Twelve months ago, on Feb. 5, 2023, the European Union effectively relinquished its main source of diesel supply by implementing a ban on imports of oil products from Russia. The continent has so far been able to find new sellers, but the current situation in the Red Sea is a reminder of how vulnerable European supply security has become.

For many decades, Europe has relied on Russia for its energy needs. Moscow’s cheap natural gas and crude oil were too convenient to ignore. So when Russia expanded its refinery capacity during the 2010s, Europe took advantage quickly. Imports of Russian diesel jumped to almost 25 million metric tons in 2017 from 6 million mt in 2012. This meant lower fuel prices for European drivers, lower costs for the industry – and more cash pouring into Russia, funding Vladimir Putin’s regime.

The deal was so good that Russian supplies increased to account for nearly half of the EU’s annual diesel imports. However, in February 2022, everything changed. Putin decided to invade Ukraine, and the G7 countries retaliated with sanctions on Russia’s main source of income – the oil and gas industry.

The EU announced a ban on imports of Russian crude and oil products from December 2022 and February 2023, respectively. This meant that Europe was obliged to find new sources for some 25 million mt of annual diesel imports, and Russia would also need to redirect the same volumes elsewhere.

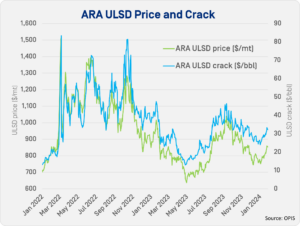

With traders scrambling to make sense of the sanctions, markets rushed to reflect the new, worrying reality. The European ultra-low-sulfur diesel (ULSD) crack, which had averaged just under $8/barrel in 2021, jumped to $40/bbl over the first month after Russia invaded Ukraine and soared to $63/bbl after the oil ban was announced.

One year later, ULSD crack values have eased to around $30/bbl, still high compared with historical levels. The market has managed to keep diesel flowing to where it’s needed, but this has come at a cost, particularly for the European economy.

One year later, ULSD crack values have eased to around $30/bbl, still high compared with historical levels. The market has managed to keep diesel flowing to where it’s needed, but this has come at a cost, particularly for the European economy.

On one hand, Russia has defied expectations, maintaining diesel export volumes broadly unchanged throughout 2023 by finding new buyers across the developing world. Some refiners, particularly in Turkey and the Middle East, have taken the opportunity to buy discounted Russian diesel for domestic consumption, redirecting their own production to Europe instead. Other countries like India have stepped in to take discounted Russian crude to maximize refinery runs and then sell the fuel to Europe.

Russia’s exports of diesel and gasoil to Turkey have climbed by 10.3 million mt on an annualized basis since the EU ban was implemented, according to Kpler data for the last three years. Flows to Brazil have increased by 8.1 million mt, with the balance mostly redirected to an array of countries in North Africa (5.6 million mt), the Middle East (4.8 million mt) and West Africa (3.9 million mt).

A source at the European Commission told OPIS that the original plan when the sanctions were designed was to reduce Putin’s oil revenues without “impacting global energy markets”, suggesting that they intended to slash Russia’s export prices rather than volumes, in particular for the global south. The sanctions were successful at harming Russia’s war effort, even if they haven’t met the expectations of some people, the source said.

The Centre for Research on Energy and Clean Air (CREA), a Finnish research organization, estimates that the sanctions have reduced Russia’s oil export revenues by 14%, or €34 billion ($36.9 billion) as of December 2023. “That impact, though, is far short of what could have been achieved,” CREA said.

Europe’s Diesel Consumption Plunges

And what about Europe? The continent, too, has found new trade partners. Compared with 2021 and 2022, the 27 EU countries and the UK increased diesel imports from the Middle East by 7.8 million mt on an annualized basis, by 5.8 million mt from the US, by 5.2 million mt from India and by 2.7 million mt from Turkey.

