IMO 2020 Resources Kit

A potential oil price game-changer will arrive as a belated holiday “gift” to the market this year — IMO 2020.

While many questions remain as to how IMO 2020 will actually shake out in the oil, gasoline and diesel market — and whether higher fuel prices are on the horizon — market analysts continue to view the new decrees by the International Maritime Organization as a major influence on prices for 2020 and beyond.

So, OPIS is presenting you an early holiday gift! Here’s a one-stop-shopping guide to the resources you’ll need to prepare for IMO 2020 so you can react to changes.

Remind Me Again, What is IMO 2020?

The International Maritime Organization (IMO) has decreed vessels must no longer use fuels that regularly now include 5,000 to 35,000 parts per million of sulfur. That change took place globally on Jan. 1, 2020, but the preparations for a lower-sulfur bunkering fuel were already underway.

Here’s a blog post with the basics on IMO.

And, if you would rather digest your IMO 101 in your car, on the treadmill or while walking your dog, check out this podcast:

What Happens If a Shipper Doesn’t Comply with IMO 2020?

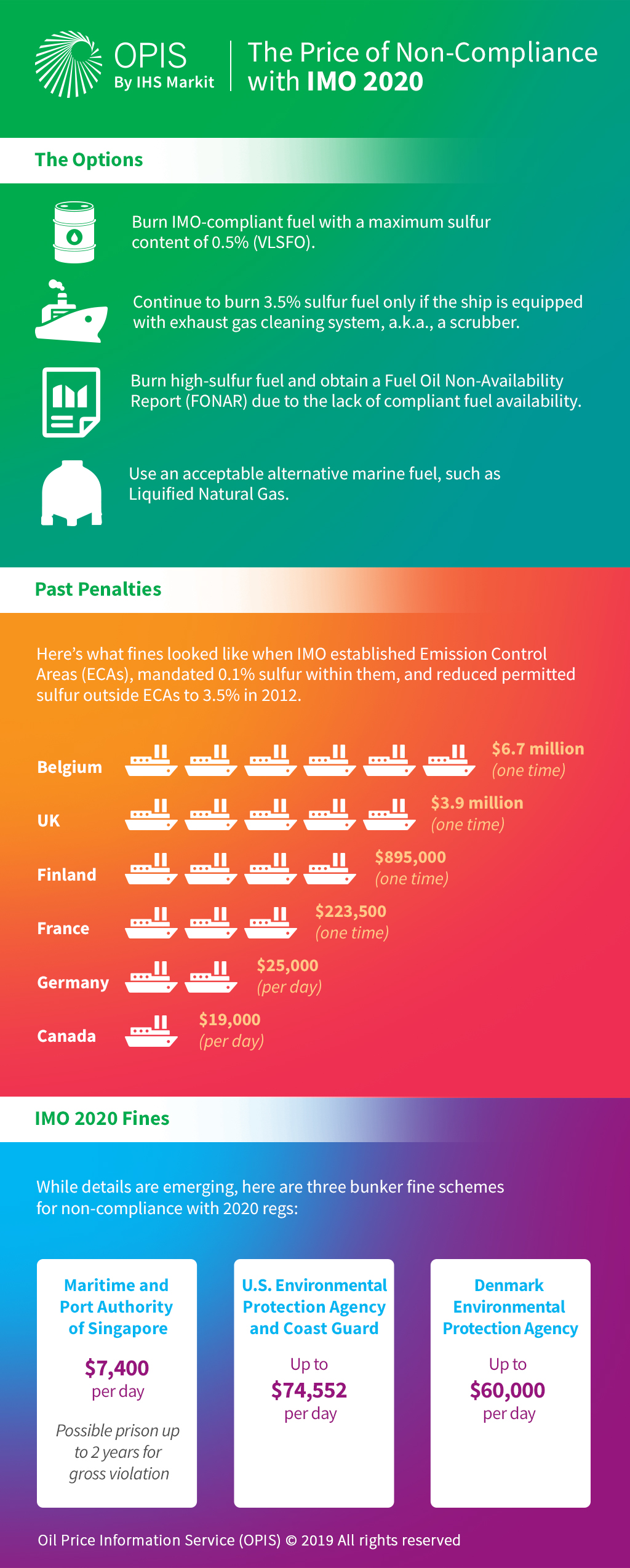

Shipowners have a choice of how, or even if, to comply with IMO 2020.

Yes, you read that right. Shipowners could also opt to chance it by not complying, though penalties are expected to rise dramatically.

Here’s a helpful infographic of what could shake out for a shipowner that doesn’t comply:

So, How Is The Oil Market Preparing as IMO 2020 Looms?

Already, increased imports of light U.S. crude oil, well-suited to making low-sulfur marine fuels, are being seen into Rotterdam, one of the largest bunkering ports in the world – number one in Europe, in fact.

That was one of the points raised by Ronald Backers, business intelligence advisor at the Port of Rotterdam, who recently spoke to OPIS about the complex and varied changes the port is expecting from the IMO 2020 regulations.

Hear his entire podcast right here:

Backers also notes in his interview that:

- IMO 2020 stands to be positive for refiners who make the new Very Low Sulfur Fuel Oil (VLSFO), storage operators and fleets that have invested in scrubbers to bring non-complaint fuel up to spec.

- Extra costs will be incurred for shipowners/charterers who rely on Marine Gasoil (MGO)

What Can We Expect for U.S. Gasoline and Diesel prices Amid IMO 2020?

OPIS founder Tom Kloza recently wrote in his latest OPIS blog:

The ability to remove sulfur from petroleum molecules is an uneven capability among the 150 or so U.S. refineries. Complex refiners will be able to deal with the change, but simple refineries may have incredible challenges. Very light and very sweet crude oil blends may be the preferred feedstock for processors that don’t have sophisticated desulfurization equipment.

This is perhaps the most significant fuel specification change since lead was removed from gasoline. Ultra-low-sulfur diesel and IMO-compliant diesel may head to tidal waters where ships may pay well over the price of crude for these fuels. Precisely how much diesel (and European gasoil) will fetch over crude prices is a point of contention. Estimates range from the present diesel “crack” of about $18/bbl to $40/bbl or more above the price of Brent crude.

Within coastal refineries, there may be an allure to sell vacuum gasoil to ocean-going vessels. Normally, vacuum gasoil goes to fluid catcrackers (FCCs), where the feedstock is converted into gasoline and road diesel. If significant amounts of this gasoil bypass other equipment in the refinery, it could substantially cut down on the amount of overall gasoline produced. For this reason, some analysts believe that gasoline will not trade at some of the razor-thin or depressed margins that refineries have witnessed in the last four winters.

Bottom Line on IMO 2020

IMO 2020 compliance entails a massive change that will require speedy adjustments across the global fuel supply chain to comply with the January deadline.

The decision by the IMO already has begun to exact far-reaching consequences on shipping company operating costs, global freight rates, shipping economics, scrubber demand, accelerated ship scrappage and more.

You can get even more IMO 2020 analyses from OPIS parent company IHS Markit right here.

We hope this toolbox has helped you wrap your head around this potential oil price game-changer. Be sure to check back in this blog space for updates.

And for daily marine fuel pricing assessments to help you make cost-efficient IMO 2020 decisions as regulations take hold, be sure to check out our Global Marine Fuels Report for key marine fuel prices, news and commentary for Asia, the Mideast, Europe and the Americas.