Washington Cap-and-Invest: After Splashy Debut, What’s Next?

Washington’s highly anticipated Cap-and-Invest Program is well underway and building momentum as the state’s carbon emitters gain clarity on market dynamics and prepare for the second auction at the end of May 2023.

The program kicked off on Jan. 1, 2023, less than two years since the state legislature adopted new carbon emissions goals.

Some uncertainties around the new market have dissipated over the past couple of months, thanks to a first-round of underlying price fundamentals — including data from the first-quarter Washington Carbon Allowance (WCA) auction in February, which sold out of 6.2 million allowances and settled at $48.50/mt.

The inaugural auction raised $299 million in proceeds, which was “dramatically more” revenue than the state legislature had estimated, according to Luke Martland, Washington Department of Ecology Climate Commitment Act Implementation Manager.

“Overall, we’re very, very pleased with the results of the first auction,” Martland said at the North American Carbon World (NACW) Conference held earlier in 2023 in Anaheim, California.

According to official auction results, the Q1 event was well overbid at a bid-to-offer ratio of 2.67 and sold all of the 6.19 million credits offered.

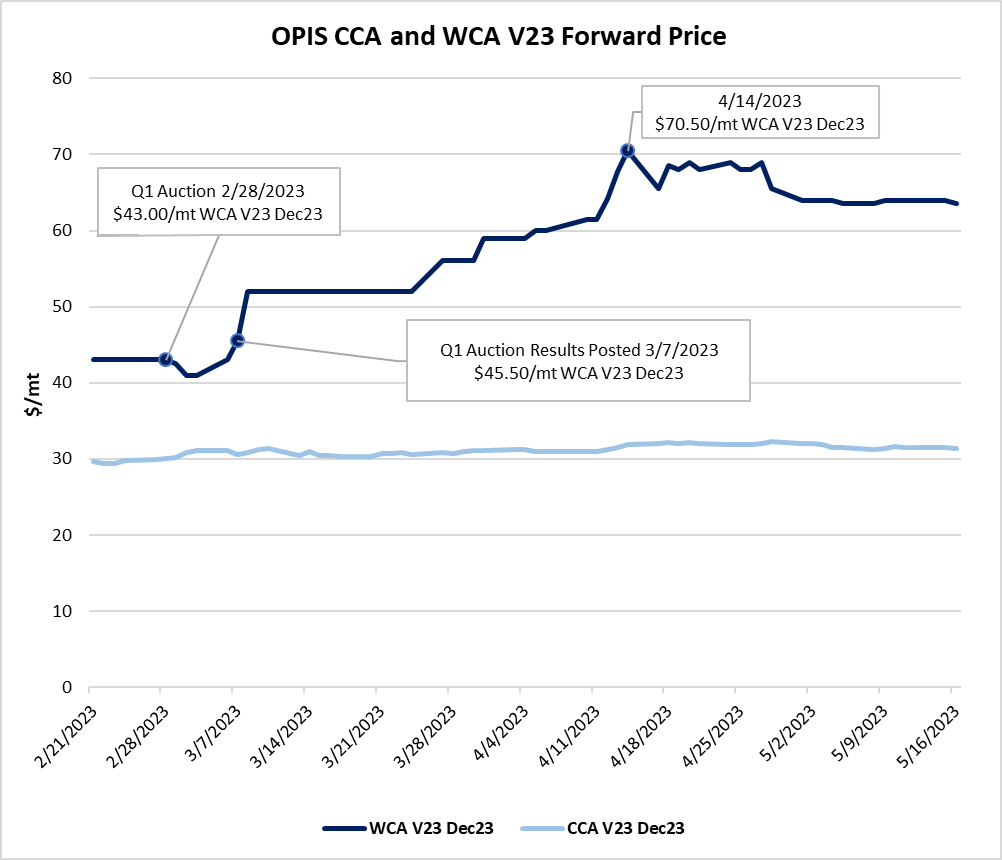

OPIS WCA assessments have also exemplified this bullish sentiment in secondary market trade — with forward delivery prices peaking at $70.50/mt on April 14, up from $43/mt at the start of the year.

Attention now turns to the program’s second allowance auction, where 11 million WCAs will be up for grabs.

Program Basics

The Washington Department of Ecology runs the state’s cap-and-invest program on authority and funding granted by the state legislature in 2021.

In general, businesses that emit more than 25,000 mt/year of “CO2 equivalent” GHGs must participate in the emissions cap program, which targets 75% of statewide emissions, according to the Washington Department of Ecology. These currently include fuel suppliers and natural gas and electric utilities, among other businesses. The program will expand to include waste-to-energy facilities in 2027 and railroads in 2031.

The statewide emissions cap lowers every three years, encompassing seven emissions periods through 2050. As the cap lowers, carbon allowances become more scarce and thus more expensive to buy at quarterly auctions.

Ultimately, the cap-and-invest program’s goal is to incentivize emitters to clean up their operations as a more cost-effective solution than continuing to buy increasingly expensive allowances.

Funds generated at auction will be used for a variety of emissions reduction and climate change programs, including projects for clean energy, carbon sequestration and the identification and reduction of air pollutants in low-income communities.

Washington’s Cap-and-Invest program targets a net-zero carbon footprint and 95% reduction from 1990 emissions levels by 2050. In addition to Cap-and-Invest, Washington state implemented a Low Carbon Fuel Standard (LCFS) and other programs to achieve climate goals.

“Washington state overall through a number of initiatives is moving in a very aggressive fashion but also a very well thought out fashion to pursue multiple policies to decarbonize the state’s economy,” Martland said.