However, the bulk of the balance comes from lower overall diesel flows into Europe of around 10 million mt. With domestic refinery runs broadly flat in 2023 compared with 2022, according to data from the International Energy Agency (IEA), the supply deficit suggests that Europe has adjusted to the loss of Russian supply by reducing its own fuel consumption.

Indeed, the IEA estimates that diesel and gasoil demand in OECD Europe declined by around 200,000 b/d in 2023, which is roughly equivalent to 10 million mt. Collapsing diesel consumption in the continent has been mainly driven by an ongoing switch away from diesel cars. These are being replaced by new models of gasoline, gasoline-fuelled hybrids and, to a lesser extent, electric vehicles.

Automobile manufacturers recently reported that sales of new diesel cars in the EU slumped to just 1.4 million units last year. This compares with 6.6 million registrations in 2017, only six years earlier.

In addition, the European manufacturing sector remains in deep contraction, particularly in Germany, which is clearly weighing on consumption. Industrial activity is directly linked to diesel and petrochemicals demand.

Finally, heating use is also falling, as gasoil systems are replaced by gas boilers and electric heat pumps, and, crucially, the last two winters have been warmer than average.

In summary, Europe is now using less diesel and paying a premium to source it from further away. “Sending Russian crude to India, and then India sending products back to Europe – that adds a structural cost,” Calvin Froedge, the founder of maritime analytics platform Marhelm, told OPIS.

Moreover, James Noel-Beswick from Sparta Commodities said the EU ban on crude oil imports impacts diesel production at European refineries. This is because Russian crude has been replaced with other crude types that yield lower middle distillate output.

Shipping Costs Soar

Meanwhile, the reshuffle of traditional diesel trade routes into longer sea journeys is causing cargoes to travel further to their final destinations, which reduces vessel availability and, therefore, increases shipping costs – all of which eventually feed into the final fuel price.

“In our last update, we had LR (Long Range) 1 and LR2 tanker rates at just under $50,000/day; that’s an extremely strong rate. It used to be around $10,000/day prior to the invasion,” Calvin Froedge said. LR1 and LR2 are the types of vessels typically used to carry oil products from the Middle East and India into Europe, able to haul 60,000 mt and 90,000 mt, respectively.

Yet, on Jan. 26, just one week after OPIS spoke with Froedge, LR2 diesel tanker rates for the TC20 route from Jubail to Rotterdam had soared above $120,000/day. This was as companies chose to avoid the Red Sea due to Houthi attacks by diverting to the much longer Cape of Good Hope route, triggering a shortage of tankers and increasing shipping costs. As a result, European ULSD cracks widened to $33/bbl from $24/bbl in the span of three weeks.

“Europe has become very dependent on flows of Asian diesel and jet fuel via the Suez Canal due to the sanctions on Russia, and that is why those recent Suez issues are affecting European prices so much,” James Noel-Beswick told OPIS.

The disruption caused by the Houthis in the Red Sea is a good reminder of how dire the situation is for Europe. The continent is now significantly more exposed to supply shocks, as evidenced when French refineries were shut by strikes in the autumn of 2022 and spot diesel cracks soared above $80/bbl.

In short, European policymakers have been relatively successful at trimming Russia’s profits. But, in doing so, these officials have increased the price that EU citizens and companies pay for fuel. They have also left the continent more vulnerable to unexpected supply disruptions and have made it costlier for everyone to transport oil and refined fuels across the world.

On September 14, 2023, front month WTI futures surpassed $90/bbl for the first time since November 2022.

The loss of access to Russian crude and unusually high summer temperatures have curbed output of oil products from European refineries, the International Energy Agency (IEA) has warned.

Industry leaders expect U.S. Gulf Coast crude exports to remain high in the coming years, maintaining that global prices should stay strong enough to justify movement offshore as infrastructure improves, demand increases, and global inventories eventually fall.

Much of the oil industry’s attention in 2022 was appropriately focused on a shortfall in global refining capacity that was borne out by some of the largest refining profits in modern history.

