Article 6 Carbon Market Takes Shape in Asia Pacific with Early Price Signals

International carbon trading under Article 6 of the Paris Agreement is gaining momentum in the Asia Pacific, with early offers revealing prices above those in the voluntary market. This evolving framework creates new pathways for countries to trade carbon credits internationally to meet climate goals.

Singapore’s recent carbon credit tender, which closed Feb. 14, marks its first public government procurement specifically for Article 6 credits and offers clear price signals, attracting 17 bidders including major commodities traders and energy companies. Global trader Trafigura submitted the highest bid at S$299.19 million ($224 million), as first reported on Feb. 20.

This tender specifically sought nature-based solutions, following Singapore’s request outlining its procurement focus. The city-state confirmed in early March that it would continue sourcing Article 6 carbon credits through additional tenders, expanding eligibility beyond nature-based solutions.

Clear Price Signals Emerge

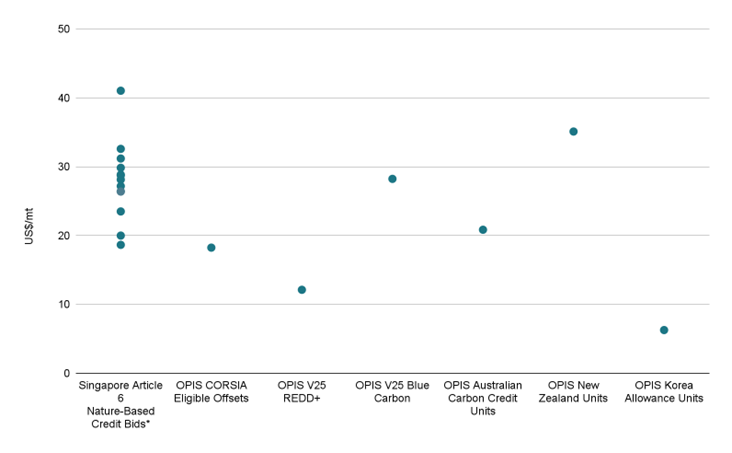

Disclosed average per-unit bid prices ranged from S$25 to S$55 per metric ton ($18.70-$41.20/mt), positioning Article 6 credits well above voluntary credits. For comparison, Carbon Offsetting and Reduction Scheme for International Aviation-eligible aviation offsets, which can be used by airlines to meet their emission targets, were assessed at $18.35/mt, while forestry REDD+ credits were calculated at $12.125/mt, our data shows.

These prices align with other early Article 6 transactions in the region. Switzerland’s Klik Foundation, which manages the country’s decarbonization efforts, paid an average price of CHF 27/mt ($30/mt) for its Article 6-aligned credits from a Thai e-bus project in 2023, as reported by OPIS.

This price difference reflects several factors, beyond comprehensive buyer criteria. Article 6 credits require formal “corresponding adjustments” to ensure the same emissions reduction isn’t counted by multiple countries, involve host country fees, and carry additional risks in these new markets, according to sources.

Carbon Credit Prices Across Voluntary and Compliance Markets

Source: Average bid price data available*, OPIS APAC Carbon Report, Global Carbon Offsets Report

Regionally, the bid prices also exceed some established compliance market levels. Korea’s K-ETS allowances trade around KRW 9,145 ($6.28/mt), Australian carbon credits at A$33.15 ($20.80/mt) and New Zealand’s NZU at NZ$61.50 ($35.12/mt), OPIS data shows. These domestic carbon prices provide key signals for what buyers may eventually pay for Article 6 credits.

Singapore demonstrates this connection directly, with some bidders structuring their pricing around the country’s carbon tax, which allows companies to offset up to 5% of emissions with international credits. The tax is set to rise from S$25 currently to S$45 in 2026, with projections for it to reach S$50 to S$80 by 2030.

The tender’s stringent financial requirements favor well-capitalized players, with successful bidders required to provide a 5% security deposit and facing penalties tied to the Singapore tax for failing to deliver credits. “It is only the big players with very big balance sheets that can take on this risk that are very active in the market,” said Roxanne Tan, Senior Managing Consultant at South Pole, at the recent Carbon Forward Asia 2025 conference.

Countries Move at Different Speeds

Carbon market development remains uneven across the region. Singapore has an anticipated demand of 25 million mt through 2030 but is just one player in what’s expected to be a much larger market.

The city-state targets emissions at 60 million mt of carbon dioxide equivalent by 2030, with plans to use international carbon credits to help support this effort. To secure these credits, Singapore has signed agreements with Ghana, Papua New Guinea and Bhutan, while adding memorandums with the Philippines, Laos and Zambia in 2024.

Others have also signaled a willingness to collaborate through Article 6. Japan, for one, is targeting to accumulate 100 million mt in emission reductions by 2030 through collaboration via its Joint Crediting Mechanism. Australia and New Zealand, both with existing carbon pricing systems, have not yet decided whether to allow international units for compliance. Sources suggest that New Zealand may need international offsets to meet its climate commitments, though formal agreements remain limited.

Despite promising demand, market participants agree that clearer rules are needed on key issues: how countries officially approve or authorize credits for international trading under the Paris Agreement, and how buying countries can use them to meet their climate goals.

Meanwhile, other Southeast Asian nations expected to be on the supply side, such as Indonesia and Malaysia, are still defining their Article 6 strategies. This geographic pattern aligns with broader market interest, as South Asia, South America and East Asia have been identified as the regions of highest interest for Article 6 projects, following a recent industry survey by the International Emissions Trading Association. India is also planning to align its domestic carbon market with the centralized Article 6.4 mechanism, with most methodologies expected in 2025, as OPIS reported.

“In the short term, Article 6.2 will continue to be the main source of Article 6 demand and supply,” Bjorn Fonden, International Policy Advisor at IETA commented at the conference, noting that “what we are seeing is actually it’s a seller’s market” as host countries develop their frameworks now.

Airlines Drive Additional Demand

As Article 6 markets develop, the aviation sector’s CORSIA program is another key demand driver beyond countries. IATA projects that airlines will need between 64 and 162 million eligible emissions units for Phase 1 (2024-2026), with compliance due in 2028.

Project developers are creating flexibility in how their carbon credits can be used, highlighting the growing integration of Article 6 credits into both compliance and voluntary strategies. “We look at trying to maximize the potential uses of different credits,” said Tan, seeking authorization for them to be tapped for multiple purposes, including for airlines under CORSIA and for countries’ climate plans.

What This Means for Businesses

What do these developments mean for companies? As carbon pricing expands across the Asia Pacific, businesses with significant emissions face increasing compliance costs. While direct emissions reductions remain the primary focus, Article 6 credits offer a complementary tool to manage the cost of emissions within broader decarbonization strategies, particularly for emissions that are technically difficult or prohibitively expensive to abate in the near term.

For carbon project developers, higher prices for Article 6-compliant credits could provide stability in what has been a volatile market. The government backing and regulatory framework underpinning these credits represent a significant step in carbon market maturation, with clear demand for correspondingly adjusted credits also viewed as downside protection against market fluctuations.

Market data as of March 12, 2025.