The Changing Face of the European Toluene Contract Price Mechanism

To CP or not to CP – that’s the question. Or is it? Participants in the European toluene market seem to have found alternative answers fairly quickly for pricing.

A colorless aromatic hydrocarbon, toluene occurs naturally in crude oil and when producing gasoline and ethylene. It’s used as a feedstock to manufacture chemical products, with a wide range of applications such as those needed to make the padded foam products found in the chair you’re sitting on.

Toluene also serves as a solvent in paints and coatings, inks, adhesives, and pharmaceuticals. More importantly for motorists, in gasoline blending, it’s a key fuel octane booster. Or simply put, toluene blended into gasoline helps to reduce the so-called ‘knocking’ in vehicle engines, allowing them to withstand higher pressure and improving overall performance.

So any changes in pricing mechanisms can have a widespread impact on many industries across Europe, as toluene plays a crucial role in several sectors.

The history of the CP in aromatics markets

The monthly contract price settlement process is a hallmark of some of Europe’s more liquid aromatics markets. Producers and consumers, buyers and sellers, get together to hash out a fixed price to set the level of the coming month, known as a Contract Price.

The monthly contract price settlement process is a hallmark of some of Europe’s more liquid aromatics markets. Producers and consumers, buyers and sellers, get together to hash out a fixed price to set the level of the coming month, known as a Contract Price.

This CP is meant to provide stability for both buyers and sellers as well as users of products made from derivatives of these aromatics further along the chain. Once the CP is settled, it’s then published as a price reference for trading activity over an agreed period.

Once upon a time, there used to be a single, monthly European toluene CP set by producers and buyers, mainly from the chemicals sector. Toluene producers and consumers would meet to settle their prices at the end of each month in an attempt to avoid exposure to sudden price movements and achieve security of supply and demand. So, these contracts typically had a single fixed price over a specified period. The negotiated price was based on market conditions at the time of the CP agreement. Adjustments were only made when the market was significantly disrupted.

But for toluene, pricing mechanisms are now beginning to change. No longer is there a single, standardized monthly CP. Gone are the days where European toluene industry participants would be deeply engrossed in contract negotiations, either for the next few months or the entire year.

Instead, in the face of weakening demand, volatile crude and uncertain gasoline prices that have eroded profit margins, many market participants prefer to settle prices based on their own pricing formulae, in private negotiations with counterparties.

In fact, analysts at Chemical Market Analytics by OPIS, a Dow Jones company, suggest there may not have been a single, market-wide European CP since late 2021.

Volatility and Demand Uncertainty

While the monthly toluene CP hasn’t altogether disappeared, and Chemical Market Analytics continues to provide a notional monthly price to the European toluene market each month, risk and volatility in pricing have spurred market interest in the adoption of alternative pricing mechanisms, away from more public discussion.

After the global pandemic at the start of the decade, increasing geopolitical tension and volatility in oil and natural gas prices have curbed consumer spending, in turn reducing demand for toluene – either as a raw material or its derivative products. High production costs and inflation have turned production margins negative at toluene conversion units in Europe, according to sources.

After the global pandemic at the start of the decade, increasing geopolitical tension and volatility in oil and natural gas prices have curbed consumer spending, in turn reducing demand for toluene – either as a raw material or its derivative products. High production costs and inflation have turned production margins negative at toluene conversion units in Europe, according to sources.

Unsurprisingly then, many companies are struggling. Force majeure declarations at chemical plants across Europe remain in place as demand fundamentals are uncertain. Even BASF, the world’s largest chemicals producer, is feeling the heat. BASF said in March that it would shut its 300,000 mt/year TDI plant in Ludwigshafen, Germany. Based on nameplate capacity, the closure of this plant removes some 200,000 metric tons of toluene demand from the market, according to Chemical Market Analytics data.

In Europe, more than 50% of supply is typically consumed by the chemicals sector, which needs toluene as a feedstock to manufacture other aromatics or end-use products.

Meanwhile, the solvents industry, especially in the construction sector, accounts for about 30% of toluene consumption. Appetite here for toluene has also fallen, with some industrial consumers reportedly ordering only minimum contractual volumes. Additional spot demand is far lower than typical for the time of year, according to market sources.

Export demand has also been limited, as arbitrage economics to ship toluene to the U.S. market have not proven viable for most of this year so far, according to traders and analysts.

And on the other side of the equation, supply has wavered as producers have struggled with high costs, lowering toluene extraction rates to focus on supplying contract volumes and adjusting toluene inventories lower to manage excess supply.

Despite this sluggish demand backdrop, the reduction in output has created an environment in which even small supply disruptions can cause prices to increase sharply as producers look to cover contractual commitments, causing toluene premia to move higher to attract additional volumes into the spot market. This too has led to market players preferring a greater degree of caution and privacy when discussing pricing with counterparties.

