How to Buy Wholesale Gasoline and Diesel Using Spot Market Prices

If you buy gasoline and diesel from a wholesale rack, keeping an eye on spot market prices may be your key to saving money on your fuel purchases.

If your company’s purchase volumes have grown in recent years and are on track to expand more, you are a very attractive customer to a major supplier or large jobber distributor. They may be keen to sell you fuel on a “spot” basis, as opposed to what’s posted at the rack. That has the potential to save you a lot of money.

These kinds of gas and diesel fuel supply deals – which use a spot price as a cost basis – are referred to as “index based” deals. To clarify: you buy at the rack at rack volumes, but you use a “spot” price as the cost basis.

What’s a Spot Fuel Price?

- U.S. spot markets are centered around seven refining centers.

- Unlike rack volumes, typically 8,500 gallons, spot transactions are larger and are done via pipeline, barge or cargo.

- Prices are negotiated and can fluctuate depending upon the volumes involved.

- It’s called “spot” because if a refiner has to replace lost production, or overproduces and needs to sell, it needs to do it “on the spot.”

Get a full rundown of the Spot Market right here.

But Wait! I Don’t Ship Huge Volumes on a Pipeline!

Using a spot basis for a fuel deal does not turn you into a “shipper of note” on a major pipeline. That’s something reserved for refiners, large distributors and others with the means to buy huge volumes and store them.

Instead, the buying strategy we are suggesting is one in which you would use a spot price as a basis for a rack transaction. In a deal like this, you would pay the spot price — plus or minus a negotiated premium or discount.

Using a Spot Gasoline or Diesel Price as a Basis for a Rack Transaction

Imagine this scenario…

Jane buys diesel fuel for Majestic Doors, Inc. Lately, she’s realized her fuel requirements are growing.

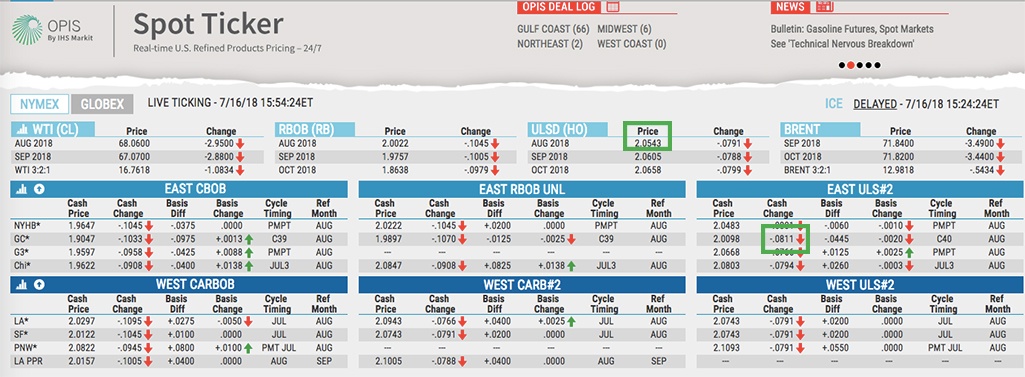

Jane’s been looking at her OPIS Spot Ticker to watch what spot diesel prices are doing in the U.S. Gulf Coast, the spot market associated with the wholesale rack from which she pulls fuel.

Note: You must have transparency into the spot markets if you are going to do an index deal.

Here’s what we mean by that. In this screenshot of the ticker, you can see what NYMEX heating oil futures are doing alongside spot pricing, so you have complete visibility into market moves.

Through her price discovery, Jane realizes that spot prices are very volatile – not good when markets are rising, but GREAT when markets are falling. Jane also realizes that when the market falls, spot prices usually dip much faster and more steeply than rack prices.

Jane has decided that 85% of her diesel requirements are going to be purchased on an unbranded rack contract basis. That leaves her with another 15% she can purchase on an open rack basis.

All that being said, Jane now needs to fill her tanks in the next few days.

She looks at her Spot Ticker and sees that NYMEX heating oil futures have fallen steeply. Spot diesel prices in the Gulf Coast have followed suit.

She also sees in the news section of the ticker that several refineries in the Gulf Coast that had been out of commission due to unit outages are now back in operation. That is putting more physical fuel supply into the market place, causing spot prices to trend lower.

One day, she notices Gulf Coast ultra-low-sulfur diesel spot prices have fallen 7cts/gal. This inspires Jane to seize the opportunity and go to her supplier to see if she can arrange a “spot-plus” deal.

Why Would Jane’s Fuel Supplier Agree to This?

The fuel business is about moving product. Jane’s supplier knows Majestic Doors’ volume requirements have been on an upswing and wants to cultivate this business relationship.

But there’s more to that motivation: Jane’s supplier’s biggest risk is that its diesel fuel is sitting in tanks losing value by the second as the futures and spot markets fall. Risk is compounded by the fact that the shipper has another shipment coming in on the pipeline that’s going to add to the supply overhang.

When markets are falling – especially if it looks like a trend – a supplier like Jane’s is more likely to do a “spot-plus” deal.

How Do They Put This Fuel Supply Deal Together?

The relationship between the customer and the fuel supplier is key – your supplier needs to understand that:

- You have insight into the market’s daily movement and

- You are “ratable,” meaning that you buy fuel on a regular basis.

The two of you will decide on the volume of the transaction, and then the “differential” either plus, or minus.

Here’s where you need to be smart! Understand the historic relationship between the local rack you’re getting the fuel from and the spot market. Once you understand what that differential is, you have a place to start negotiating.

One way to get that intel is to do some historical analysis over time to see what the difference is between your spot and rack markets. That can give you some perspective on differentials.

Your deal with your supplier may be for one day or it could be for a “strip,” which means more than one day.

Five Takeaways for Spot Index Deals:

- Make sure you have a daily pricing view into the spot market – one that lets you know when it’s time to pull the trigger on one of these deals (especially if the market is falling). Do not do one of these deals without that insight!

- Talk to your wholesale supplier – let him or her know that you have daily insight into the market. Let them also know that you understand how these index deals work. You will negotiate two things – first, the Price Reporting Agency (such as OPIS) whose spot price discovery will be your basis and second, the “differential” for the formula (spot plus, or spot minus).

Remember, price reporting agencies cover spot markets differently from one another. OPIS’ methodology is an average of a full day’s worth of trades. Others base their ranges off a small portion of each day’s activity. See more on OPIS’ methodology here. - Use your gasoline and diesel volumes as a negotiating tool. If your fuel spend is sizable, if it’s growing and if you are “ratable,” your supplier LOVES you. They want to keep you and are more likely to agree to work with you on these kinds of fuel deals.

- Always monitor the “basis” relationship between your local rack market and the associated spot market. The differentials change often, so updating that basis history every six months is critical!

Index-based supply deals require more time and attention – if you don’t have someone in your shop to back you up when you’re not there, doing an index-based deal may not be right for you.

However, if you are ready to take your fuel buying to the next level, then by all means get negotiating!

Now that you have a taste of what index deals involve, learn more from Scott….