Asia’s LPG: Facing Demand Growth, Tariff Threats and Fragile Supply

The U.S.-China tariff dispute escalated in April 2025, with China’s proposal of a 125% tariff on U.S. propane—its latest move before renewed trade talks—laying bare the fragility of Asia’s LPG supply chain to policy shifts. The tariff has threatened a product critical to China’s petrochemical sector, where propane is the primary feedstock for an expanding network of propane dehydrogenation (PDH) units. Even without being enacted, the proposal triggered price volatility and trade uncertainty, underscoring how exposed regional balances are to geopolitical signals.

This risk has been amplified by China’s heavy reliance on U.S. propane. The country imports around 1.4 million metric tons of propane from the U.S. each month—roughly one-third of total U.S. propane exports and over half of China’s total propane imports on average, according to data from OPIS Global LPG Outlook. Complete substitution is difficult given constraints in supply availability, shipping patterns and feedstock composition from other regions.

The trade tensions echoed a familiar pattern. Over the past six years, Asia’s LPG market has weathered repeated shocks—from trade disputes and pandemic disruptions to war-driven supply squeezes. Yet throughout, demand has continued to climb. China’s propane imports more than doubled since 2018 to 29.6 million mt in 2024, while India, Pakistan and Southeast Asia have steadily scaled up both propane and butane intake to a combined 40.5 million mt, a 74% increase from 2018, to support population growth and industrial expansion.

Flow Shifts and Price Signals: What the Market Is Telling Us

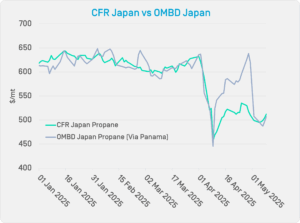

Recent pricing movements have highlighted growing tensions in Asia’s LPG trade flows. A recurring theme in 2025 so far has been the temporary divergence between OPIS Mont Belvieu Delivered (OMBD) Japan and CFR Japan prices. OMBD Japan, which reflects cost-based U.S.-origin propane delivered to Asia, priced at a premium to the broader CFR Japan benchmark on two separate occasions—first around February and again in early April. In both cases, the spread was short-lived, narrowing as U.S. cargoes continued to flow and regional balances adjusted.

Recent pricing movements have highlighted growing tensions in Asia’s LPG trade flows. A recurring theme in 2025 so far has been the temporary divergence between OPIS Mont Belvieu Delivered (OMBD) Japan and CFR Japan prices. OMBD Japan, which reflects cost-based U.S.-origin propane delivered to Asia, priced at a premium to the broader CFR Japan benchmark on two separate occasions—first around February and again in early April. In both cases, the spread was short-lived, narrowing as U.S. cargoes continued to flow and regional balances adjusted.

These dislocations point to a market that remains structurally reliant on U.S. volumes, yet increasingly reactive to shifts in upstream pricing and policy signals. The early-April price gap coincided with renewed tariff concerns and firm U.S. propane prices, while the February episode followed weaker Asian demand and steady U.S. supply.

In addition, some market sources have pointed to signs of shifting shipping behavior. Reports have emerged of North Sea-origin cargoes potentially heading to Asia in early June—routes not commonly seen in recent years. While unconfirmed, such signals suggest a cautious reassessment of sourcing strategies as buyers navigate the evolving policy backdrop.

China’s ability to fully pivot to Middle Eastern supply remains limited. Most Middle Eastern exports are propane-butane mixes, which are better aligned with demand in India and Southeast Asia. If China were to increase its intake from the Middle East, it could disrupt the regional balance, either by leaving excess butane without a destination or by displacing mixed cargoes from markets that rely on them.

Feedstock Decisions Under Pressure

The prospect of higher tariffs on U.S.-origin propane—though currently suspended—has underscored the vulnerability of Asia’s petrochemical producers, particularly those operating PDH units. These facilities are highly margin-sensitive and rely heavily on imported propane.

According to Chemical Market Analytics by OPIS, over 40% of China’s PDH capacity could face feedstock shortfalls under a tariff scenario, potentially resulting in up to 6 million mt of lost propylene output.

As of end-March 2025, China had around 23 million mt of nameplate PDH capacity, with PDH units accounting for more than 30% of total domestic propylene capacity. With first-quarter 2025 operating rates averaging 70%, any disruption to propane flows could significantly tighten domestic supply. Naphtha crackers may provide some buffer, though their additional output is limited—estimated at just 400,000 mt of propylene, according to CMA. Imports from regional producers may also increase to help bridge the gap.

Steam crackers, which can process a wider range of feedstocks, offer more flexibility in adapting to cost or supply shocks. Thus, naphtha remains a fallback despite its lower propylene yield, while ethane could remain competitive due to low U.S. natural gas prices—though constrained by concentrated trade routes and infrastructure limits.

With tariffs now on pause, the immediate pressure has eased. However, the potential for renewed disruption remains. Rising feedstock costs, limited substitution options and downstream pricing constraints could still expose vulnerabilities across the sector. Feedstock strategy and flexibility will continue to shape how producers adapt to shifting conditions in supply, policy, and market economics.

The Pause Before the Next Move

Asia’s LPG market is more exposed to policy shifts than ever. Even a suspended tariff proposal has triggered price dislocations and re-routing behavior—underscoring how trade signals can move both cargo and sentiment. At the same time, structural demand from China and other Asian economies remains strong, particularly from the petrochemical sector.

This ongoing tension between firm demand and unstable trade flows will likely define market behavior in the near term. How producers, traders and buyers adapt will depend on the ability to balance feedstock economics with evolving supply realities—both in the waterborne market and downstream value chains.

From Mont Belvieu to the World: Navigate Global LPG Markets with Greater Transparency

From Mont Belvieu to the World: Navigate Global LPG Markets with Greater Transparency

As LPG exports from the U.S. Gulf Coast surge, the OPIS Global LPG & Naphtha Report provides the transparency you need to navigate evolving markets. Powered by the OPIS Mont Belvieu benchmark, this report integrates freight intelligence and delivery costs to key ports worldwide—helping you make informed decisions with confidence.

Review this report for free to explore our unique market coverage.