How Will NGL Markets Adapt to the Oil Price War & COVID-19?

The coronavirus disease 2019 (COVID-19) has significantly impacted the mainland Chinese energy markets, and the spread of the virus to pandemic proportions is affecting energy markets across the world.

Demand destruction from COVID-19 disrupted mainland China’s energy system, and the virus is now propagating through and to energy markets globally, lowering energy demand in its wake.

To add insult to injury, a global oil price war erupted and has raised the situation to extraordinary proportions. Oil prices have plummeted, tearing down the historical price relationships in the energy and chemical markets, including NGLs.

The NGL Market Backdrop

- The United States and the Middle East are being pulled into the wake of the oil price war given their LPG supply positions.

- These two alone are the primary LPG supply sources and dominate the global LPG market on an absolute and incremental volumetric basis, thus making LPG supply highly sensitive to oil market events.

- These sources of LPG supplies are not created “equal” and incremental oil production from the Middle East and by-product LPG production is not equal to decremental production from the United States.

- Declines in US oil production would correspondingly result in lower associated natural gas production.

- Barring any US natural gas end-use market demand losses, the associated natural gas production loss would exert upward pressure on the Henry Hub price.

- Residential and commercial demand has and will fall with the spread of COVID-19; chemical demand, which is the most price-sensitive tranche of LPG demand, is likely to fall with lower crude oil prices from the oil price war, leading to significant LPG production declines.

- NGL prices are influenced by many other non-oil factors including but not limited to natural gas, naphtha, basic chemicals (including ethylene and propylene) balances and prices, and waterborne freight rates.

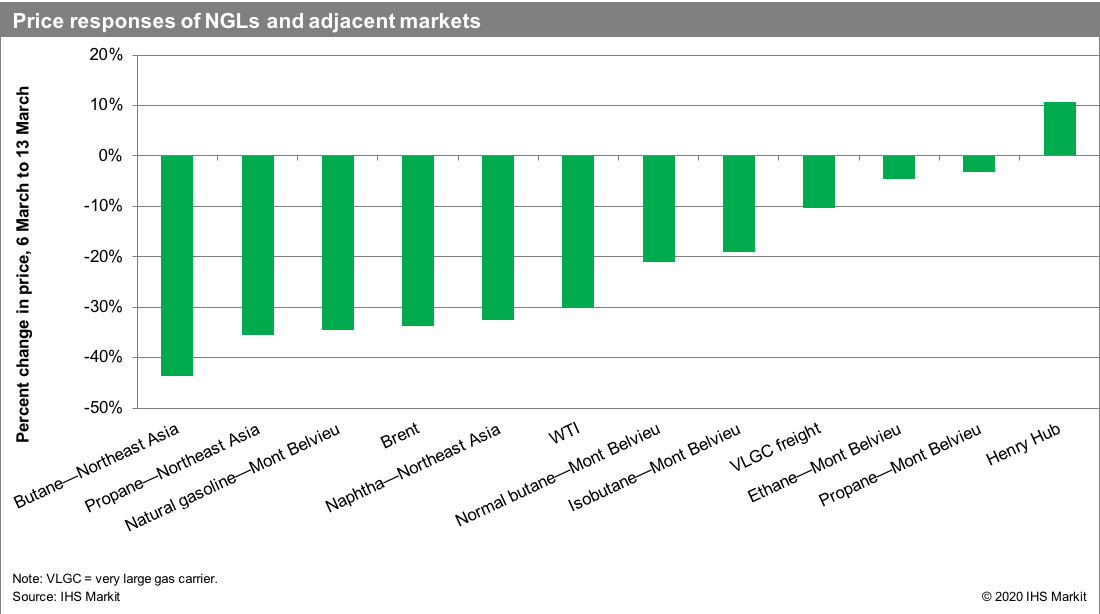

- The oil price war shock does not affect all NGL (ethane, propane, butane, natural gasoline) prices to the same degree

Key NGL Market Question and Views

How should we expect the NGL prices — by-products of upstream oil and gas development and refining operations— to adapt and react?

- The plummet in oil prices served as a shock to the system, causing ripple effects across the value chain that have various implications on NGL price setting.

- US ethane follows the trajectory of “local US” natural gas prices as a floor and ethylene production cash cost parity values for US propane and normal butane as a ceiling.

- In Asia and Europe feedstock switching between LPG and naphtha compete on an ethylene production cash cost basis with a with waterborne freight being the possible tipping point for selecting waterborne LPG versus local naphtha.

- Higher natural gas prices would help support higher ethane prices.

- In terms of LPG prices, lower oil prices have pushed Asian LPG prices down sharply, narrowing the price arbitrage between Asia and Mont Belvieu.

- At the same time, even though VLGC rates have slowly retreated from the 2019 high levels, they remain relatively high at about $90 per metric ton today.

- Therefore, US LPG prices are depressed, on a netback basis, incentivizing LPG cracking and consumption of LPG for chemical manufacturing.

- Figure 1 below shows the percentage changes in prices for the key NGLs and adjacent markets during the week following oil price war events, 6 March through 13 March.

- As of this writing, current LPG ethylene production cash costs (about 7.4 cents per pound for propane and 6.8 cents per pound for butane) are below that of ethane, at about 8.5 cents per pound.

Written by Darryl Rogers, Vice President, IHS Markit and Yanyu He, Ph.D, Executive Director, Asia Pacific/Middle East NGL Service, IHS Markit

Learn more about OPIS benchmark pricing, news and analysis for NGL markets in the United States, Asia and Europe.

And optimize your NGL buying and selling decisions with immediate-term to long-term fundamental market analysis from IHS Markit: Learn more