INTERVIEW: Phasing Out Coal – Inside the Transition Credit Methodology with South Pole

Verra’s recent approval of VM0052 — a carbon methodology designed to enable the early retirement of coal-fired power plants — marks a milestone in carbon markets and the clean energy transition. South Pole played a leading role in developing this framework, aiming to monetize avoided emissions while ensuring affected communities aren’t left behind. In an interview with OPIS, Frédéric Gagnon-Lebrun, Global Senior Director of Policy & Strategy at South Pole, reflects on the journey, the challenges and what comes next.

Facing the Complexity of Coal Transitions

On May 6, carbon registry Verra approved the world’s first carbon credit methodology for the early retirement of coal-fired power plants. Known as VM0052 Accelerated Retirement of Coal-Fired Power Plants Using a Just Transition, the Verified Carbon Standard methodology was developed under the Coal to Clean Credit Initiative, co-led by The Rockefeller Foundation and the Global Energy Alliance for People and Planet, with South Pole serving as the lead implementing partner.

Gagnon-Lebrun describes VM0052 as a result of nearly three years of work, shaped by a need to navigate complex economic and policy realities. One of the early challenges was identifying in which contexts it would be most difficult — and impactful — to decommission coal-fired power plants. The team focused on narrowing the types of plants to target: those that are connected to electricity grids (not captive industrial plants) and those operating in regulated markets or under long-term power purchase agreements (PPAs), which provide them with “a secured income effectively.” This approach allowed the methodology to focus on plants “shielded from competition effectively… over the longer term,” he said.

Another challenge was ensuring that early retirement did not lead to emissions leakage — for example, by simply replacing one coal plant with another. To address this, the methodology includes a strict eligibility requirement: project proponents must commit to “no new coal,” as Gagnon-Lebrun emphasized, and demonstrate that the plant was financially viable at the time of retirement to prove that it would have otherwise continued operating.

Initially, the methodology assumed a full 100% replacement of the retired coal plant’s capacity with renewable energy, potentially supported by storage. However, this assumption did not hold up under scrutiny. “In a lot of consultations and a lot of studies that we’ve conducted in different contexts in different countries… that proved to be very challenging,” Gagnon-Lebrun noted.

The approach was therefore revised to allow for partial replacement. Under the final methodology, at least 40% of the retired capacity must be replaced with renewable energy by the end of the first crediting period. The emissions associated with any electricity that may need to be sourced from the grid are conservatively determined and subtracted from the baseline emissions. “Those emissions… are completely taken into account and estimated in a very conservative manner in the methodology,” he said, ensuring that transition credits reflect a true net reduction in emissions.

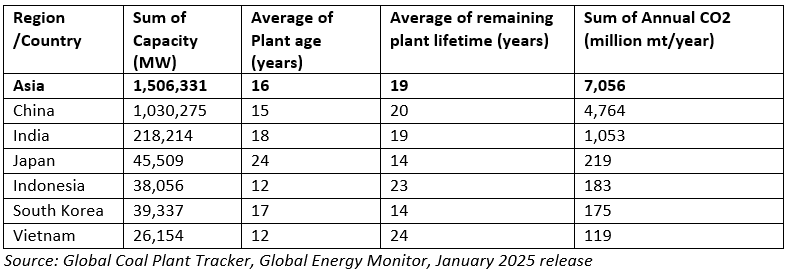

Exhibit 1 Operating Capacities of Grid-Connected Non-Captive Coal Power Plants in Key Asian Countries

A critical technical element of VM0052 is establishing the “earliest plausible shutdown date” — the point at which a coal plant could reasonably be expected to retire without carbon finance. This forms the baseline for calculating the emissions reductions and ensures that any credited reductions are truly additional.

“The main starting point for determining the baseline is essentially estimating when the plant might have closed,” explained Gagnon-Lebrun. This date must pre-date any government-mandated retirement and is based on factors such as the end of a PPA, the plant’s technical life or the point at which continued operation becomes economically unviable. The most conservative of these is selected.

