Fun fact of the day: refiners, generally speaking, don’t make gasoline.

Drivers may think that crude oil goes into a refinery and gasoline comes out.

That’s only partially correct. Think of making gasoline as making a cake. There’s flour, eggs, milk, and oil in a cake recipe. Gasoline is similar in that it has multiple components that make up the gasoline recipe. At the end of that recipe you have two types of almost finished gasoline called Conventional Blendstock for Oxygenate Blending and Reformulated Blendstock for Oxygenate Blending.

To these blendstocks other liquids are added to make the substances that fuel our carpools, take us to grocery stores and get our families to their summer vacations. And, mostly, that final mixology does not happen at the refinery level.

The Mixers: CBOB and RBOB

To reiterate, most of the gasoline produced by refineries is actually unfinished gasoline or gasoline blendstock.

Blendstocks are blended with other liquids, such as ethanol, to make finished gasoline.

Most of the finished gasoline in the US contains 10% ethanol.

The blendstocks are a mix of components such as butane, reformate and FCC gasoline, which can be combined in different ways to reach needed specifications.

Conventional Blendstock for Oxygenate Blending (CBOB) is a blendstock that’s combined with ethanol to get E10 gasoline.

Reformulated Blendstock for Oxygenate Blending (RBOB) becomes reformulated gasoline (or RFG) after blending with ethanol.

What’s the Difference Between RBOB and CBOB?

Reformulated gasoline is required in certain areas to reduce smog per Clean Air Act amendments. RFG is required in cities with high smog levels and is optional elsewhere. RFG is currently used in 17 states and the District of Columbia. About 25 percent of gasoline sold in the US is reformulated.

Many of the RFG areas are in the mid-Atlantic and Northeast. So, OPIS spot market editors see a lot more Reformulated Blendstock for Oxygenate Blending (RBOB) trading in the New York Harbor region.

In the Gulf Coast spot market, Conventional Blendstock for Oxygenate Blending (CBOB) tends to be the most liquid product because there are fewer areas requiring RFG in that region.

Where Does Ethanol Enter the Picture?

Ethanol is like the icing on that cake made from gasoline. (Eww. Please don’t eat it.)

The use of ethanol is largely linked to the advent of the Renewable Fuel Standard (RFS) program, which Congress enacted to reduce greenhouse gas emissions, expand the US renewable fuels sector, and diminish US reliance on imports.

Ethanol isn’t blended into gasoline blendstock at the refineries, largely because ethanol can’t be transported through pipelines. It would damage them. Strong stuff!

Instead, ethanol is most often blended in at the rack, closer to its ultimate destination. That’s why you’ll often see ethanol listed along with gasoline and diesel in rack prices.

Ethanol serves to boost octane levels in gasoline, which can be helpful. But it also raises Reid Vapor Pressure (RVP), which can be tricky.

RVP measures the volatility in gasoline and is subject to seasonal mandates. So, blending ethanol can be complicated during summer months, when people are looking for lower-RVP gasoline.

Sometimes, detergents or other additives are blended into gasoline before it hits retail stations—those additives are a way that fuel brands differentiate themselves with customers.

Happy baking!

US Midwest spot refined product market participants entered 2024 with major questions over how EPA will handle a 2022 request from a group of eight Midwest governors to allow year-round sales of E15 in their states.

The governors in 2023 asked the agency to issue regulations that would allow equal treatment of E10 and E15 during the summer of 2023 by capping the RVP for both fuels at 9 psi during the high-demand driving season.

EPA, in March 2023, proposed a rule that would allow the summertime sale of E15 in the petitioning states, but not until the spring of 2024.

Refiners, however, have argued that EPA’s decision would require them to provide a lower 7.8 lb RVP CBOB that would allow both E10 and E15 to meet the 9 psi specification.

Fuel producers, however, are concerned that because not all Midwest states signed onto the petition to EPA, the waiver could create logistical issues for the Midwest market, especially for pipelines, which could be forced to move two different CBOB RVP specifications during the summer. Some Midwest sources, however, told OPIS that if EPA grants the waiver in the spring of 2024, those states in the region that were not part of the request would likely move to the lower 7.8-lb RVP CBOB.

