In Opaque REDD+ Markets, Identical Credits Can Fetch Diverse Prices

Buyers and sellers of voluntary carbon credits have, in recent months, begun to value offsets issued from the same projects at wildly different prices.

Vintage 2021 credits from an Asia-based REDD+ project traded in February 2024 at $16/metric ton. In January, a seller offered V18 credits from the project at $1.25/mt. V21 credits from a Latin American REDD+ project traded in February at $10.10/mt and $6.50/mt. Since October 2023, credits of various vintages from an Africa-based REDD+ project have cleared between $1.70/mt and $5/mt.

Voluntary carbon markets are notoriously opaque. Credits can transact on electronic exchanges either through direct trades or in standardized contracts. Many deals, however, occur on a bilateral basis. Buyers may also sign forward offtake agreements with developers for future issuances.

Voluntary carbon markets are notoriously opaque. Credits can transact on electronic exchanges either through direct trades or in standardized contracts. Many deals, however, occur on a bilateral basis. Buyers may also sign forward offtake agreements with developers for future issuances.

In that milieu, buyers and sellers can arrive at varying conclusions regarding the quality of a carbon offset project and the value of its credits.

In Search of Quality

REDD+ projects have received harsh criticism over the past two years. John Oliver detailed a range of low-quality initiatives in an August 2022 segment on the HBO show “Last Week Tonight.” In a January 2023 article, The Guardian alleged that “more than 90% of rainforest carbon offsets … are worthless.”

In the months since, further criticism of voluntary carbon markets has proliferated. In response, the market has flocked to quality.

Many buyers have reported seeking out high-quality credits. The Integrity Council for Voluntary Carbon Markets is working to signal quality by assessing methodologies under its Core Carbon Principles framework, which it published in March 2023. The Voluntary Carbon Markets Initiative has begun to approve corporate offsetting statements with its Claims Code of Practice, which it published in June 2023.

General agreement exists among market stakeholders as to what constitutes a quality REDD+ project. Among other measures, projects should be additional, meaning they would not have occurred without the intervention of the developer. Offsets should be permanent, meaning developers should reasonably expect to sequester carbon on an ongoing basis and put measures in place to address the risk of reversal. Credits should be counted just once and then retired. Projects should not simply displace carbon emitting activity somewhere else, known as leakage.

And, per the ICVCM’s principles, projects should ensure “robust quantification of emission reductions and removals.” In other words, if a project issues a credit representing a metric ton of carbon dioxide equivalent, or CO2e, it should be confident that a metric ton of CO2e has been removed, reduced or avoided.

Finally, credits can also earn co-benefit designations for advancing sustainable development goals or other benefits that do not directly relate to carbon offsetting. Many buyers pay a premium for strong co-benefit designations.

Yet, as evidenced by the disparity in prices reported to OPIS for credits from the same project, buyers and sellers can disagree over how quality translates to price.

Carbon credit ratings agencies, such as BeZero Carbon, Sylvera and Renoster, have brought greater clarity to the market, but the availability of ratings doesn’t necessarily lead to price consistency.

For example, V20 credits from an Asia-based REDD+ with a co-benefit designation traded in September for $13.50/mt. V20 credits from the same project were offered at $5.75/mt in January.

OPIS assessed the REDD+ V20 Tier 3 range at $6.75/mt to $14.75/mt on the day of the trade in September. The range was assessed at $5.10/mt to $16/mt at the end of January and was assessed at $5.50/mt to $14/mt on March 5.

Renoster rates projects based on its confidence that one credit represents one metric ton of offset emissions. An ideal score is 1. Anything above that level indicates the project has understated its impacts, and anything below indicates it has overstated them.

Renoster gave the Asia-based REDD+ project a score below 0.80. While it was judged to be additional and to have set a conservative baseline, leakage involving deforestation in nearby areas brought its score down. Significant permanence risks were also detected.