Emission reductions are then modeled against this baseline, with crediting tied to renewable energy capacity replacing the plant’s output. “The emission reductions come from the replacement with renewable energy capacity,” Gagnon-Lebrun said. The faster that clean energy is deployed, the more carbon finance can be unlocked — for both the shutdown and the just transition plan. “There’s a real incentive to shift to as much renewable energy as quickly as possible,” he added.

One Methodology, Many Contexts

A defining strength of VM0052 is its ability to adapt to different national and plant-specific contexts. The methodology is designed to account for the realities of each country’s energy policies and the operational details of individual coal plants. This bottom-up approach enhances credibility. As Gagnon-Lebrun put it, “the fact that the methodology is able to take into account country-specific and plant-specific data and circumstances makes it, in our view, higher integrity and… more robust.”

Rather than relying on generalized assumptions, the methodology is applied at the project level — with each plant assessed against its regulatory environment, market structure, and technical and financial profile. While this adds complexity, it also strengthens the rigor of the emissions calculations and supports more accurate crediting outcomes.

Just Transition as a Value Driver

One of the most innovative aspects of VM0052 is its integration of social safeguards into the core of the methodology — not as an add-on, but as a requirement. From the beginning, South Pole set out to address “the social aspects of coal transition on the same footing as the environmental aspects,” Gagnon-Lebrun explained.

To do this, the methodology mandates that a just transition plan be prepared upfront to assess the potential social impacts of early coal plant retirement. Two key requirements ensure that this is more than a formality: first, at least 2% of the net carbon finance revenue must be allocated to implement the just transition plan; second, the plan must be independently monitored, reported and verified — using the same rigor applied to emissions accounting.

When asked whether this embedded social component might function like traditional co-benefits in the voluntary carbon market — where projects with social or biodiversity benefits often command a price premium — Gagnon-Lebrun was optimistic. “I would expect the fact that a just transition approach is baked into the methodology… will catch a premium and will be seen as valuable by the buyers,” he said.

Supply is Ready — But is the Market?

While much of the discourse around carbon projects focuses on supply, Gagnon-Lebrun emphasized that the bigger challenge is on the demand side. “I think the main challenge is scaling demand, in fact,” he said, noting that transition credit projects like those under VM0052 are significantly larger than typical voluntary market projects.

The pilot project currently under assessment, for example, is expected to generate 1.9 million metric tons of emission reductions annually over 10 years — nearly 90 million metric tons in total — from a single coal plant. “That is a lot larger than the carbon project that we’re seeing in the voluntary market – many, many folds larger,” he added.

Exhibit 2. Top Carbon Credit–Generating Methodologies on the Verra VCS Registry (as of May 14)

Because of this scale, unlocking demand from both corporates and compliance buyers is critical. South Pole is encouraging Article 6 credit buyers and companies with climate targets to consider how transition credits can support their decarbonization strategies. “Demand is a key focus,” Gagnon-Lebrun stressed.

The Rockefeller Foundation, which co-leads the Coal to Clean Credit Initiative, estimates that scaling this model to support 60 similar projects by 2030 could mobilize up to $110 billion in public and private investment — underscoring the potential market size if demand signals align.

Looking ahead, South Pole is exploring the development of additional methodologies to expand the role of carbon markets in financing decarbonization. “We are in discussions around looking at other types of methodologies,” Gagnon-Lebrun said, noting that the company’s focus extends beyond grid-connected coal plants.

One example he highlighted is captive coal-fired power plants — facilities that supply electricity directly to industrial operations rather than feeding into the national grid. These plants fall outside the scope of VM0052 but represent a significant source of emissions. “There could be a role for carbon markets… for that,” he said, suggesting that future methodologies could aim to unlock transition finance for a broader range of fossil assets.

As demand for high-integrity transition credits grows, VM0052 may offer a scalable framework to anchor compliance and voluntary buyers alike in coal-heavy regions.

Reporting by Lujia Wang, lwang@opisnet.com

Editing by Mei-Hwen Wong, mwong@opisnet.com

© 2025 Oil Price Information Service, LLC. All rights reserved.