California Carbon Market Slides as Cap-and-Trade Uncertainty Persists

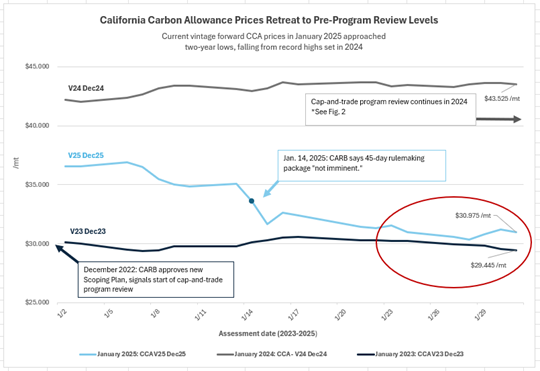

California Carbon Allowance (CCA) trade prices approached their lowest level in two years in January 2025, nearly 12 months after setting all-time highs for forward delivery.

The OPIS CCA V25 December 2025 price sank more than $5/mt between Jan. 2-31, punctuating a year-long decline from all-time high CCA prices assessed one year ago. OPIS assessed the CCA current vintage forward price at a record high of $43.93/mt on Feb. 5, 2024, before prices declined, essentially erasing any gains made in anticipation of the forthcoming cap-and-trade rulemaking.

Trade prices and auction settles deflated throughout 2024 amid delays in the ongoing cap-and-trade program review, which began in late 2022 with approval of the updated Assembly Bill 32 climate scoping plan. The California Air Resources Board (CARB) held its initial workshop to update the state’s Cap-and-Trade Program rulemaking in Nov. 2022. During the 2023-2024 workshops, the agency released piecemeal updates for the forthcoming rulemaking.

“The work continues here at CARB on this rulemaking. We expect to complete and release the regulatory package for a 45-day public comment period in early 2025,” according to CARB’s rulemaking website.

Prices climbed during the program review throughout 2023 and early 2024, before deflating sharply on announced delays and other stalls in the process. See the chart for a recap of CARB program review updates and secondary market CCA pricing in 2024. (Click the image to view it larger.)

Prices climbed during the program review throughout 2023 and early 2024, before deflating sharply on announced delays and other stalls in the process. See the chart for a recap of CARB program review updates and secondary market CCA pricing in 2024. (Click the image to view it larger.)

CARB released information, including potential emissions budget cut scenarios throughout 2023 and 2024, before announcing it would delay the release of a formal Initial Statement of Reasons (or 45-day package) from autumn 2024 to “early 2025.” Rulemaking delays in 2024 signaled that the proposed emissions budget cuts would arrive later than expected, and CCA trade values weakened accordingly. CARB more recently signaled it does not expect to release the ISOR soon.

During comments made on Jan. 14, 2025, at the 13th Annual OPIS LCFS & Carbon Markets Workshop in San Diego, CARB Deputy Executive Officer Rajinder Sahota said that publication of the rulemaking’s Initial Statement of Reasons is “not imminent.”

“There are a couple of things on our plate that we have to juggle in the near term, so it’s not imminent and I’m not going to say it’s going to be a few weeks from now,” Sahota said.

OPIS CCA prices deflated more than $3/mt through two trading sessions following Sahota’s comments on Jan. 14, and by Jan. 31 the OPIS CCA V25 December 2025 price was down $5.605/mt from an assessment of $36.58/mt to start of the year.

The California Cap-and-Trade Program will hold its first quarterly allowance auction of 2025 on Feb. 19. Auction 42 will offer 51.47 million V25 CCAs in the current portion and 6.8 million V28 CCAs in the advance portion. The Q4 auction in November sold out all 52.63 million CCAs in the current portion of the event and settled at $31.91/mt.