While the petitioning states and the ethanol industry criticized the agency for failing to approve the regulatory change in time for the 2023 driving season, the Biden administration, for a second straight summer in 2023, issued a series of waivers lifting restrictions on the sale of E15. Those did not, however, require refiners to provide lower RVP blendstock.

See also: US Ethanol Industry Explores Avenues for Expanding its Markets, Jan. 26, 2024

Midwest market participants said they would enter 2024 somewhat in the dark over what the summer RVP requirements will look like, cautioning that unrestricted sales of E15 could have big impacts on the fuel supply chain and prices.

Patrick Searles, downstream fuels policy director with the American Petroleum Institute, told the EPA at a March 2023 public hearing on the proposed rule that even with the decision to delay the move to April 2024, “there still is likely to be insufficient time to engineer projects, identify capital, obtain the permits, and contract and deploy the skilled trades to construct the systems needed.”

In September 2023, Paul Machiele, director of the EPA’s Fuel Programs Center, acknowledged that the rule could “require significant changes in the distribution systems.” And he added that EPA has the right to delay implementation if concerns over the supply persist.

And if EPA does approve the change in the spring of 2024, then many are wondering just how the decision would affect the spot gasoline market. “You instantly increase the gasoline pool by 5% with the stroke of a pen,” one source said. “What does that do to the basis?”

Spot gasoline prices trade at differentials to NYMEX futures and the question being asked by many in the market is whether more E15 will lead to lower spot RBOB prices and just how the lower 7.8 lb CBOB will be priced in relation to more typical 9 psi blendstock.

The Midwest gasoline and distillate spot market also experienced strong price volatility in 2023 and a question on the minds of many is whether this is likely to continue into the new year.

One market player, citing the unusually long period of volatility this year, said he believes more of the same is likely on tap for the Chicago market in 2024.

According to OPIS data, Chicago CBOB spot prices fell to a 2023 of just under $1.70/gal on Dec. 7, 2023. The last time the price fell below that mark was mid-February 2021.

And the 2023 low came just four months after prices hit a 2023 high above $2.80/gal.

Group 3 sub-octane gasoline also saw hefty price spikes in 2023, rising to a $3.57/gal high for the year on Sept. 7, 2023, the highest mark since late June 2022.

Similarly Group 3 ULSD hit a 2023 high price of $4.20/gal on Oct. 20, 2023, the highest recorded price in about a year.

While this type of volatility remains difficult to plan for, and market participants have grown used to price swings due to extreme weather and refinery disruptions, and one source said 2023 may be viewed by some as a reference market, given that the Midwest harvest season – a period of high distillate demand – was “ideal.”

2023 was also notable for a lack of major refinery upsets, particularly in the fourth quarter. If this trend continues into 2024, participants may have a clearer picture of what they can expect.

The Energy Information Association put Midwest refinery utilization at above 100% for two weeks starting in late August, allowing the region’s refiners to easily meet increased demand as the harvest season ramped up.

That baseline of what supply and pricing looks like when running at full capacity may provide market participants with a clearer picture for 2024 – if they can count on that continuing.

See also: Changing Regulations Could Spur Pricier Midwest Gasoline This Summer, Feb. 3, 2023

Carbon markets are increasingly being seen by countries in the Asia Pacific as a tool to reach decarbonization goals, and stay abreast of policy changes such as cross border carbon tariffs. Across the region, carbon markets fall across a full spectrum of growth – with its fair share of both emerging and mature markets.

Anyone working in the gas liquids market knows the need (and hassle) to convert global NGLs.

NGLs — a.k.a. ethane, propane, pentanes+, normal butane and isobutane — are shipped all over the world, every day, from export hubs as diverse as Mont Belvieu, Texas, and the Arab Gulf.

Spot fuel markets are where gasoline, diesel, jet fuel and other commodities get a physical price tag.

Buying fuel is confusing even for seasoned pros. We’re here to help.

The petroleum market features a slew of specialized fuel blends and no one-size-fits all requirement for what you can use — or where or when you can use it.

