Unbranded Gasoline Market Share Continues to Grow at Branded Expense

It was not that long ago that branded outlets sold most of the fuel, but the past six or so years have seen a rise in unbranded outlets taking market share away from the branded outlets on a sometimes slow and steady basis.

As the peak of gasoline demand appears to be in the rearview mirror, it is imperative for retail chain operators to concentrate on market share to keep their customers. The market share advantage for unbranded appears to perhaps have peaked, but the difference between the two remains steady.

A study of OPIS monthly U.S. market share data from the past six years, which counts visits and the type of gasoline brand sold, shows that at the start of 2018, retail gasoline properties were mainly branded.

For the month of January 2018, the branded/unbranded breakdown was about 55% versus 45%. The advantage stuck close to 10% throughout the first quarter before slimming down throughout the rest of the year. By December, the branded market share dropped to about 51% and unbranded to 49%.

For the month of January 2018, the branded/unbranded breakdown was about 55% versus 45%. The advantage stuck close to 10% throughout the first quarter before slimming down throughout the rest of the year. By December, the branded market share dropped to about 51% and unbranded to 49%.

During 2018, the branded market share advantage averaged just over 7%. OPIS defines market share as visit counts to a site for a brand in a chosen market based on cell phone pings, in this case, the U.S.

There are advantages to being branded or unbranded. Branded dealers have the power of a brand behind them, but perhaps more importantly, there’s a guaranteed supply as the branded dealer is the last to be cut off in times of tight supplies. However, the most attractive aspect of branding is the upfront money offered by the brand. On the other hand, with being unbranded, there are no fees, all the margin goes to the retailer, and usually, being loyal to a distributor will bring supply reliability.

Branded outlets had the market share advantage for some time, but that reached an inflection point in June 2019 as unbranded market share topped 52% with branded slipping to about 48.5%. Unbranded market share has topped branded in the U.S. ever since then and has seen its advantage grow to as much as about 14.5%.

The peak difference between branded and unbranded market share took place at the beginning of the year, when unbranded market share topped 57%, with branded just inside of 43%. Branded market share has narrowed the gap a bit through October, but for the most part it has been running between 12-12.5% over the past six months.

Growing unbranded market share can come down to something as simple as price when it comes to selling more fuel. Drivers’ brand loyalty does not exist to a great extent like it once did, or consistently across all markets.

At the beginning of the data set, January 2018, branded outlets in the U.S. on average priced 1.74cts above the average which is in fact the smallest premium to the average in this sample of just under six years. At the same time, the unbranded average price in the first month of 2018 stood at 2.81cts versus the U.S. average. Like branded, this is the tightest price to the average that unbranded had, and, as a result, the difference between the two was 4.55cts.

It has taken almost six years for that variance from the average to peak as August 2024 saw the difference between branded and unbranded reach 8cts/gal in the U.S. while a move from 4.55cts to 8cts may not appear but it is a more than 75% expansion.

During August 2024, branded stations on average priced 3.15cts over the street average while the unbranded station was 4.85cts below the average. Since the beginning of this sample from January 2018 through October 2024, the price difference between branded and unbranded has averaged just over 6cts/gal.

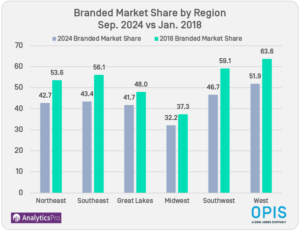

The national trend of brands losing market share to unbranded outlets is evident on a regional basis as the six-year change in market share has been stark as multiple regions have seen double digit percentage point losses.

With the rise of regional chains, the Southeast and Southwest have seen the largest swings as branded market share has declined 12.7% in the Southeast and 12.4% in the Southwest. The Great Lakes has seen the smallest branded decline at 6.3%, though that can be due to a smaller geographic region. Meanwhile the West and Northeast saw branded market share down 11.7% and 10.9%, respectively.

With the rise of regional chains, the Southeast and Southwest have seen the largest swings as branded market share has declined 12.7% in the Southeast and 12.4% in the Southwest. The Great Lakes has seen the smallest branded decline at 6.3%, though that can be due to a smaller geographic region. Meanwhile the West and Northeast saw branded market share down 11.7% and 10.9%, respectively.

Although the brands are losing market share, the number of branded stations does not appear to be materially declining.

In January 2024, branded stations had a nearly 61.5% outlet share. Outlet share is defined as the amount of locations a brand operates as a percentage of locations within a chosen market, in this case the U.S.

At its low point over the past six years, branded outlet share bottomed out at roughly 59.6%, which was in May 2020 and at the height of the pandemic lockdowns. The unbranded outlet share climbed to just over 40.2%.

Over the past six years, branded outlet share has averaged 60.4%, while branded averaged just over 39.4%.

Finally, branded and unbranded efficiency are on diverging paths. Efficiency is simply taking the market share and dividing it by outlet share. A higher number represents a site that is selling more fuel than its competitors in a market. A 1.0 efficiency rating should be the target.

The efficiency category can be argued as where the price difference between branded and unbranded chains is most evident.

Not once over the six-year sample period did branded outlets top 1.0 efficiency, while the unbranded efficiency has never been below 1.0. This could simply be the fact that there are more branded outlets than unbranded. A current OPIS count shows more than 76,000 branded outlets compared to just over 50,000 unbranded.

The first year of the data shows a tight spread between branded and unbranded efficiency. In 2018 the average branded efficiency was 0.88 with unbranded coming in at 1.19, a difference of just over 0.30.

The rise of large regional chains has put pressure on the branded market share in recent years as more aggressive pricing has seen the unbranded site take gallons away from branded. That trend is expected to continue as the chains grow and expand into new territories, but brands are still going to have a strong presence as upfront capital offerings can be too much to resist.