But with the start of the new year, some new refinery capacity is much closer to entering service. That makes it more likely that facilities far from the continental U.S. will have a sizable impact on global markets, particularly if consuming countries flirt with or slip into recession.

Many refinery projects originally expected to come online in 2021 or 2022 were delayed into 2023 and a few of the more ambitious projects may have to wait for 2024 or 2025. In short, products’ and crude traders need to keep close track of the upcoming changes to world crude runs and downstream conversion capacity that may significantly impact returns for both new and existing refineries.

OPIS, together with the refinery consultants at Turner Mason, took a look at expected global refining additions and subtractions. Some of the names may be familiar and others may soon move into the lexicon of trader vocabulary, replacing facilities such as St. Croix that no longer appear relevant.

Turner Mason’s John Mayes pointed to a new sense of urgency for some of the expansion projects, saying the huge margins created by Russia’s invasion of Ukraine have hastened the need for more barrels.

In less than a month, the European Union will begin to enforce an embargo on Russian refined products. Many of the managers of new refinery equipment are motivated to take advantage of record returns before that happens.

The U.S. is home to only one real 2023 “mega-project,” but it may impact gasoline, diesel and jet fuel later in the first quarter of 2023.

ExxonMobil Corp. will expand the capacity of its Beaumont, Texas, refinery by 250,000 from its current nameplate of 384,000 b/d.

The project is part of the company’s “Growing the Gulf” plan and is designed to find a home for Permian Basin crude produced by the major. When completed, the refinery will be the largest single refining complex in the country.

The Beaumont facility weathered a cold snap on Christmas weekend and reports indicate that it is currently running at around 235,000 b/d, during the expansion work, which is expected to be finished by April. At some point in the second quarter, it will be processing about 534,000 b/d of crude and feedstock.

In addition to that project, the first quarter is expected to see the restart of the rebuilt 50,000 b/d Superior, Wis., refinery that has been offline since an early 2018 explosion and fire. Most industry sources expect the plant will resume production sometime in March.

Some smaller tweaks are also in the works for other U.S. refiners. Valero Energy Corp. is adding 102,000 b/d of crude processing capacity at its Port Arthur, Texas, refinery and the work will include a 55,000 b/d increase in coking capacity.

In the minus column, the largest subtraction will come when Lyondell’s Houston Refinery complex closes at the end of 2023. The 268,000 b/d plant is destined for repurposing and sources believe efforts to its production will have little chance of success, given that a new owner would need to make more than $1.5 billion in required upgrades.

Phillips 66 Co.’s twin facilities in the East Bay region of California will be taken out of the mix soon this year. The company is well underway with its “Rodeo Renewed” project to convert the San Francisco area complex into a renewable fuels’ facility.

The company will stop running crude and instead use waste oils, fats, greases and vegetable oils to make more than 50,000 b/d of renewable diesel, renewable gasoline and sustainable aviation fuel.

And the company’s Santa Maria facility in San Luis Obispo County, which now processes crude and makes intermediates for Rodeo, will be decommissioned.

Hurricane Ida, which made landfall as a Category 4 hurricane on August 29th packing strong winds and heavy rain along with flooding.

Recapping his remarks at the Aramco Virtual Energy Forum in conjunction with IP Week 2021

Oil, gasoline, diesel and renewable fuels markets have started 2020 off with a bang.

Here are 20 price-influencing factors identified by OPIS experts and those of our parent company, IHS Markit, that stand to sway the markets this year and beyond.

A sense of hope emerged for many Mexicans when Andrés Manuel López Obrador (AMLO) won the presidential election in July 2018. But frustrations have set in, particularly when it comes to the oil market.

Much of the oil, gasoline and diesel price direction in 2020 markets may be determined by whether the Middle East calms down into modern stasis, or is routinely subject to drones flying, missile assessments and damage to oil infrastructure.