- Who We Help

- Commodities

- Products

- Pricing

- Pricing Overview

- Spot

- Rack

- Retail

- Price History

- News

- Analytics

- Find a Product

- Pricing

- Energy Transition

- Events

- Resources

- About

- Contact

General Oil Industry News, Videos, Podcasts and More:

Free Downloads – Spot & Wholesale Rack Pricing:

Free Downloads – Retail Fuel Markets, C-Stores/Gas Stations:

Energy Market News

Mexico Fuel Markets:

Infographics:

From gasoline and petrochemicals to coal and carbon credits, the OPIS team of expert analysts covers the global supply chain. The OPIS Blog features expert tips, practical insight and timely pricing and market information. It covers the spot, rack and retail markets as well as gasoline, diesel, renewable fuels, NGL/LP, feedstocks, natural gas, jet fuel and crude oil. It’s the simplest way to gain a greater understanding of how fuel markets tick and to keep up with changes that could affect pricing — and your bottom line.

Propylene, particularly PGP, play an integral part in the costs that trickle downstream and spread throughout the refining, petrochemical and broader manufacturing industry. If you don’t fully understand the pricing method by which you are buying or selling PGP, you could be selling too low, or buying too high.

Download How Polymer Grade Propylene is Priced to strengthen your understanding of the PGP market and the different ways it can be priced.

A stronger understanding of each pricing method helps to identify which is the best for place on the supply chain, positioning you to save money by choosing the most cost-effective pricing method for your business.

If you produce or consume a commodity made from ethylene, you have unique exposure in the market. And price exposure involves risk.

But you don’t need to be a prisoner of this risk. Tools exist to help you.

In an ideal world you:

If none of these perfect-world scenarios apply to you, this report will underscore the importance of ethylene price protection using forward curves.

Download the updated Fuel Buying 101 e-Book for a step by step guidance on how gasoline, diesel and other fuel products moves through the supply chain and how prices are determined.

Before you negotiate your next wholesale fuel supply agreement, here are 7 tips to help you write a contract like a pro. This checklist is perfect for gasoline and diesel retailers, municipalities and end-users. Download the checklist before finalizing your next supply contract.

Download your copy of the Fuel Supply Contract Checklist today and discover:

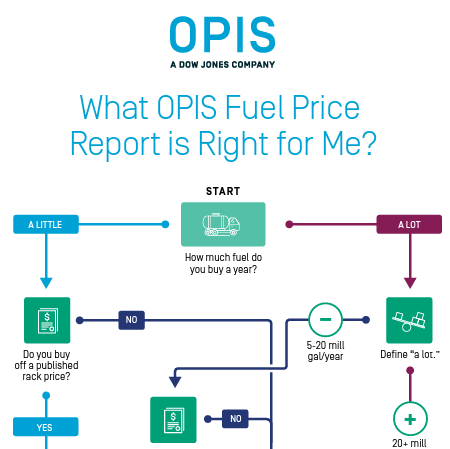

OPIS publishes several wholesale gasoline and diesel pricing reports, plus online tools. Three of our most popular pricing resources are the Invoice Checker, daily Gasoline and Diesel Rack Price Report and the Spot Ticker (a spot pricing tool that helps wholesalers gauge whether wholesale rack prices will go down or up, based on spot price movement.) This handy rack product-finder infographic leads you to the most relevant of these three products for you, based on some quick questions about your wholesale business.

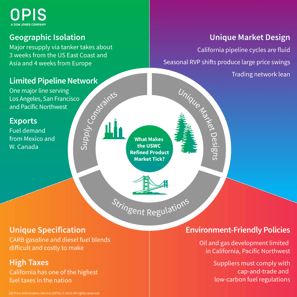

Because of unique market fundamentals, limited refining capacity, and a boutique gasoline blend needed to meet regional specs, the West Coast region has a relatively lean gas and diesel trading network compared to other spot markets. That lack of market liquidity can lead to huge price moves and surges, like the one that caused retail gasoline prices to top over $4/gal in spring 2019.

Download this infographic for a visual breakdown of the key reasons and fundamentals why the U.S. West Coast refined spot market is so unique and often, challenging.