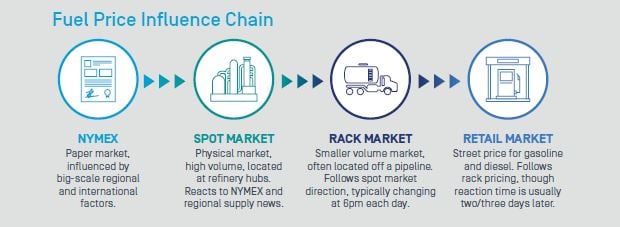

Pricing 101: Spot Fuel Markets Made Simple

Spot fuel markets are where gasoline, diesel, jet fuel and other commodities get a physical price tag.

“Spot” purchases refer to fuel that is physically traded either on a pipeline or on the water (via barge or cargo). We call it “spot” because you negotiate for the fuel “on the spot.”

Unlike the NYMEX, physical product actually changes hands in this market. Refiner X sells diesel to end-user Y to put into a tank at location Z.

Size Matters

Spot deals are always done in bulk. That’s the essence of what makes it the spot market. No truck and trailer quantities here!

Spot deals are always done in bulk. That’s the essence of what makes it the spot market. No truck and trailer quantities here!

Here’s an idea of scope: Pipeline deals are a minimum of 5,000 barrels (210,000 gallons) up to 50,000 barrels (2.1 million gallons).

These markets are located in specific refinery hubs and it’s important to know which one best corresponds to your particular local wholesale market. There are seven major U.S. spot markets.

Who Buys and Sells?

- REFINERS produce fuel and may need to buy because they don’t have enough or sell because they have too much.

- TRADERS are speculators. They bet that the market is going up or down and take very large physical positions based on those bets.

- BROKERS match a buyer to a seller and collect a commission. Brokers never touch the fuel.

- END-USERS can be fleets, truckstops or jobbers, who want to supplement their rack purchases with spot purchases. However, an end-user would have to be able to trade sufficient volume on the pipeline and have enough storage to take a spot-sized fuel shipment.

How is it Priced?

Now, if you were to call up the trading desk of a Gulf Coast refiner (or more likely you would get them over instant message) and ask them what they were selling spot gasoline for, they won’t say, “I’ll sell it to you for $1.50 per gallon.”

They will say instead, “I’ll sell it to you for 15 cents under.”

Wait. 15 cents under what??

Introducing Spot “Basis”

Spot basis is the relationship between the paper NYMEX market and the physical spot market.

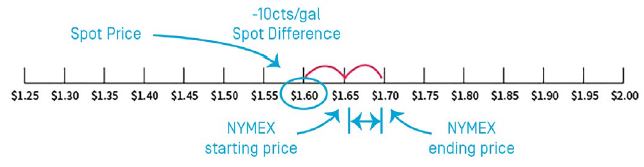

Remember the number line your third-grade teacher taped to the top of your desk?

Imagine that the current-month, sometimes called spot-month, RBOB gasoline blendstock is trading on the NYMEX at $1.65/gal. Circle that on your number line.

Our Gulf Coast refiner said they were selling spot for 15 cents under. Traders are busy. They don’t have time to say “15 cents under NYMEX RBOB.” But that’s what they mean.

That minus 15cts is what you are negotiating against the NYMEX price. We also call this a “differential,” or a “diff.”

Spot basis is the relationship between a commodity on the NYMEX and the corresponding commodity in the physical, bulk market.

Sometimes it’s a plus, sometimes a minus. Occasionally it’s even “flat” to futures. The differentials go up or down depending upon what’s happening in the U.S. and all over the world.

So, count back 15 cents from your $1.65/gal circle on your number line and you get the spot price of mogas in the Gulf Coast: $1.50/gal.

Every major U.S. refined products market adheres back in some way to a product on the NYMEX, with basis forming the glue between them. Distillates, like diesels and jet fuel, tie back to ULSD while finished gasoline and blendstocks tie back to RBOB.

Pretty Easy, Right?

Not always…

Remember that NYMEX futures don’t just sit still. They react to various forces in the market, such as the Russian Invasion of Ukraine. Those forces can swing that circled value on the number line up and down.

But the the relationship between futures and physical fluctuates, too. A refinery turnaround in the Los Angeles market can widen CARBOB premiums to the NYMEX and send local spot prices flying in excess of what NYMEX is doing.

On the other hand, prolonged rain in, for example, the Chicago spot market, doesn’t just dampen spirits — it dampens local driver demand. That can lead to differentials weakening in relationship to the NYMEX and skew the cash side of the equation down.

So, sometimes the NYMEX can be up 10cts on the day, but a particularly bullish bulk given spot market volatility that is separate from futures, could outpace it – gaining by, say, 20cts.

Or, if the NYMEX is up by 5cts, but local differentials drop by 10cts, the NYMEX will show gains while spot posts a loss, as indicated in the number line below. This is often referred to as “market dislocation.”

The bottom line is: you can’t rely on the futures market to tell you the whole story of what is going on with physical prices. You need to track the spot fuel markets.

On top of this, the NYMEX trades all day, settling at around 2:30pm Eastern Time. The spot arena also sees deals all day long.

Price reporting agencies (PRAs) – OPIS being one of them – spend a lot of time and effort tracking spot markets to make sense of the constant push and pull between futures and physical trading. For example, a typical PRA takes the NYMEX 2:30 p.m. settlement price and applies the day’s spot differentials to it to create a price “range.” The middle price of that range is the spot average, which is used to set industry supply contracts.

Whichever PRA you look at, it’s critical to find a price service that keeps tabs on the peculiarities of each market — things like spec requirements and seasonal fuel slate changes, as these factors become even more key the further downstream we look.

Understand the fuel chain from start to finish with this helpful e-Book from OPIS.