Whether you are new to the fuel industry or are already an expert, the words “spot,” “rack” and especially “basis” are terms that confuse even the most veteran buyer. There’s a good chance you or someone on your team may not be 100% sure what these words mean.

Why Is It Important to Understand These Fuel Pricing Basics?

Chances are you already have a fuel contract with a supplier in place. Maybe you are looking to set one up or modify one that already exists. Without a firm handle on what the difference is between futures, spot, rack and retail markets there’s a good possibility that you:

- Are unaware what the “cost basis” is in your fuel agreement

- Are not purchasing the right fuel for your area or paying too much for the fuel you buy

- Don’t understand what factors are making your fuel costs go up and down

Let’s clear up some confusion with a basic guide to pricing gasoline and diesel. Much of what you will learn here also applies to jet fuel, LPG and renewables.

Step One: Getting to Know the Futures Market

Before you can understand spot and rack prices, you need to understand the first piece in the downstream fuel puzzle: The New York Mercantile Exchange.

The industry commonly refers to this as the NYMEX or the Merc. Sometimes it is called “the futures market” or “the print.”

It’s a mostly electronic platform exchange, on which buyers and sellers can trade various fuel commodities — on paper — any time from a month from now to 18 months in the future. That’s why it’s called a “futures” market.

They call it a “paper” market because few, if any, physical barrels ever change hands. Trade volume is made up of contracts that transact among players.

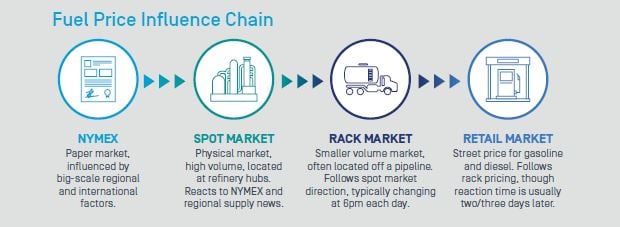

From here on out, to reduce any further confusion, we’ll refer to it as the NYMEX. The NYMEX is possibly the most influential factor in the upward/downward movement of wholesale rack markets. Oil futures affect spot markets, then rack markets, then ultimately retail markets.

The first energy contract was launched in 1978. Since then, the Merc’s launched contracts for:

- Crude oil (CL)

- Natural gas (NG)

- Ultra-low-sulfur diesel (HO)

- Reformulated blendstock for oxygenate blending, RBOB (RB, a blendstock that takes the place of a gasoline contract)

These abbreviations are what you’ll see on the trading screen, so add them to your alphabet soup full of acronyms to memorize.

Thanks for the History Lesson But What’s In This for Me?

One word: Transparency.

The NYMEX really took off as a major factor in the U.S. petroleum market back in the 1980s because it was the only place refiners, suppliers, traders, jobbers, retailers and procurement end-users had full access to see the value of a commodity at any given time.

The transparency was generally not for real barrels of crude oil that you could turn into gasoline. Remember, this is mostly a paper market – physical delivery only occurs for 2% to 3% of all contracts on the current NYMEX. But, at that time, unlike today, there was no downstream price discovery.

So, the futures market became a place where fuel buyers or sellers could go to find a cost basis for fuel supply agreements. This is why, when we talk about the NYMEX, we start to introduce the concept of “basis.” More on that later…

Since the 80s, price transparency has extended to the spot market (the refinery level) and rack market (the wholesale level). We’ll dive deeper into those markets in the sections that follow. But, that clear level of transparency has always remained on the NYMEX.

In addition, the exchange is regulated by the CFTC (Commodity Futures Trading Commission), adding a level of accountability to every 1,000-barrel, or 42,000-gallon, contract traded.

The paper market is used to hedge physical fuel purchases – kind of like insurance for prices rising or falling, to protect the companies holding contracts from losses related to their physical energy business. But, for our purposes right now, the critical point is that it is the primary building block of

downstream gasoline and diesel pricing.

There are two other key elements about the futures market:

- First, the trades are anonymous.

- Second, and most importantly, the exchange guarantees counterparty performance. No chance of an Enron-like implosion here.

However, the Block Is Rarely Stable

However, the Block Is Rarely Stable

Military conflicts, hurricanes, domestic refinery problems, fluctuations in domestic output abound. Often, the first trace of any breaking news is seen on the futures screen, because oil prices spike and dive.

