3 Things Storage Contracts Say About Nat Gas Inventories

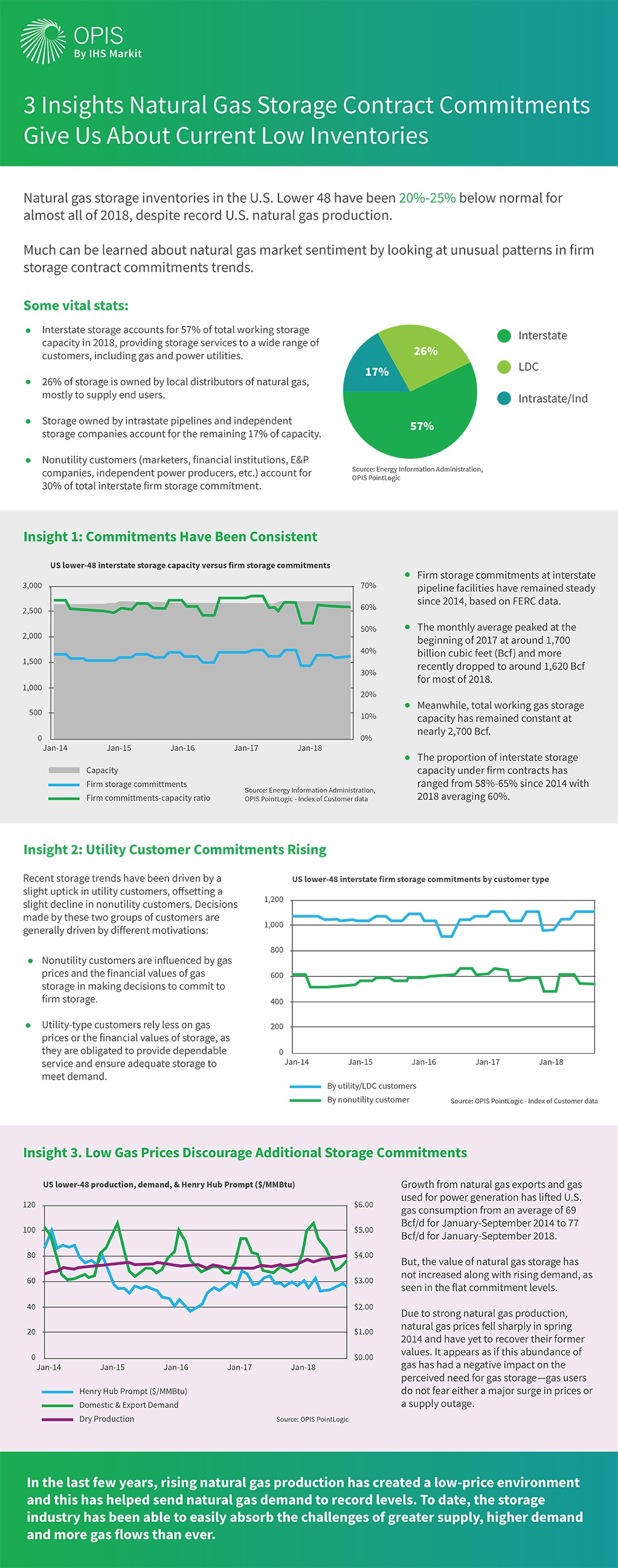

Natural gas storage inventories in the U.S. Lower 48 have been 20%-25% below normal for almost all of 2018, despite record U.S. natural gas production.

OPIS PointLogic, tracking natural gas storage, notes that firm contract commitments for that storage are exhibiting patterns that were not expected several years ago.

Much can be learned about market sentiment by looking at firm storage contract commitment trends.

Attention visual learners! Jump to a handy info graphic on natural gas below.

First, some vital stats:

- Interstate storage has accounted for 57% of total U.S. Lower 48 working storage capacity in 2018 to date, providing storage services to a wide range of customers, including gas and power utilities.

- Another 26% of storage is owned by local distributors of natural gas, mostly to supply their end users.

- Storage owned by intrastate pipelines and independent storage companies account for the remaining 17% of working storage capacity.

- Nonutility customers include marketers, financial institutions, E&P companies, independent power producers, etc. These customers account for 30% of total interstate firm storage commitment. Since 2014 this customer base has ranged from 30%-36% of the commitments.

Insight 1: Commitments Have Been Consistent

- Firm storage commitments at interstate pipeline facilities have remained steady since 2014, based on OPIS PointLogic analysis of FERC data.

- The monthly average peaked at the beginning of 2017 at around 1,700 billion cubic feet (Bcf) and more recently dropped to around 1,620 Bcf for most of 2018 to date.

- Meanwhile, total working nat gas storage capacity has remained constant at nearly 2,700 Bcf.

- The proportion of interstate storage capacity under firm contracts has ranged from 58%-65% since 2014 with 2018 averaging 60%.

Insight 2: Utility Customer Commitments Rising

Recent storage trends have been driven by a slight uptick in utility customers, which is offsetting a slight decline in nonutility customers. Decisions made by these two groupings of customers are generally driven by different motivations:

- Nonutility customers are influenced by natural gas prices and the financial values of gas storage in making decisions to commit to firm storage.

- Utility-type customers rely less on gas prices or the financial values of storage, as they are obligated to provide dependable service and ensure that adequate gas is stored to meet seasonal demand.

Insight 3. Low Gas Prices Discourage Additional Storage Commitments

Growth from natural gas exports and gas used for power generation has lifted U.S. gas consumption from an average of 69 Bcf/d for January-September 2014 to 77 Bcf/d for January-September 2018.

But, the value of natural gas storage has not increased along with rising demand, as seen in the flat commitment levels. Why?

One possible answer is strong natural gas production and accompanying low prices for gas. Due to strong natural gas production, natural gas prices fell sharply in spring 2014 and have yet to recover their former values. It appears as if this abundance of gas has had a negative impact on the perceived need for gas storage — gas users do not fear either a major surge in prices or a supply outage.

Also, low nat gas prices are expected well into the future.

Conclusion

In the last few years, rising natural gas production has created a low-price environment, and this has helped send natural gas demand to record levels. To date, the storage industry has been able to easily absorb the challenges of greater supply, higher demand and more gas flows than ever.