more expensive, zero-carbon alternatives to adhere to stringent environmental regulations. The industry is also battling with increased operating costs from purchasing European Carbon Allowances, upgrading or retrofitting older less efficient vessels as well as trying to compete with the aviation and road transport sectors for biofuels.

Several refineries in Amsterdam, Rotterdam and Antwerp (ARA) scheduled maintenance work during the fourth quarter of 2024 reducing output. Prices for High Sulfur Fuel oil (HSFO), Very Low Sulfur fuel oil (VLSFO) and diesel marine oil (DMA) prices have strengthened due to tight supply in the ARA region.

Since Russian fuel oil exporters were banned from exporting refined products into the European Union starting in February 2023, fuel oil supply has tightened. Russian HSFO barrels have been replaced by imports from the United States and neighbouring countries in Europe. While an arbitrage opportunity between northwest Europe and the United States opened between August and November 2024, analysts expect this arbitrage opportunity will close moving into 2025.

“I see this trend as an opportunistic move by traders rather than a long-term trend,” said Xavier Tang, market analyst at ship tracking data provider Vortexa. “With Europe returning back from its seasonal refinery maintenance and the U.S. drawing its residual fuel oil inventories to 42-year lows, it is unlikely that this trend will continue in the long term,” he added.

OPIS bulk HSFO barge prices in northwest Europe were at an average of $433/metric ton in November, compared to an average of $443/mt three months earlier in August. By Dec. 5, HSFO barges prices basis ARA fell by 4% from $444/mt at the start of the year. VLSFO barges fell by 16% from $581/mt at the start of 2025 to $486.75/mt on Dec. 5, according to OPIS pricing data.

Also, the HSFO barge crack, a spread between the flat price versus Brent futures and a measure of a refiner’s profitability was in negative territory for most of 2024. The HSFO barge crack strengthened to positive territory for the first time on Oct. 1 when it climbed $0.24/bbl, before flipping negative again to minus $4.57/bbl on Dec.13.

Looking ahead to 2025, the European shipping industry will be forced to transition to lower carbon marine fuels or face fines for non-compliance.

The FuelEU Maritime legislation comes into force in 2025 and will target a 2% reduction in greenhouse gas emissions from shipping that year, rising to a 6% reduction in 2026 and reaching up to an 80% reduction in greenhouse gas emissions by 2050. The European Commissions introduced the ‘Fit for 55’ climate policy in 2021 as part of its plans to plan to cut greenhouse gas emission by 55% by 2030 compared to emissions levels in 1990 and to achieve net-zero carbon by 2050.

Still, shipowners have voiced their concerns about the lack of availability and scalability of low-carbon alternative marine fuels such as methanol, ammonia, liquefied natural gas (LNG) and biofuels. One of the aims of the FuelEU Maritime regulation is to incentive producers of alterative marine fuels to increase output and to close the cost gap between traditional and alternative marine fuels by making fossil fuels more expensive to use.

Those shipping companies that choose not to comply with the legislation and exceed permitted emission levels will face severe penalties, ranging from €39 ($43.60)/mt of non-compliant fuel used in 2025, which will rise to €1,997/mt by 2050.

The shipping sector was included in the EU’s Emission Trading System (EU ETS) in January 2024. Ships weighing above 5,000 gross deadweight tons travelling to and from ports within the European Union will need to pay for 70% of their carbon dioxide emissions in 2025, up from 40% in 2024 and increasing to 100% in 2026. Vessels moving from EU ports to non-EU ports will benefit from a 50% discount on their carbon emissions.

French shipping company CMA CGM told its customers its EU ETS surcharge will increase by around 75% in 2025 due to increased costs. The final surcharge cost is dependent on fluctuations in European carbon prices.

There is still ambiguity about who will pay for the increased cost of compliance between the ship owner or charterer. The shipping supply chain will need to re-negotiate existing contracts to make it clear who will absorb the higher operating costs to comply with EU regulations.

“We are in an industry where it is harder to use the existing technologies of electrification to achieve decarbonization, but we will be pushed along decarbonizing policies; we must adapt,” said research analyst Steve Christy at bunker brokerage Intergr8 Fuels in October 2024.

Also, the Mediterranean Sea Emission Control Area will become effective from May 1, 2025, part of a move to reduce air pollution from ships in the Mediterranean Sea. The sulfur content of the fuel vessels burned while operating in the area cannot exceed 0.10%, unless the ship deploys an exhaust gas cleaning system.

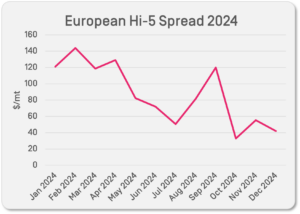

During 2024, the price difference between HSFO and VLSFO barges loading in the Port of Rotterdam, also known as the Hi-5 spread, increased to its widest point of $144/mt on Feb. 1 before falling to the narrowest spread of the year of $20/mt on Oct. 25 compared to $57.50/mt on Dec.13, OPIS pricing data showed.

Going forward into 2025, the Hi-5 spread is expected to remain under pressure due to the introduction of environmental regulations that will start to discourage and reduce the widespread use of conventional marine fuels such as HSFO and VLSFO.

Going forward into 2025, the Hi-5 spread is expected to remain under pressure due to the introduction of environmental regulations that will start to discourage and reduce the widespread use of conventional marine fuels such as HSFO and VLSFO.

“There are potential downside implications [in 2025] to VLSFO demand due to stricter decarbonization regulations, while Egypt HSFO for power demand will remain robust in the face of more expensive LNG cargoes,” said Royston Huan, research analyst for fuel oil and feedstocks at Energy Aspects.

“Overall supply in Europe will go down due to some crude distillation unit capacity closures [in 2025], but almost all will be HSFO volumes that we expect to be taken out, not VLSFO,” he added.

–Reporting by Stacy Maphula; Editing by Rob Sheridan

Try the OPIS Global Marine Fuels Report FREE for 30 days

Try the OPIS Global Marine Fuels Report FREE for 30 days

Global Shipping Market Outlook and Bunker Fuel Pricing

The Global Marine Fuels Report includes price assessments for 0.5% VLSFO and high-sulfur bulk and bunkering fuels in the most important ports around the world. The OPIS BTU Indicator helps buyers plan cost-effective fuel purchases by calculating the energy content in the new 0.5% VLSFO compared with legacy high-sulfur marine fuels. Also featured are exclusive OPIS benchmarked ULSD rack prices for key North American markets, plus ULSD spot prices for Gulf Coast, New York Barge, Los Angeles, and the Pacific Northwest.