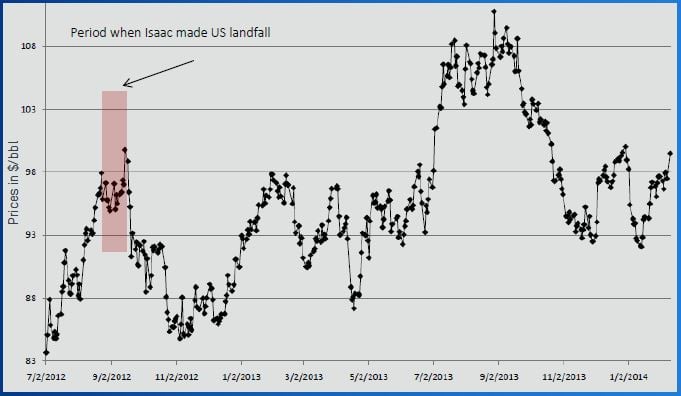

Take a look at this chart to see how Hurricane Isaac sent futures flying and how the market volatility continued.

The NYMEX tends to react to big-ticket items, like:

- Currency market moves

- Geopolitical “saber rattling”

- OPEC decisions

- Supply reports, like the weekly U.S. inventory and production figures

- Refinery explosions

- Weather events

Sometimes the market “prices in” so-called fundamental factors. For example, if the U.S. government is expected to show crude stock supplies falling by a large amount, the market might slowly crawl higher in advance of the weekly inventory report as opposed to rallying sharply when expectations prove true. On the other hand, a quickly developing weather event can lead to immediate price swings.

And the market also responds to seasonal trends. For example, the RBOB market tends to peak ahead of summer driving season. The ULSD contract (a proxy for heating oil) will often spike on the first chilly fall day.

Some terminology you will hear when people talk about the market:

- Bullish – the market is rising

- Bearish – the market is weakening

- Oversold – the market is rising

- Overbought – the market is weakening

But, What Does This Mean in a Market That Trades ACTUAL Barrels?

The NYMEX is the first column in your price equation. If RBOB futures go higher, it will send gasoline prices up right through the fuel chain — unless the next link in the chain does something to counteract it.

Understand the fuel chain from start to finish with this helpful e-Book from OPIS.

One year after Russia invaded Ukraine, energy commodity flows across the globe have shifted and prices have experienced extreme bouts of volatility.

Volatility was the name of the game for east of the Rockies gasoline and distillate spot markets in 2022, with the war in Ukraine creating upheaval in Europe and shifting international product movements.

With stubborn global inflation, the increased likelihood of a U.S. recession this year and continued conflict between Russia and Ukraine, this year’s uncertainty will hang over the marketplace into 2023.

For much of 2022, gasoline and distillates contended with steep backwardation — in both futures and physical markets — with prices dropping off quickly over time. The backwardation widened in the wake of the Ukraine invasion, as refined product exports rose.

But that pricing structure changed quickly in December, as RBOB prices moved toward a contango structure, with front-month RBOB futures valued below the next-month futures contract. The backwardation in ULSD futures narrowed to roughly 3cts between front-month and next-month contracts in early December.

With east of the Rockies production levels high and inventories remaining low along the East Coast (PADD 1), domestic and international product flows are likely to continue to play a sizable role in the year to come.

Refinery outages and falling inventory levels in Europe have significantly tightened diesel supplies across the continent, causing spot price differentials to soar to record levels.

Ukraine is in the grip of widespread fuel shortages as the country tears itself away from Russian exports, and imports from the west are impeded by logistical challenges and regional shortages in a redraw of the European energy map.

Since Russia’s invasion of Ukraine on February 24, about 60% of its retail fuel stations have closed, according to Kyiv-based Artem Kuyun, director of Ukrainian fuel consulting group A-95. Motorists who want to drive to the border face waiting times of between five and seven hours to fill up their tanks, with some resorting to sleeping in their cars parked at the stations. Supplies are unpredictable, as some regions have adequate gasoline but no diesel, while other locations only have diesel and no gasoline.