What the Seven and Seven Oil Cocktail Means For Price Forecasting

The Seven-and-Seven Oil Cocktail

Oil pundits predicting a return of $75/bbl or higher benchmark crude prices are delusional.

They are either obsessed with predicting what they prefer to happen for their own investments and clients, or are unaware of what the seven and seven oil cocktail means for price forecasting. Hint: it should temper prices into the new decade.

Oil Market Psychoanalysis

A well-respected term used in 21st century psychiatry is “anosognosia,” which loosely translates into a lack of insight. It is perhaps an appropriate term for the scores of commodity “experts,” “analysts,” and “researchers,” who still maintain a view that $75/bbl, $80/bbl, or even $100/bbl oil will again prevail as a typical benchmark before the next decade commences. In the oil business, analytical anosognosia is almost always accompanied by wild hyperbole and an unwillingness to recognize trading levels that have become modern day anachronisms in price forecasting.

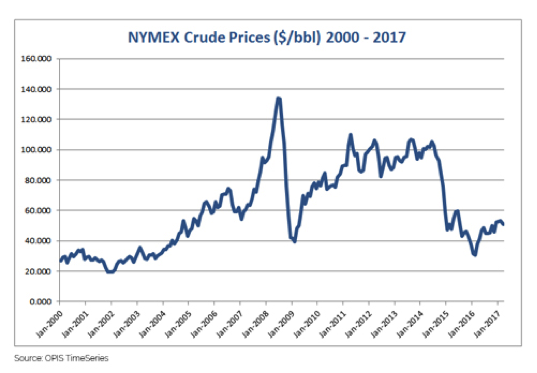

Forget about the wild swings in one day or one week. Using the OPIS TimeSeries historical fuel price database, monthly averages going back to 2000 tells a different story:

- The market has been suppressed since 2H 2014, when OPEC lost its ability to manage pricing and shale was properly anointed as the new game changer.

- There was an amazing head fake when WTI rose on mere rhetoric alone to $62.58/bbl on the day after Cinco de Mayo in 2015, but we’ll chalk that up to too much tequila in the trading rooms. The $60/bbl level, mentioned in nearly every investment bank position paper this year, has been missing in action since that unusual May week.

More on Monthly Averages

There is precedent for the disappearance of benchmark pricing levels once thought to be routine. Global markets first saw WTI and Brent trade at $40/bbl or higher in October 1990 against the backdrop of Operation Desert Shield and worries about Persian Gulf choke holds and interruptions. Not until May 2004, a span of some 175 months later, did we see the first $40/barrel monthly average make its monthly debut.

Is $60/bbl the new $40/bbl? I’d probably pad the high range assessment slightly and cast severe doubt on $65/bbl crude. Interestingly, if you want to find the last month where WTI actually averaged more than $60/bbl, you’d have to go back to November 2014, before the disastrous OPEC meeting. The average settlement that month was actually $75.81/bbl. If you want to recreate a monthly average in the ‘60s, you must go all the way back to September 2009 when WTI averaged $69.47/bbl.

Back to the Seven-and-Seven Cocktail

Think back to that the brief, but critical chapter this decade, when oil prices commonly fetched more than $100/bbl. Billions of dollars in capital expenditures were allocated to ambitious global oil projects in nearly all corners of the world. Many of those projects will bring their first oil to market in 2018 and 2019 — approximately seven years after funding.

Now consider the rough seven-month estimate to bring lucrative oil shale projects online in the Permian Basin or in other nearly as lucrative plays such as the SCOOP/Stack and Eagle Ford. The seven-month timeline neatly overlays the seven-year timeline as long as prices don’t again drop below say $40/bbl, although chasing a real “break-even” number is a moving target.

The Case for Market Bloat

One can quibble with just how gelatinous the belly of surplus crude is in the U.S. and worldwide but it is certainly measured in hundreds of millions of barrels. It should slim down in the next few quarters, but there are elements on the refined products’ side that could keep the weight loss less noticeable. Some examples:

- The U.S. has the capacity to run more than 18-million b/d of crude, an increase this century of no less than 2.3-million b/d. But where to move the product? Export markets have quieted and the U.S. consumer only ignores gasoline when it is at record cheap levels. The difficulty in selling a marquee product ultimately provides a strong undertow for crude.

- The disappointment among U.S. refiners is growing. The EIA and most investment houses are still suggesting that gasoline consumption will rise in 2017 to some 60,000-70,000 b/d above the record 2016 level. I disagree with that reading and believe the best that refiners can hope for is a flat line.

- There’s a glut of crude oil, but there is never a glut of gasoline thanks to its perishable status (it really shouldn’t be stored in tanks for more than seven months) and the lack of new tanks in any region of the country. Just-in-time inventory management can lead to just intolerable price spikes when there are refinery events (think of California) or hurricanes (think Texas and Louisiana). The resulting paroxysm in local pricing has few limits, but it often provokes demand destruction that lasts much longer than the cyclonic development, landfall, and aftermath of storms.

My view is that WTI numbers in the $50s represent the 2017-2019 norm. We may occasionally stray as low as $39/bbl during the worst of times for producers, but I doubt whether the best of times can conjure up a $65/bbl number, thanks to that Seven-and-Seven cocktail.