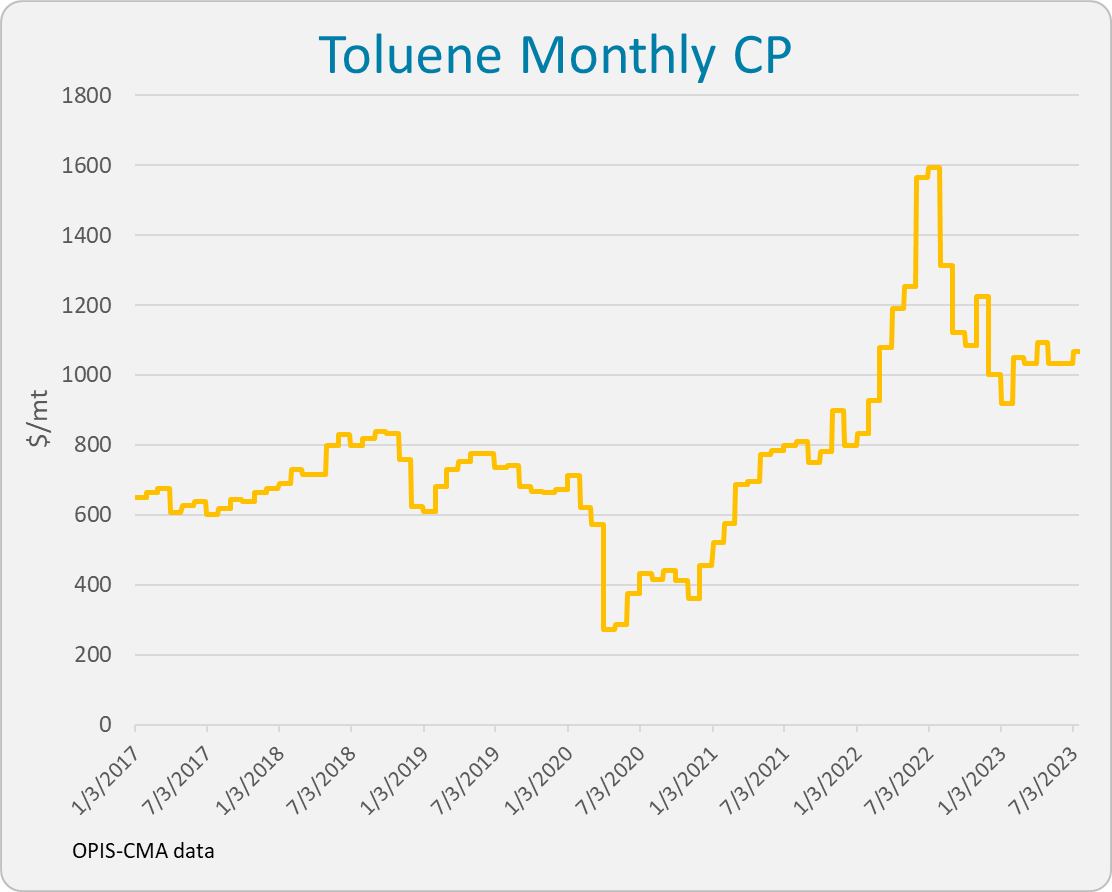

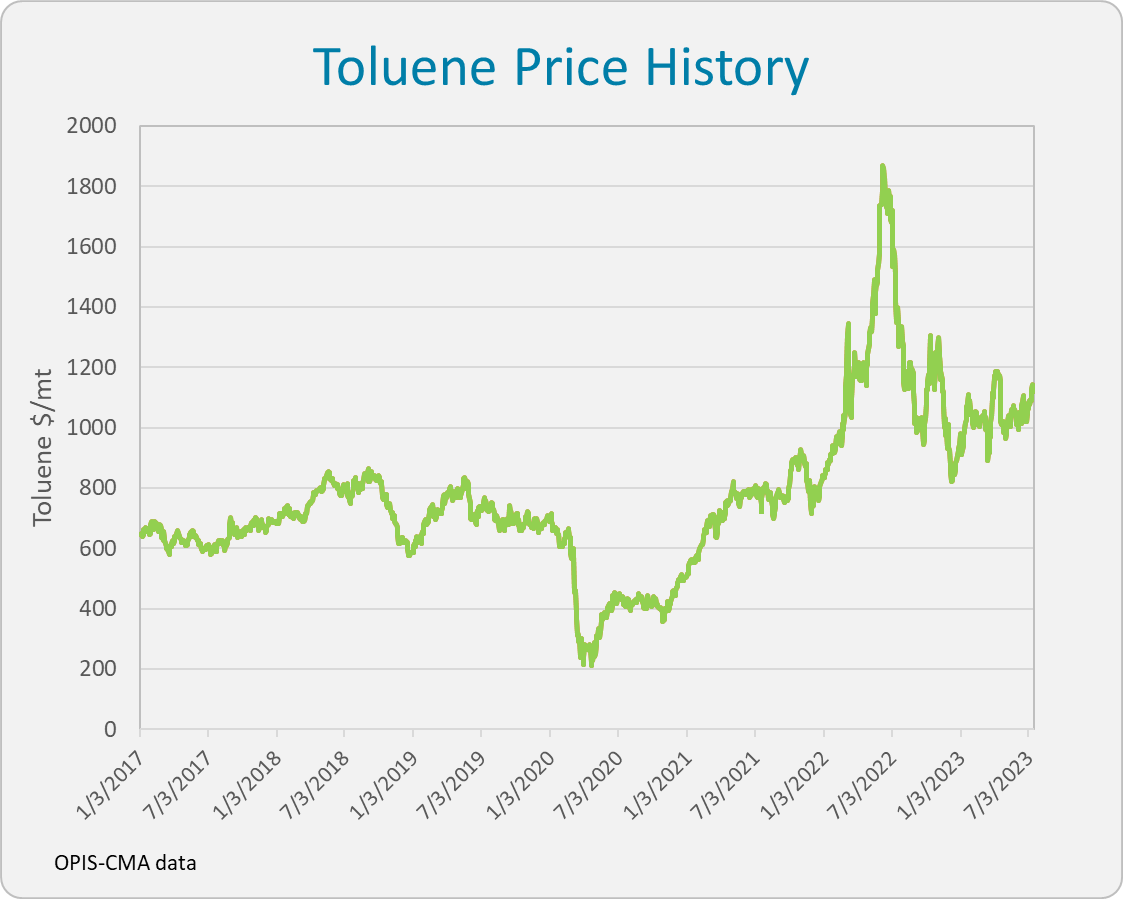

The huge swings in toluene spot pricing due to market volatility have made a standardized, single CP for a fixed period very difficult to manage in terms of risk and exposure, according to industry sources.

For some, the burden of risk has become unmanageable. It’s increasingly difficult to establish a consensus between larger groups of consumers and suppliers, as both sides face volatile price moves, higher costs and lower margins. So many favor more discreet price discussions and the development of other types of pricing formulae.

“Fixing a monthly price used to be easier because before 2021, prices and market movements were more predictable, and we would see big price changes maybe every two or three months,” a market participant told OPIS.

“Since 2021, we’ve seen extreme volatility that has led to dramatic price changes, sometimes within just two days. So, fixing a price became too difficult.”

The change in supply-demand fundamentals and weaker margins has led to an illiquid spot toluene market, sources said, which in turn has also encouraged the adoption of formula pricing.

“Two years ago, 70% of our demand was locked in contracts; the rest we bought in the spot market,” one source explained. “Now, 95% of our requirements are based on contracts and priced on a flexible formula.”

Amid the demand slump, gasoline blending, which represents just 15% of regional toluene demand but can increase up to 40% during the high summer season, is now being touted as the sole savior of this aromatic, keeping the European market on its feet.

“Toluene pricing is being shaped primarily by the gasoline sector, as persistently weak global economic factors have depressed demand from chemicals,” said Megan Brenchley, principal research analyst at Chemical Market Analytics.

Huge increases in gasoline prices in the summer of 2022 were another blow for toluene CP negotiations, with toluene values increasing rapidly due to exceptional demand from the gasoline sector, according to Brenchley.

