Renewable Energy Certificates Supply Constraints Showing Some Signs of Easing

Many of the conditions that limited the supply of renewable energy certificates in 2023 could begin to ease in 2024, but by how much and when is unclear. At the same time, other developing trends could work to upend the market.

Influenced by supply constraints, the majority of OPIS REC price assessments reached record highs in 2023, sometimes exceeding state price caps.

The supply of RECs is determined by how much energy a region’s renewable generation fleet produces over time.

Renewable grid additions were relatively strong in the second quarter of 2023 and that was followed by a record third quarter, during which 5.6 gigawatts of capacity was added. But due to a poor first quarter, year-to-date installations trailed those of 2022 through the first three quarters of the year, according to American Clean Power.

In recent years, four main factors have made it more difficult and expensive to build new renewable generation: rising inflation, rising interest rates, supply chain disruptions and congested grid interconnection queues.

In 2022, total US renewable additions fell to just over 25 GW from more than 30 GW in 2021 and more than 28 GW in 2020.

In July 2023, the Federal Energy Regulatory Commission issued a broad rule aimed at reforming the interconnection process and several regional transmission organizations have also worked to refine their own processes.

The reforms will take some time to come into effect, but the PJM Interconnection, which has one of the longest queues in the country, has already reported progress.

A PJM spokesman in October 2023 said projects with more than 40 GW had obtained signed Interconnection Service Agreements and had been cleared to proceed.

Meanwhile, inflation has eased and is expected to continue to fall in 2024, according to a December 2023 survey of economists by the National Association for Business Economics.

The Demand Picture

Demand for RECs is largely determined by how much power electricity suppliers deliver and the percentage of that load that, per state law, must be accounted for with renewable credits. Those laws are commonly known as renewable portfolio standards. Most also contain an alternative compliance payment option that can be paid in place of retiring RECs. The ACP typically serves as a market price cap.

Twenty-nine states and the District of Columbia have active RPS. Of those, 16 states have set targets of 50% of power sales or higher from renewables, according to the Department of Energy’s Lawrence Berkeley National Laboratory. Seventeen states have a 100% clean energy standard or RPS target, according to the lab.

In most states, the RPS requirement is designed to become more stringent over time. The lab said RPS mandates will require 300 terawatt-hours of additional power from renewable sources by 2030.

2023 Market Snapshot

Most RECs prices assessed by OPIS rose in 2023, with some reaching new records, while others consistently traded above their state’s price cap or just below it.

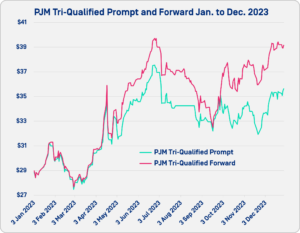

REC markets serving the PJM Interconnection faced a supply crunch that drove up prices as compliance deadlines approached in the summer of 2023. The PJM Tri-Qualified contract can be retired in Pennsylvania, New Jersey or Maryland and serves as a bellwether in the market.

REC markets serving the PJM Interconnection faced a supply crunch that drove up prices as compliance deadlines approached in the summer of 2023. The PJM Tri-Qualified contract can be retired in Pennsylvania, New Jersey or Maryland and serves as a bellwether in the market.

The prompt-year PJM Tri-Qualified assessment hit a low of $27.48/MWh on March 1, 2023, before surging by more than $10 to a 2023 high of $37.55/MWh on June 26, 2023. Over the second half of 2023, the assessment remained in the low to mid-$30s/MWh.

Meanwhile, the spread between prompt and forward-year PJM vintages remained in a wide contango, a market structure in which prompt-year vintages are assessed at a discount to forward years. PJM Tri-Qualified V25 was assessed at $39.28/MWh on Dec. 14, 2023, marking a $4.28 contango.

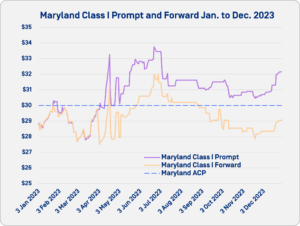

Among PJM states, Maryland is an outlier because of how it has structured its ACP. It is set much lower than other states—$30/MWh for 2023 and 2024—and designed to fall over time. Going into 2023, many REC market analysts expected that $30/MWh ACP would serve as a ceiling to the market. But that didn’t happen.

Maryland Tier I RECs traded above the price cap for several months over 2023. Maryland Tier I V23 was assessed as high as $33.75/MWh on June 23, 2023, and has remained above $30/MWh since April 26, 2023. A range of factors led to this trend, according to market experts. First, an update to Virginia’s RPS, which went into effect in 2021, spiked demand in the region and took some supply from Maryland. Second, many renewable projects have faced delays in the region and REC offtakers expecting to have fresh supply were forced to turn to other sources. Finally, some businesses with aggressive voluntary decarbonization strategies have begun to use a lot of power in Maryland and Northern Virginia’s Data Center Alley, and they have likely retired a growing share of the state’s RECs in recent years, further shrinking supply.

Maryland Tier I RECs traded above the price cap for several months over 2023. Maryland Tier I V23 was assessed as high as $33.75/MWh on June 23, 2023, and has remained above $30/MWh since April 26, 2023. A range of factors led to this trend, according to market experts. First, an update to Virginia’s RPS, which went into effect in 2021, spiked demand in the region and took some supply from Maryland. Second, many renewable projects have faced delays in the region and REC offtakers expecting to have fresh supply were forced to turn to other sources. Finally, some businesses with aggressive voluntary decarbonization strategies have begun to use a lot of power in Maryland and Northern Virginia’s Data Center Alley, and they have likely retired a growing share of the state’s RECs in recent years, further shrinking supply.

In New England, Massachusetts and Connecticut, Class I RECs prices tend to move together and both can supply the NEPOOL Dual-Qualified contract. The two states set their ACP at $40/MWh for 2023. Prompt-year Massachusetts Tier I RECs started 2023 at $36.30/MWh. As the compliance deadline approached in June of that year, they steadily crept up to $40.25/MWh, but fell soon after and have maintained an assessment of $39/MWh or higher since.

The Voluntary Market

The US voluntary REC market is also on track to continue growing. DOE’s National Renewable Energy Laboratory has tracked continuous growth in the number of customers and total purchases in voluntary REC markets. Voluntary buying grew from 37 TWh in 2011 to 244 TWh in 2021, according to the latest data available.

On the Nodal Exchange, the volume of transactions for Texas RECs—a primary source of supply in voluntary markets—rose from 62,426 MWh in 2022 to 106,615 MWh in 2023 as of Nov. 30, 2023. Open interest across REC markets on the exchange jumped by 28.22% in 2022 and 28.99% in 2023.