Widening Spreads Between High- and Low-Quality Credits

As carbon offset buyers began to conduct greater due diligence regarding project quality over the past 18 months, prices reflected that shift. Buyers began to pay a premium for credits they deemed to be high-quality, while sellers of credits perceived to be low-quality grew willing to trade them for less and less.

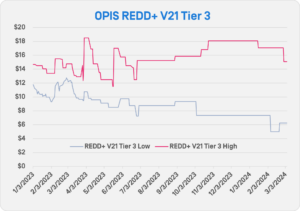

OPIS accounts for project type, vintage and volume, as part of its voluntary carbon market assessment range. Over the past year, the spread between the high and low end of OPIS assessments has widened.

On Jan. 18, 2023, the day The Guardian published its article, OPIS assessed the REDD+ Tier 3 V21 range at $10.44/mt to $14.50/mt. On Tuesday, the REDD+ V21 Tier 3 range was assessed at $6.25/mt to $15.07/mt. In the interval between, the low end was assessed as low as $5/mt on Feb. 7, 2024, while the high end was assessed as high as $18.50/mt on March 30, 2023.

On Jan. 18, 2023, the day The Guardian published its article, OPIS assessed the REDD+ Tier 3 V21 range at $10.44/mt to $14.50/mt. On Tuesday, the REDD+ V21 Tier 3 range was assessed at $6.25/mt to $15.07/mt. In the interval between, the low end was assessed as low as $5/mt on Feb. 7, 2024, while the high end was assessed as high as $18.50/mt on March 30, 2023.

In other words, the market has weakened overall, but some projects perceived to be high-quality have been able to fetch stronger prices than they could 12 to 18 months ago.

BeZero Carbon Co-Founder and Chief Innovation Officer Sebastien Cross has also noticed this phenomenon.

“We’ve begun to see big spreads in the market, particularly after last year, when you saw some of the pricing crash off of some of the stories and headlines,” Cross said. “But, if you look at the underlying transactions going through, some projects have still been appreciating.”

Some disparity in prices can be explained by the volume of credits delivered in a trade. Sellers typically ask more for credits in smaller-volume transactions.

OPIS divides its assessments by tiers to account for these volume discounts and premiums. Tier 3 involves trades between 2,000 and 49,000 credits, Tier 2 reflects volumes of 50,000 to 349,000 credits, and Tier 3 is 350,000 credits and above.

Credit vintage can also influence pricing. Newer vintages tend to trade at a premium to older vintages, which represents a contango market structure.

But disparity can be found in credit prices from the same project even accounting for vintage and volume. Since December 2023, Tier 3 volumes of V19 credits from a Latin American REDD+ project have traded between $8/mt and $13.45/mt. Less than a year ago, Tier 3 trades for V19 credits from the project cleared as high as $17.50/mt.

What’s more, the project has a rating from Renoster well above 1, indicating very high confidence in its emissions reductions and project quality.

While the previous example of the Asia-based REDD+ project indicated that some buyers were overpaying for middling quality credits, Renoster’s rating of the Latin American REDD+ project indicated that some buyers have been able to pay less for high-quality offsets.

According to Saif Bhatti, CEO and Co-Founder of Renoster, this disconnect indicated how immature the voluntary carbon market remains.

“This is a very nascent market,” said Bhatti said. “There’s just not a high level of liquidity or information transfer from different market participants. If you compare it to the stock market, the price of the same share on one exchange is likely to be the same as the price on another. That’s obviously not the case here. It’s just such a different ballgame.”

Both Bhatti and Cross, however, believe buyers are getting smarter and savvier when it comes to judging quality.

Cross pointed out that The Guardian article based its broad conclusions on a sample of the REDD+ market. When it was published, it had a strong impact on REDD+ prices.

“The market has progressed a lot,” Cross said. “The marginal impact of these headlines [criticizing carbon projects] has been less and less. People have realized that taking a sub-sample of a sector and saying, ‘These projects are crap, therefore the whole sector is crap and therefore the whole market is crap.’ That is not actually an indication of reality. You have to be a bit more specific.”

See also: REDD+ Project Hedges Against Drought and Weakening Carbon Markets, June 1, 2023