Falling back on Formula

So, if the market prefers to conduct transactions on a more discreet level, between smaller groups of counterparties and away from discussions on a single monthly CP, what other types of pricing mechanisms are employed when buyers and sellers want to negotiate monthly pricing and contract duration and avoid exposure to price volatility?

Currently, some in Europe use either a ‘fall back formula,’ already written in the contract, or a flexible formula-based pricing mechanism.

Under more flexible mechanisms, prices can be determined using an adjustable formula incorporating key market variables, including feedstock costs, supply-demand dynamics, and regional pricing benchmarks.

These pricing mechanisms are intended to enable market participants to make frequent price adjustments, where necessary, allowing them to capture real-time market conditions and mitigate risk while optimizing their procurement strategies, according to sources.

Some formulae are based on the underlying Eurobob gasoline price, while others can take into account naphtha pricing and derivative product costs. Others might include a spot toluene price component plus a premium, although the exact details remain private and confidential to the counterparties involved amid the many combinations available.

“There are many different formulae,” said another toluene market source. “The possibilities are only limited by participants’ creativity.”

In the meantime, some market players are unconcerned that the monthly CP is “a dead horse,” as several sources describe it.

“I’d be happy to use a CP again if the market dynamics allow it. For now, we’re happy with our formula system,” a market participant told OPIS.

Luckily there is always a daily and monthly spot European toluene price from OPIS, which can reliably be used for any price negotiations.

Chemical Market Analytics provides unique chemical data and insights to support your making critical investment decisions, optimize your portfolios, facilitate your business planning, and enable your buy/sell decisions.