Pemex in Transition: What to Expect as Lopez Obrador’s Term Ends

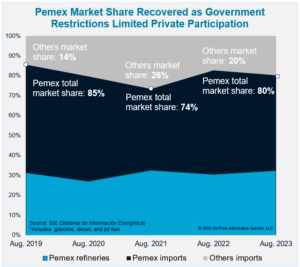

As Mexican President Andres Manuel Lopez Obrador’s administration begins its final year, doubts are rising over whether the government can do much more to boost state-owned oil company Pemex’s position in the market.

The Lopez Obrador administration has already exhausted all possible legislative, administrative and regulatory steps to help Pemex increase its market share, a key objective of the president when he took office in 2018, analysts and market participants told OPIS.

Still, they believe Pemex will continue to expand its market share through attractive commercial strategies that offer favorable terms to marketers and retailers.

Pemex has been particularly successful in 2023 in regaining market share, largely through its independent fuel marketing subsidiary MGC, which was selected as Pemex’s first strategic customer and provided with maximum bulk fuel discounts across the country.

MGC’s aggressive discounts and credit guarantees have squeezed private competitors and smaller Pemex fuel distributors, a market participant told OPIS.

MGC’s aggressive discounts and credit guarantees have squeezed private competitors and smaller Pemex fuel distributors, a market participant told OPIS.

Other Pemex’s distributors are “doing everything to stay afloat,” and are competing with MGC by transferring all Pemex discounts to their customers, the source said.

Pemex has regained the most market through MGC rather than relying on a few branded distributors, the source added. A market analyst said Pemex also is gaining a foothold in the unbranded market, due to its strategic customer program.

MGC’s aggressive bulk discounts and 30-day credit are advantages that other companies are hard-pressed to match, he added.

Sources believe the market may already be dominated by a select group of Pemex-branded marketers that have benefitted from the strategic customer discount program and generous credit terms offered by the oil company.

Pemex records show that in December 2022, brand distributors Damora Crane and Lemargo were selling more than the 65,000 b/d of fuel required to become a strategic client. Along with MGC, the companies that month supplied a combined 234,000 b/d of fuel.

“Pemex granted them too much power,” a source said, adding that “these companies wield significant negotiating power, even with Pemex.”

Market participants also said they believe Mexican energy regulator CRE and other government agencies have done everything possible under the president’s energy policy to limit Pemex’s competitors.

OPIS has detailed steps taken by the Lopez Obrador administration to favor Pemex, including suspending or restricting private fuel import and transload rail terminal permits as well as authorizations to import fuel outside customs points.

But CRE still has some cards to play in its efforts to disadvantage Pemex competitors, including finalizing a 2022 package of proposed rules that would restrict sales between marketers and suspending distributors who have not complied with the government’s strategic fuel inventory requirements, sources told OPIS.

The agency, however, may not end up finalizing the rules because the provisions also could hurt Pemex and its network of branded suppliers.

Another market analyst said he believes Pemex’s market share has expanded in parallel with the revitalization of its network of retail fueling stations.

The source said expansion into the retail sector by Pemex’s major private competitors has been hindered by CRE-imposed limits on new permits.

The number of Pemex-flagged retail stations rose by 222, or more than 3%, in the second quarter of 2023 to 7,080 from the same period in 2022. Pemex Chief Executive Octavio Romero Oropeza has said that the company has successfully stopped its losses in the retail sector because of the strategies it implemented over the last year.

A market analyst said private importers may over the short to mid-term limit imports due to Pemex’s growing presence in the market and their inability to expand their retail networks in the face of regulatory constraints.

An appetite for Mexico

Still, sources said that despite the nationalistic measures taken by Lopez Obrador and the regulatory barriers to private companies’ participation, Mexico continues to be an attractive destination for investment due to its proximity to the U.S.

“Mexico has always been an important market for refined product exports and will continue to be so,” one market participant said.

“There’s a narrative of self-sufficiency, but that’s something that is unlikely to happen.”

Even if all six of Pemex’s domestic refineries operate at 80% capacity and the new 340,000 b/d Dos Bocas becomes fully operational, Mexico’s demand for fuel would still exceed Pemex’s ability to supply it. The sources said it’s clear that the reality of the fuel market is at odds with what the government wants to achieve.

A number of sources are skeptical that Dos Bocas will contribute in any significant way this year to Mexico’s finished fuel supply, despite government promises. Most of the reports about upcoming production from the facility have been political in nature, with Pemex under pressure to reduce its reliance on imported gasoline from the U.S.

Private fuel suppliers, however, could find themselves back in favor by 2025, depending on who wins the presidential election next year, an analyst said.

“The challenge is navigating the six-year term while anticipating a shift and ensuring survival along the way; the name of the game is to survive,” the source said.

–Editing by Daniel Rodriguez, drodriguez@opisnet.com and Jeff Barber, jbarber@opisnet.com