Possible Linkage

Though the programs’ first months have helped to answer some of the questions stakeholders had late last year on pricing and demand, one big one remains: If and when Washington will link its program with California’s and Quebec’s joint cap and trade program under the Western Climate Initiative (WCI) and what the impacts could be for stakeholders.

Washington began the exploratory side of the linkage process in January with a public information request period seeking input on linking with California and Québec’s program. The state’s Department of Ecology provided a survey and schedule of events through April to collect opinions ahead of a decision by summer 2023 or later.

During NACW 2023, Martland described the linkage decision timeline as “summer or fall 2023.”

Former Washington State Senator Reuven Carlyle, of the Senate Environment, Energy & Technology Committee, sponsored the state’s Cap-and-Invest legislation with the intent of getting the program off the ground quickly. Carlyle also said linkage is a fundamental objective of the legislation creating Washington’s program.

Carlyle said Washington had the “absolute fortune of going second” behind California in creating its statewide emissions cap-and-trade program.

“We built the structure on top of the Western Climate Initiative from Day 1,” Carlyle said. “Our fundamental objective is other markets and linkage.”

A linked market would mean a common carbon price, likely closer to the current CCA price than the newer WCA price, according to Jennifer McIsaac, director of market analysis at ClearBlue Markets.

A linked market would mean a common carbon price, likely closer to the current CCA price than the newer WCA price, according to Jennifer McIsaac, director of market analysis at ClearBlue Markets.

OPIS assessed the mean price for the Washington Carbon Allowance (WCA) V23 forward contract at $64/mt on May 12. OPIS meanwhile assessed the mean price for California Carbon Allowance (CCA) V23 forward contract at $31.475/mt on May 12.

The supply of allowances in the Washington market is tighter, supporting higher pricing than the California/Quebec market. If the markets link, Washington entities could have access to lower carbon allowance pricing than they currently see in the WCA market, McIsaac explained.

However, proponents of an unlinked market argue that a higher price signal in Washington has the potential to accelerate local decarbonization efforts, she added.

In any case, the Washington Department of Ecology does not expect market linkage until after 2025, in the case it does decide to immediately pursue a link at all, according to a blog the department published on March 31.

To link programs, the three jurisdictions — Washington, California and Quebec — must first adjust their emissions trading program regulations to coordinate together.

“Even if everyone wanted to move as quickly as possible, there are practical considerations for linkage,” McIsaac said.

Q2 Allowance Auction

Washington state’s second-quarter carbon allowance auction on May 31 will offer 11.1 million Washington Carbon Allowances — a 77% increase from the first quarter — reflecting a reduction in the number of allowances previously allocated to utility providers covered under the new cap-and-invest program. Those allowances will now be available for purchase through the auction.

“We have found that the total number of no-cost allowances to be distributed is lower than the projections we used in developing the Q1 auction supply,” Washington Department of Ecology Auctions and Markets Unit Manager Derek Nixon said last month.

“This has resulted in a larger supply of current vintage allowances that can be sold at auction than previously estimated,” Nixon said.

Other factors raising the supply at the Q2 auction are the addition of forward-year vintage allowances and an adjustment based on natural gas sector allocations that are slated to hit the fourth-quarter event, Nixon said.

The upcoming auction will offer 8.6 million current-year and 2.5 million V26 forward year allowances. The inaugural auction only offered 2023 vintage allowances.

Under the Cap-and-Invest program, allowances are distributed at no cost to state utilities, including the electricity, natural gas sector and emissions-intensive trade-exposed manufacturing sectors.

For natural gas, the state in auctions later this year will directly transfer allowances and require that 65% of the no-cost allocation be consigned at auction.

“Because natural gas allocation will only occur later in the year, natural gas allowance consignment will result in a boost of supply in the fourth-quarter auction,” Nixon said, adding that increasing the auction supply pool in Q2 with state-owned allowances will help to keep it “stable” through the rest of the year.

APCR On Deck

Meanwhile, the next auction also has the potential to help address an ongoing supply and demand imbalance that spurred a jump of more than $20/mt for WCA prices in April.

In emission trading markets, the secondary market price for carbon allowances and those bought at auction are typically tied closely together, with one acting as a price signal for the other dependent on market conditions, as allowances bought at quarterly auctions can be resold into the secondary market. On Wednesday, OPIS assessed WCA V23 December 2023 at $64/mt.

At recent prices, WCAs have held above the Cap-and-Invest Program’s Allowance Price Containment Reserve threshold of $51.90/mt. A Q2 auction settlement at or above that price would trigger an additional auction this year aimed at increasing the allowance supply and cooling prices. The state’s Department of Ecology in late March released a notice saying it could hold its first APCR auction as early as Aug. 9.

The Department of Ecology also announced emergency rule-making that would be in effect for APCR auctions, clarifying allowance holding limits and requiring that allowances acquired through APCR auctions be deposited into an entity’s compliance account and can not be sold or traded in the secondary market.

–Reporting by Slade Rand, srand@opisnet.com; Editing by Kylee West, kwest@opisnet.com and Bridget Hunsucker, bhunsucker@opisnet.com

The OPIS Global Carbon Offsets Report along with the daily OPIS Carbon Market Report provide the largest compliance and voluntary carbon market price suite by any price reporting agency in the world. OPIS’s robust and comprehensive coverage of the carbon markets enables global project developers, traders, marketers and investors to accurately identify a fair value for their assets and understand compliance costs associated with carbon and emissions programs.